CHEERS TO

Going beyond your 401(k)

Many of us have come of age believing that contributing to a 401(k) is the magic ticket to retirement. Unfortunately, this may not be the case. Understanding what you’ll realistically need for a comfortable retirement requires a little bit of planning. We'll review how to:

- Assess the value of your 401(k) at retirement

- Estimate what you'll need in retirement

- Optimize your savings plan to get you there

Assess the value of a 401(k) at retirement

If you open a 401(k) early in your career and make steady contributions, you'll likely accumulate a reasonable sized account by retirement. However, a number of factors will impact the actual value of this account in the future:

- Returns

How your current and future savings are likely to grow over time is key. But there isn't a good one-size-fits-all assumption you can make about future market returns since 401(k) portfolios will vary.

- Inflation

A dollar today is not going to be worth a dollar 30 years in the future. Over the past five decades, inflation has roughly accumulated at 4% per year. That means that by the time you are 60, it will take about $3.24 to buy what $1 buys today.

- Costs

Fees from your 401(k) provider (and from the investment products they offer) can vary from 0.25% all the way to 2.5%. Naturally those fees will eat into the amount you'll ultimately be able to withdrawal.

- Taxes

While contributions to a 401(k) are tax-free, you will have to pay taxes when you make withdrawals.

To arrive at a reasonable estimate of the future value of your 401(k), you’d need to conduct some pretty detailed calculations that account for these factors. In fact, to get a truly comprehensive view of what you’re on track to cover in retirement, you need to incorporate value of other savings and investing accounts besides your 401(k). Once you’ve aggregated all your assets, project their value over time using reasonable assumptions around factors like investment returns, inflation, social security, etc.

More resources

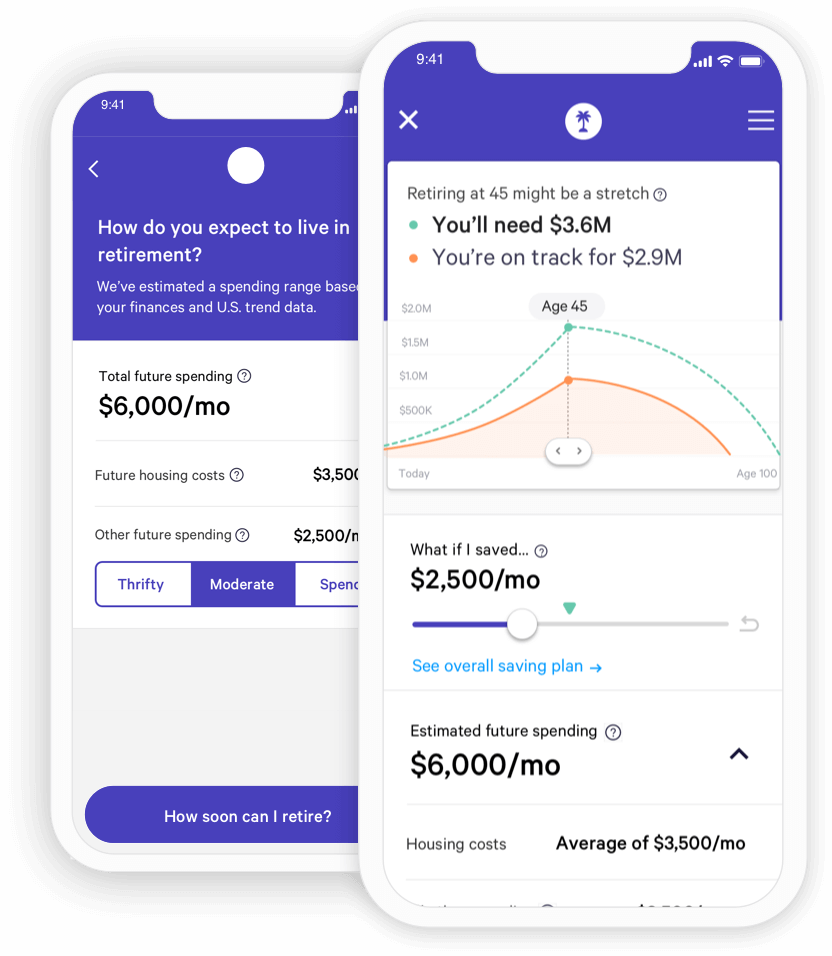

Want to skip the calculations and spreadsheets?

