New welcome offer3.95% APY

New clients get 3.95% APY for 3 months when you open a Cash Account. After that, earn the base 3.30% APY, so your cash keeps earning sweet, sweet interest.

Base Annual Percentage Yield (APY) as of 1/30/26 is provided by program banks and is subject to change.

Savings? Checking? Better.

Who says you should have to choose one or the other? Wealthfront isn’t a bank, but we work with program banks to get you an industry-leading annual percentage yield (APY), the security of FDIC insurance, and a full array of fee-free, no-strings-attached checking features — all wrapped up into one label-defying package we call a Cash Account.

Checking features

ATM fee reimbursement

We’ll reimburse 2 fees per month at out-of-network ATMs in the U.S. (up to $7.50 each). You can also access 19,000+ free ATMs nationwide.

Free wire transfers

Transfer funds for free to title and escrow companies and accounts you own at other institutions.

Pay bills, send and deposit checks

Move money and pay bills with account and routing numbers, plus send free checks and make deposits with our mobile app.

Saving features

Transfer to invest in minutes

Move cash to a Wealthfront investing account in minutes, and get your long-term money working even harder, ASAP.

Automated savings and transfers

Create your own automated plans and set recurring transfers to move money to your savings goals and investments with Wealthfront.

Cash Categories

Easily bucket your money to stay organized and set customizable saving goals.

Ready to get your money earning?

Open an account

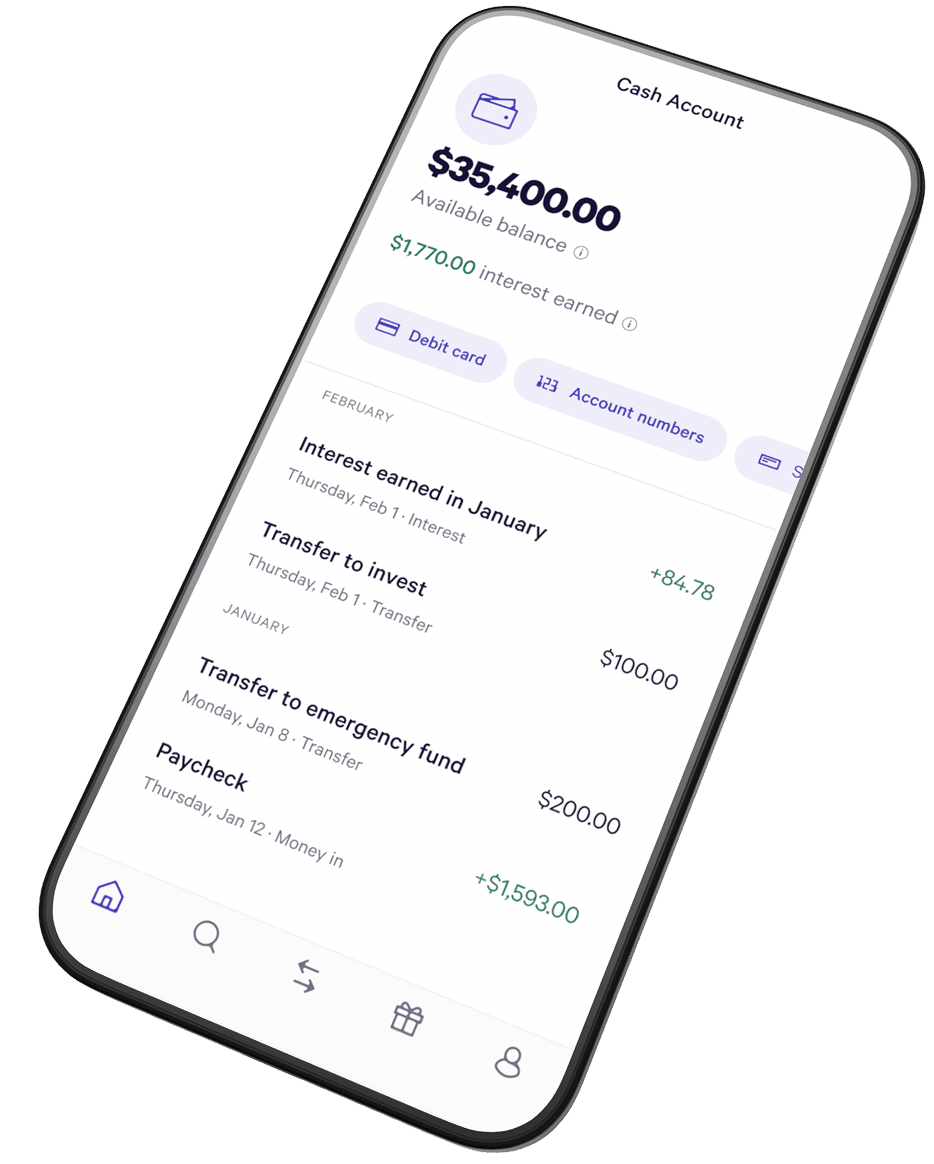

Earn interest on every penny of your paycheck.

