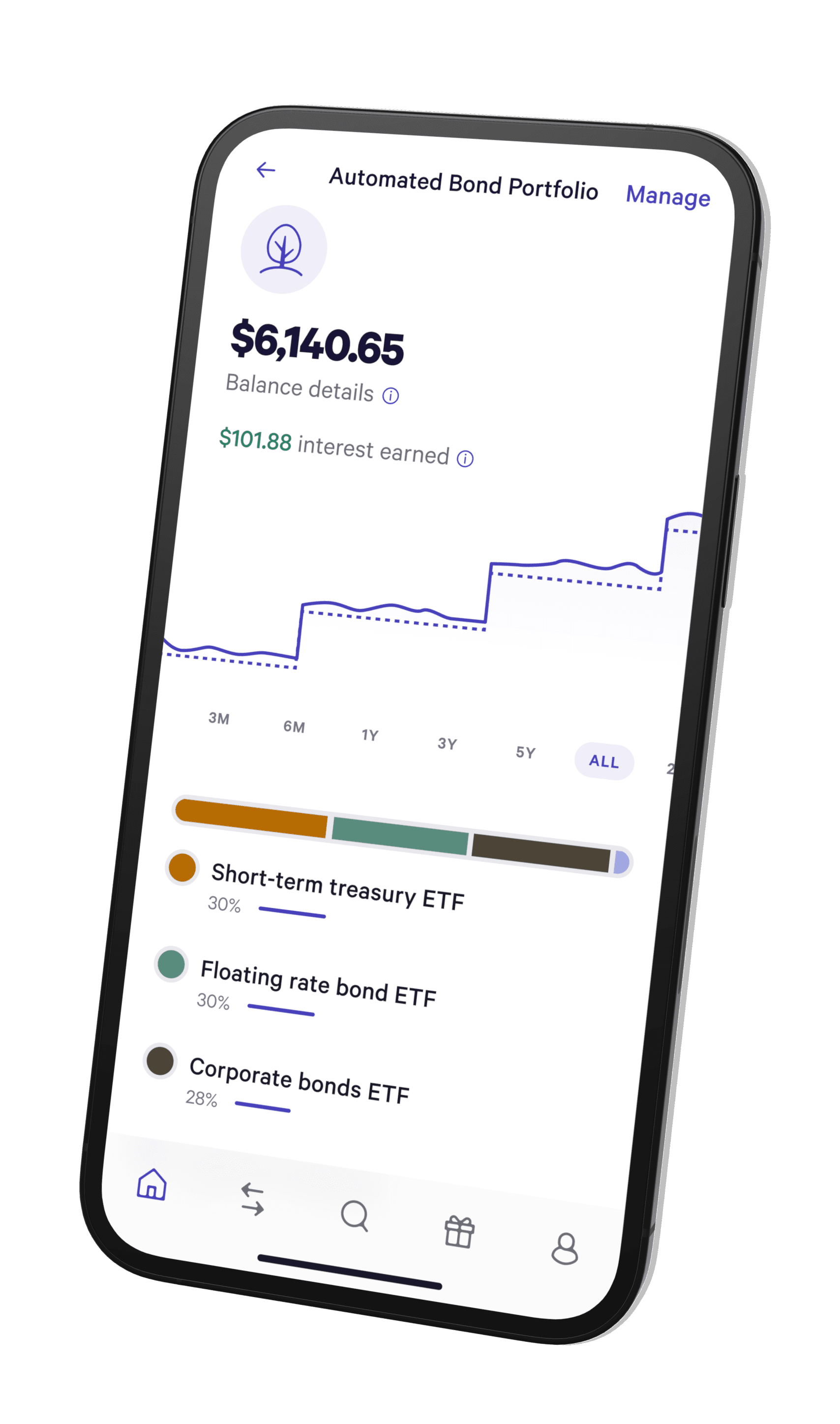

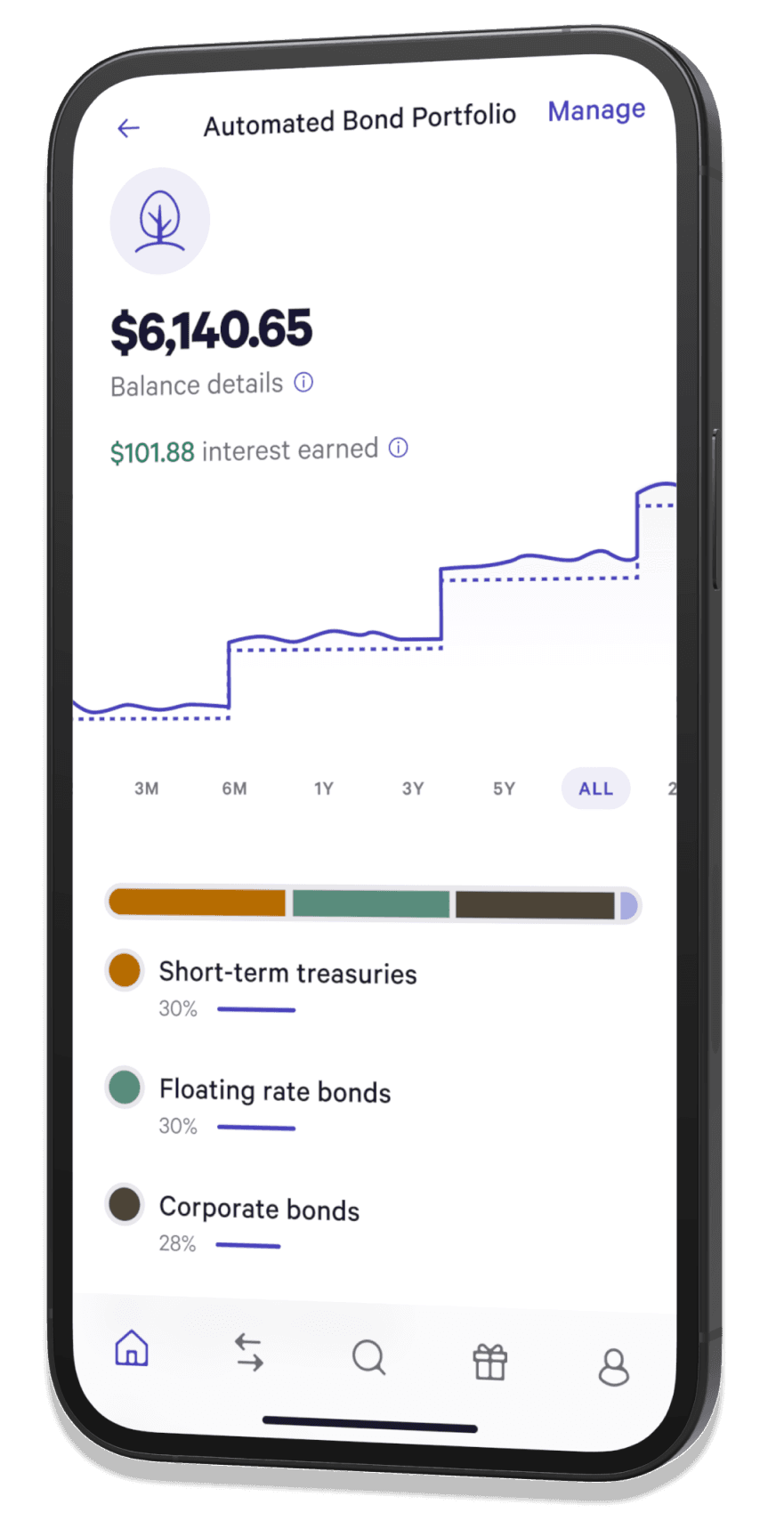

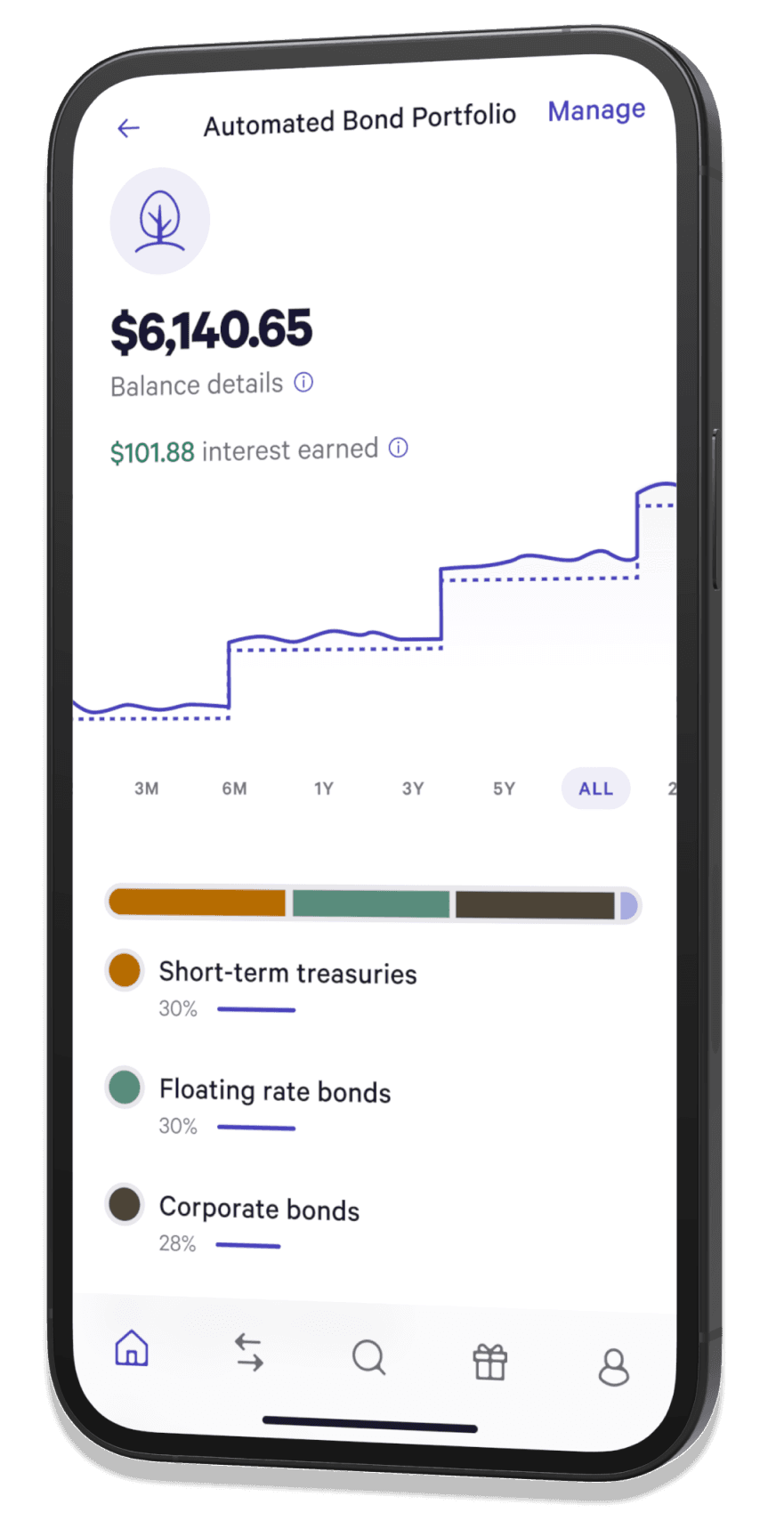

Meet the automated, diversified bond portfolio.

Invest for the near term without too much risk.

Whether you’re planning to retire soon, or you’re looking for lower risk than equities, bonds can be a great way to invest for the next few years. Our Automated Bond Portfolio is optimized to your tax situation with the added benefit of monthly dividends. Best of all, your account stays liquid for more flexibility.