Our free planning app automatically estimates what you have today and what you’re on track to have at retirement.

Estimate what you may need

Once you've calculated what you'll have, the next step is understanding how much you'll need in retirement. If don't know this number, you're not alone. According to a study by FINRA, only 39% of Americans have tried to estimate what they need to save for retirement.1

Here are the key steps to estimating the total amount you’ll need to cover your retirement:

- Consider your desired lifestyle and determine how much your living expenses and housing costs will be.

- Take into account the impact of inflation and the projected income from Social Security.

- Once you have estimated an average monthly spending number, multiply that amount across the number of months of your planned retirement.

Getting to this answer requires some detailed calculations. In the rest of this section, we'll walk you through some of the key factors that could impact your retirement needs.

Your spending at retirement

Whether it's thrifty or "spendy", only you can decide on type of lifestyle you want to live in retirement.

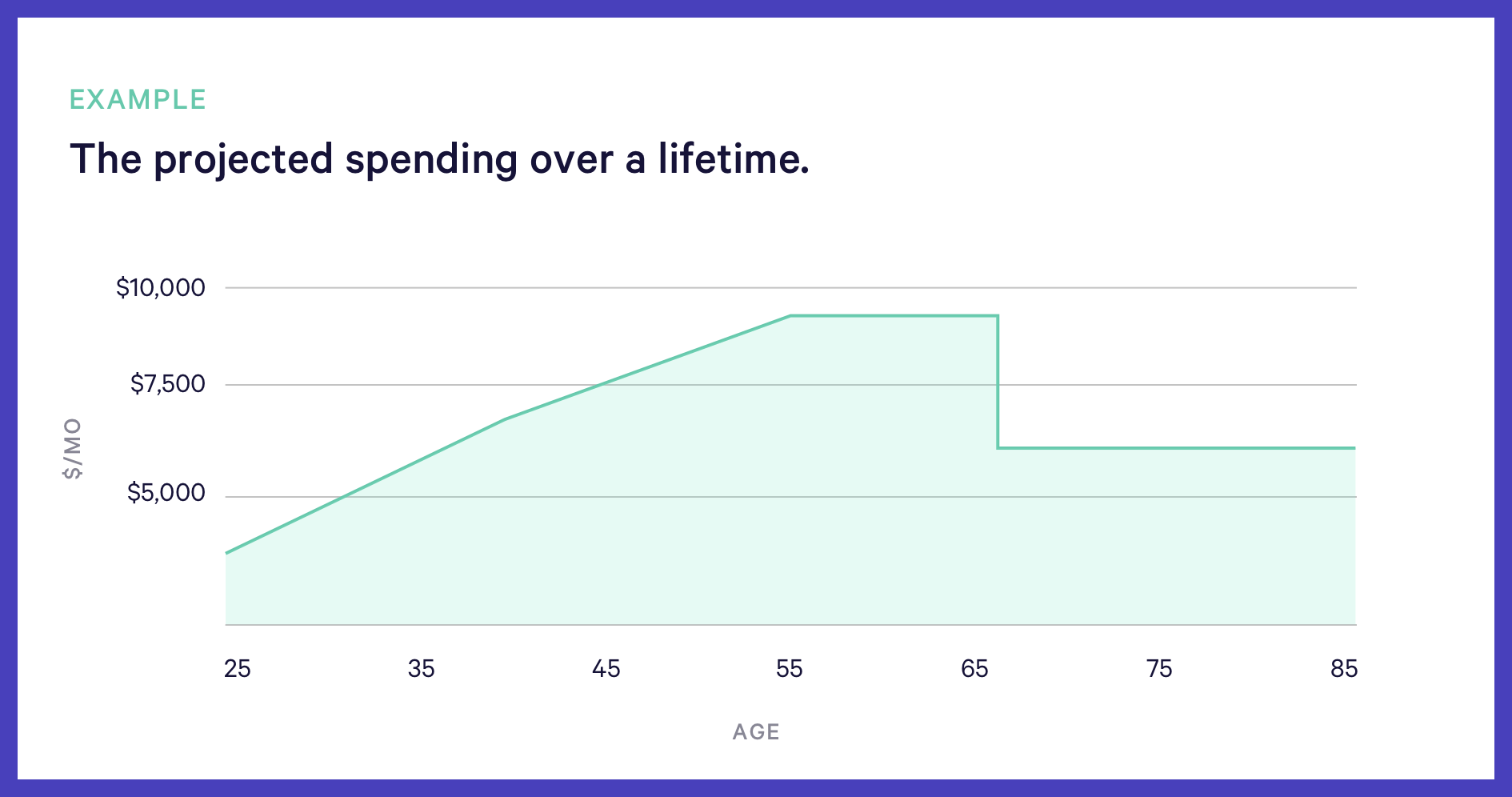

But putting a dollar amount to that future lifestyle can be a challenge. Through analyzing data from the Consumer Expenditure Survey and research findings from academics, our research team found that regardless of income, location, or even lifestyle, most college-educated, professional Americans follow a surprisingly consistent spending pattern over the course of their life:

Source: Wealthfront; note that this is the projected median spending for someone age 25.

A few things to note:

- Your spending changes over time

- At age 40, spending is roughly the same as in retirement.

- At age 55, spending peaks due to high housing and family costs.

- By age 65, spending decreases from the peak by roughly 22%

Social security

While there's differing opinions around the future of Social Security, we believe it can still represent a significant portion of your retirement income. While it's widely known that you can start claiming Social Security benefits at age 62, that may not always be the right choice. Our research shows that for each year you wait after age 62, your Social Security income could increase by about 7.3%, which is nothing to scoff at. But whether you should wait to start collecting depends on your unique situation, including what other sources of income you expect. Read more →

Other upcoming goals

Planning for your retirement can't happen in a silo. The life milestones you plan to achieve (and the spending required for them) will impact what you will have leftover. Having a sense for what other goals like buying a home or covering the cost of your kids — and when you plan to achieve them — will inform if you are saving and investing enough for retirement.Need help making your plan? Our free app has you covered.