Enroll in direct deposit to get your money earning 3.30% APY faster. You can easily spend (hello, handy debit card), invest, pay bills, and withdraw instantly to eligible external accounts. In other words, get the most out of your paycheck and keep your money exactly where you need it—at your fingertips.

Don’t just grow your savings.

Grow your spendings, too.

Why pay for expenses out of a low-APY account if you don’t absolutely have to? With multiple ways to cover everything from credit card bills to aikido classes, you’ll keep earning a 3.30% APY until your money’s out the door — without even breaking a sweat.

Money for monthly expenses: $7,500

You could earn an extra +$20.32 in monthly interest.

Calculation is an estimate and assumes 3.30% APY for 30 days and no withdrawals. Actual interest payments and APY can vary. Learn more

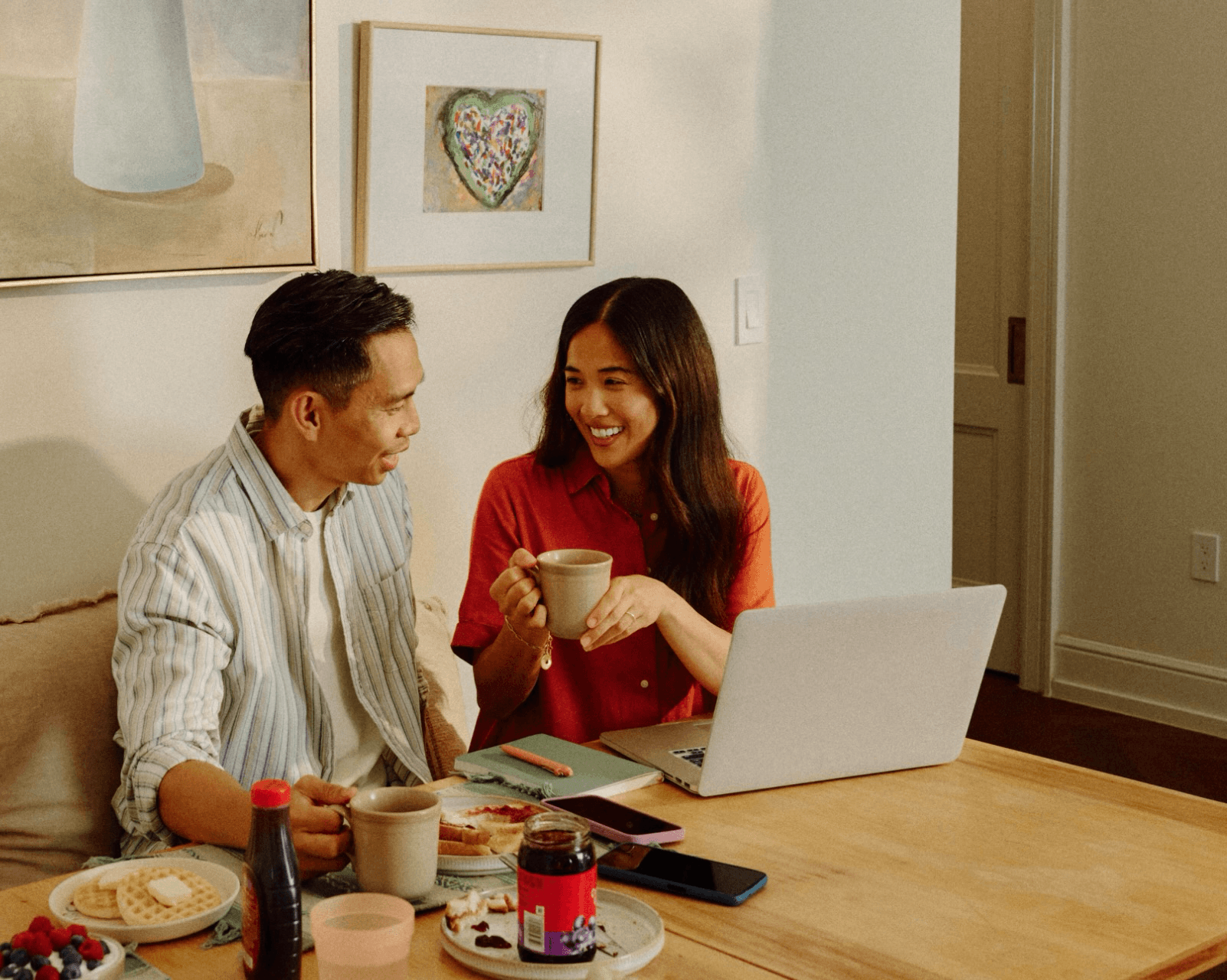

“The Wealthfront Cash Account is my main source of money coming in and going out. I just like the convenience of having everything in one place versus a whole bunch of services that I need to manage.”