Blended 30-day SEC yieldafter advisory fee, as of 01/08/2026

Total return since inception

(03/30/2023): 16.77%

12-month performance: 5.01%

Meet the automated, diversifiedbond portfolio.

Blended 30-day SEC yieldafter advisory fee, as of 01/08/2026

Total return since inception

(03/30/2023): 16.77%

12-month performance: 5.01%

Invest for the near term without too much risk.

Whether you’re planning to retire soon, or you’re looking for lower risk than equities, bonds can be a great way to invest for the next few years. Our Automated Bond Portfolio is optimized to your tax situation with the added benefit of monthly dividends. Best of all, your account stays liquid for more flexibility.

Get startedBond Investing Gets The Robo-Adviser Treatment

Wealthfront is offering an automatic portfolio just for bonds in response to surging interest in fixed income.

Tax benefits from Treasuries and higher yields from corporates.Two birds, one portfolio.

short-term treasury etf

tax advantaged

corporate bond etf

floating rate bond etf

long-term treasury etf

tax advantaged

With an expert-built portfolio, you’ll benefit from the diversification of four different types of bond ETFs, from tax-advantaged Treasury bonds to higher-yield corporate bonds. And to help you save even more on your tax bill, we'll optimize your holdings based on your personal details — like your annual income and state of residence.

Get startedHigher yield. Zero hassles.

Bonds can be a pain in the math — orrr they can be a piece of cake. Designed to earn a higher yield than a savings account, our Automated Bond Portfolio can give you the dividends of bonds without all of the annoying “hard work.”