- Link your accounts and we'll use your current spending behaviors to estimate your spending at retirement.

- Get projections that automatically incorporate Social Security, inflation returns, investment returns, and more.

- Make informed trade-offs against other goals, like buying a home or covering college.

Optimize your savings plan to get you there

Once you've estimated what you have and what you need, you should have a sense of whether you can afford your desired retirement lifestyle. You may find out today that you're right on track. That peace of mind about the long-term can help you feel more confident to pursue ambitious shorter-term goals, such as taking time off work to travel or buying a home.

But if there’s a gap in what you want to have in the future and what you can currently afford to save, that’s okay – you can make adjustments as you go. Consider making adjustments such as retiring later, spending less in retirement, downsizing to a smaller home when you retire, or proactively saving more today.

Whether you are on track today or have a way to go, there are a few optimization techniques to keep in mind, which can help your money grow faster to meet those future needs.

Use the right retirement accounts

Aside from 401(k), there are other tax-efficient investment accounts, specifically designated for retirement savings: the Traditional IRA and Roth IRA for individuals, and the SEP IRA for those who are self-employed. Your income and age will dictate whether you qualify to open these account and your contribution limit. But in many cases, it may be more advantageous to put retirement savings in a taxable investment account.

Read more →

Choose passive investing

To grow wealth for the long-term, we recommend passive investing. This means putting your money towards a diversified portfolio of low-cost index funds. We would recommend this approach to managing the funds in your 401(k) and other retirement accounts.

Learn more →

Rollover 401(k)s with high fees

If you have a 401(k) account with a previous employer, you are permitted to roll it over to a Traditional IRA. Since 401(k) programs are set up by the employer, you don't have control over the provider they choose or the investments that are offered. This means that you may be stuck using a provider who offers high-cost investments and charges a high advisory fee. Once you’ve left the employer, however, you’re free to rollover that account — with no penalties — into an IRA account at a provider of your choice.

More resources

TO SUM IT UP

Being prepared for a comfortable retirement requires more than just setting up your 401(k) contribution. Whether you take the time to make the calculations yourself, or lean on our handy (and free!) app that do it for you, find out what you'll have, compare it to what you need, and optimize your savings to fill the gap.

Dive into another question →