Sid V. | Client since 2015

The testimonials above are by clients of Wealthfront Brokerage. No compensation was provided. These testimonials may not be representative of other clients’ experience. Rate is subject to change.

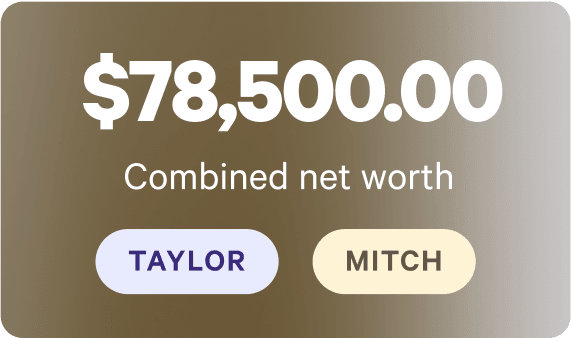

Earn 3.30% APY as

a couple with a

Joint Cash Account.

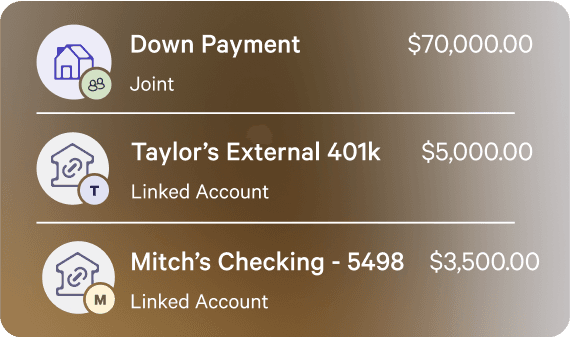

- Track your combined net worth by linking external accounts

- Stay organized with customized categories for your shared goals

- Debit cards, plus account and routing numbers for paying bills, direct deposit, and more

How do we stack up?

See for yourself.

Cash Account

Traditional Bank

Savings Accounts

High-Yield Cash Management Accounts

High-Yield Savings Accounts

Yield

3.30% APY base rate paid by program banks

0.39% APY

National average - FDIC.gov

3.25%

2.50% - 3.25%

(Can require commitments like direct deposit)

Account Fee

$0

Typically $5-$8/month

Up to $5/month

Typically $0

Withdrawals to external accounts

Free instant withdrawals to eligible accounts — even on weekends and holidays!

Free, typically 2-3 days

Free, typically 2-4 days

Free, typically 1-3 days

Insurance

FDIC insured up to $8M through program banks

FDIC insured up to $250K

FDIC insured up to $2M-$5M through program banks

FDIC insured up to $250K

Domestic wires

Free wire transfers to title companies and accounts you own

$25-$40

Usually not available

$20-$35

The APY rates and other information listed are as of January 30, 2026, and are subject to change. Traditional Bank Savings Accounts include the top US banks based on total assets. High Yield Cash Management Accounts were chosen based on a combination of industry-leading high APYs, strong insurance protection, and low to no account fees, and are most comparable to Wealthfront’s Cash Account. High Yield Savings Accounts were chosen based on being top rated by popular personal finance review platforms such as Bankrate and Nerdwallet.

Don’t save your questions.

We’ve got answers.

What happens to the APY after the first 3 months?

Your rate will revert to the base rate of 3.30% APY provided by program banks, which is subject to change. We’ll always notify you when the Cash Account rate changes — which generally happens in response to a change in the Federal Funds Rate, or when there’s a significant change in the rates our program banks pay us to hold our clients’ deposits.

When do I collect that sweet, sweet interest?

But what if I want to withdraw my money?

It’s your money, so you can withdraw it whenever you want, with no fees. If your external account is in the RTP® or FedNow® Network, it’s eligible for free instant withdrawals when you request every day, even on weekends and holidays!

For other accounts, withdrawals usually take only one business day to arrive — although if it’s from a recent deposit, it may take a few extra days to process.

How hard is it to transfer from savings to investing?

Is my money safe with Wealthfront?

Exceptionally safe. Your money gets up to $8 million in FDIC insurance (or $16 million for joint accounts). This is possible because we aren’t a bank — we sweep your deposits to up 32 program banks (each with its own federally-insured $250,000 limit) at any given time. As a result, you get 32x the FDIC insurance in a Wealthfront Cash Account than you’d get with a regular bank account.

Beyond the federal backstop provided by the FDIC, we keep your money secure by complying with the rules of our federal regulators, protecting your data with robust security practices , and conducting annual third-party accounting audits.