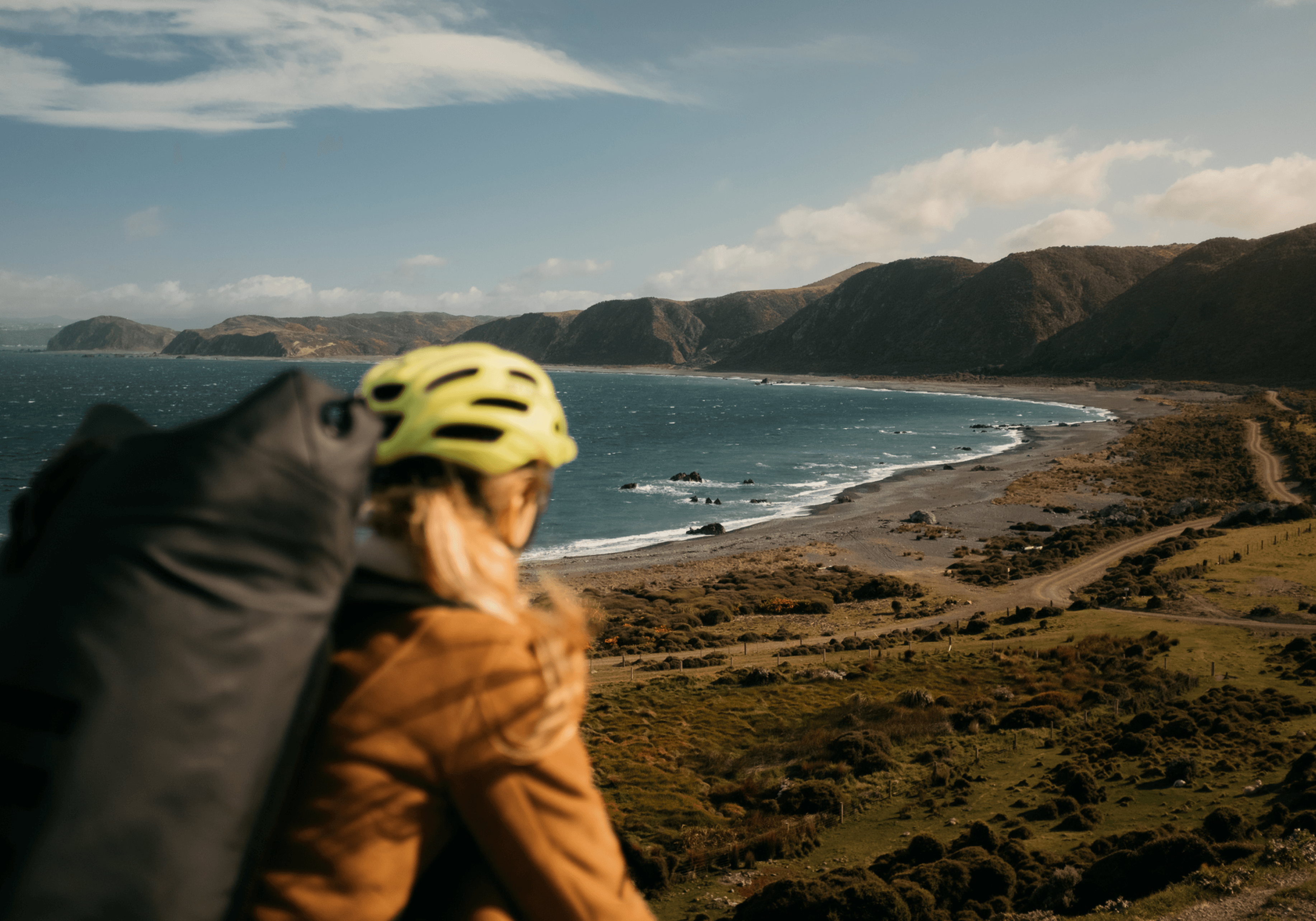

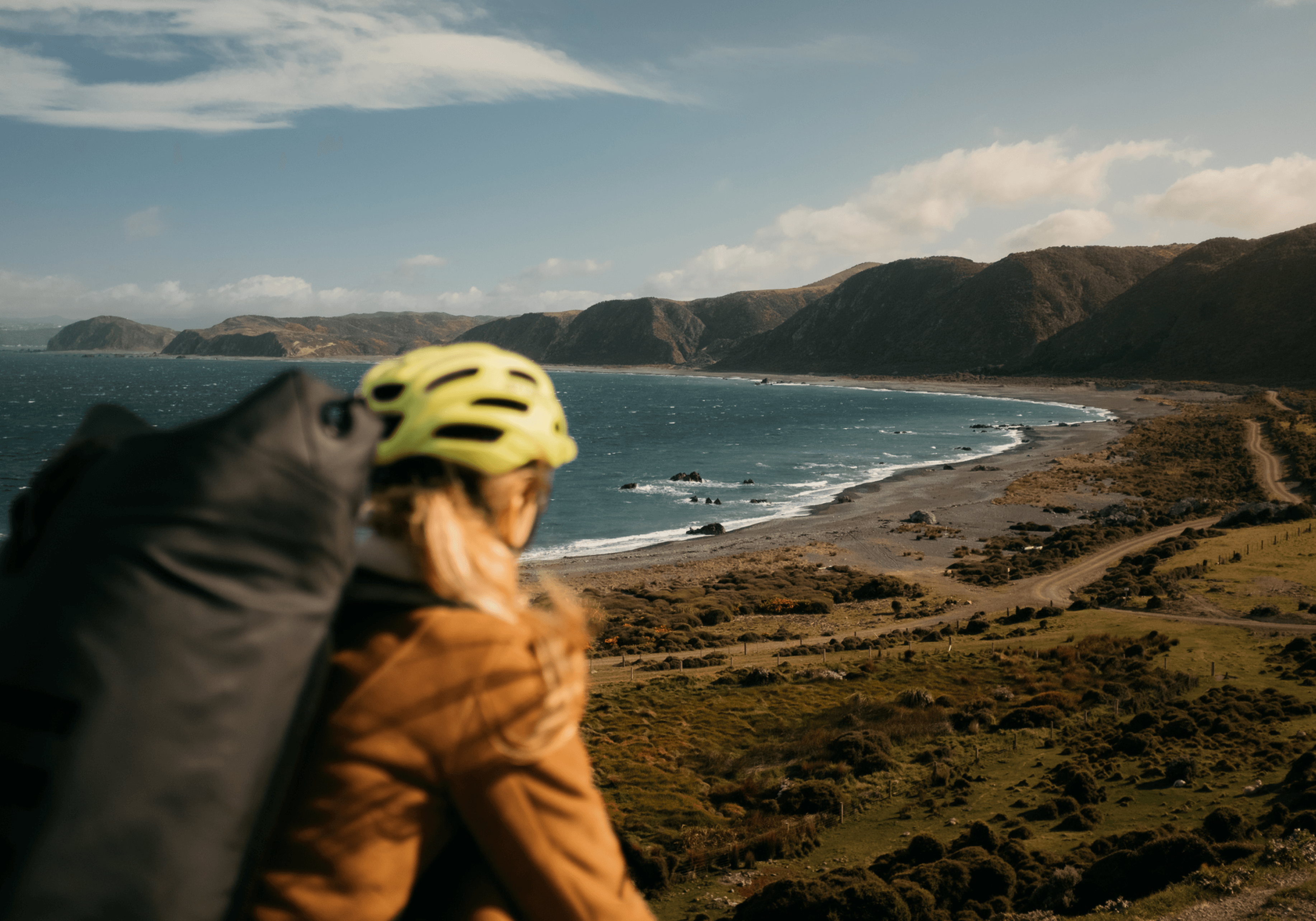

Not too hot. Not too cold. It’s like the Goldilocks of risk.

High-yield savings

Best for your daily expenses and your emergency fund, until you’re ready to invest.

Bond ETFs

Increase your earning potential on extra cash with low volatility. Ideal when saving for purchases in the next 1–3 years.

Index funds

The time-tested method designed to earn you greater returns over the long term, with more exposure to risk.

Individual stocks

At risk of higher volatility, but useful when investing in specific companies you believe in.

VOLATILITY ILLUSTRATION

Thinking about the competition? Be our guest.

Higher yields than

Treasury bills

CDs

High-yield savings

More liquid than

I bonds

CDs

Corporate bonds

Lower risk than

Individual stocks

Index funds

Corporate bonds

now

We re-invested this month’s dividend of $153.75.

The best bit?We do it all for you.

Automatic rebalancing

Dividend reinvesting

Tax-Loss Harvesting

100% managed for you.

Not only can you earn a yield with the Automated Bond Portfolio, but you won’t even have to think about it. Since your portfolio is fully managed, we’ll automatically adjust your portfolio to optimize your allocations, reinvest your dividends, and help you lower your taxes with Tax-Loss Harvesting, whenever we can. You’re welcome to watch, or do anything else.

Get startedThe best bit?We do it all for you.

now

We re-invested this month’s dividend of $153.75.

Automatic rebalancing

Dividend reinvesting

Tax-Loss Harvesting

100% managed for you.

Not only can you earn a yield with the Automated Bond Portfolio, but you won’t even have to think about it. Since your portfolio is fully managed, we’ll automatically adjust your portfolio to optimize your allocations, reinvest your dividends, and help you lower your taxes with Tax-Loss Harvesting, whenever we can. You’re welcome to watch, or do anything else.

Get startedWhen it comes to bonds, everyone has questions.

Learn more about our portfolio of bond ETFs with these helpful FAQs.

So about this “blended 30-day SEC yield.” What even is that?

Does that mean the yield is guaranteed?

How do I know if this product is right for me?

When do I get my dividends?

How does the tax-optimization part work?

OK, but there’s a fee? Walk me through it.

Is my portfolio really liquid?

It really is. Generally, it takes 3-4 business days to withdraw since your money is in bond ETFs, not a savings account. But unlike CDs or I bonds, there’s no penalty to withdraw your money whenever you need it.