Start your home buying journey with Wealthfront

Looking to buy a home in CO, TX, or CA? Join the waitlist to get updates about Wealthfront’s new home lending offering.

If the need for a home is imminent, the first step you should to take is to figure out what you can afford.

And we don't mean just the down payment, we mean total affordability.

When it comes to securing a mortgage, there are several financial factors at play. Here are a few things you can do to ensure you qualify for a mortgage with favorable terms:

Mortgage lenders consider your credit score when determining how risky it is to give you a loan, which impacts the interest rate you can get. All else equal, if your credit score is above 760, you are likely to get a mortgage interest rate that is about 0.25% to 0.375% lower than someone with a credit score of 660. If your credit score is in the 500s, you should expect some challenges in qualifying for a mortgage and, if you do find one, it may have a much higher interest rate.

Your DTI is the sum of all of your monthly debt payments, including credit lines, minimum monthly payments for any credit card debt, auto loans, and your upcoming mortgage expenses, as a percentage of your monthly pre-tax income. Most mortgage lenders prefer to issue a mortgage that will keep your DTI below 40%. Once your DTI goes above 43%, it becomes much more difficult to secure a mortgage.

The size of your down payment, or the upfront payment you make on the house, impacts your interest rate, whether you need to pay private mortgage insurance, and the size of your monthly mortgage payments. Conventional wisdom is to put at least 20% down to avoid the need for mortgage insurance, but there are various loan options that allow for a down payment as low as 3%. On average, first-time homebuyers put about 9% down. In general, the bigger your down payment, the lower your interest rate.

While your home budget is limited by the size of your mortgage, other factors are at play as well when it comes to affordability. See more details

The size of your down payment directly affects the overall costs of your home. The more you put down, the smaller your loan amount, and thus the smaller your monthly principal and interest payments will be, all else equal. You should also know, however, that lenders will typically give you a better interest rate the more you put down. If you put less than 20% down, you will typically need to pay for mortgage insurance. Conventional wisdom is to put at least 20% down to avoid the need for mortgage insurance, but there are various loan options that allow for a down payment as low as 3%. On average, first-time homebuyers put about 9% down.

The example assumes a single-family home that costs $800,000 with a 30-year fixed rate mortgage. It also assumes the buyer has a 760 credit core with a 25% DTI ratio.

| Down payment | 10% | 20% | 30% |

| Monthly principal and interest payment | $4,521.57 | $4,013.30 | $3,469.17 |

| Monthly mortgage insurance | $90 | $0 | $0 |

| Total monthly costs | $4,611.57 | $4,013.30 | $3,469.17 |

Conventional wisdom may lead you to believe that the only costs of home ownership are the down payment and the monthly mortgage payment. However, if you budget with only these two factors in mind, you'll likely be caught off guard when the bills come rolling in.

Some additional costs to keep in mind:

This cost breakdown is not meant to discourage you from exploring homeownership. Rather, this information should help you better anticipate the costs you can expect when you become a homeowner. See the benefits of home ownership

Once you're armed with a home budget, you can start to understand what's possible and what trade-offs you may have to make.

Deciding where to buy is often almost as big of a decision as which home to buy. For those living in urban areas like New York or San Francisco, a fairly common question that arises is whether or not to make the move to the suburbs.

A major draw of the suburbs is you can sometimes get a larger home for the same budget. But, on the other hand, there are many perks and conveniences of city life that can’t be easily replaced when you move away. This is worth considering when you work through the decision to buy a home.

Aside from size of home you can get for your money, there are a number of other factors to consider and trade-offs to think through when deciding on the location to buy that's right for you:

Property taxes can vary dramatically by city or county. According to the Tax Foundation, some states have property tax rates of over 2%, while others are under 0.50%

The location you choose may affect the interest rate on your mortgage. Lenders factor in the difficulty of selling a home given its location in case of foreclosure.

If you are planning on starting a family or have kids now, school districts are another major factor in deciding where to live. Great public school districts often increase home prices in a specific area, which means you may have to pay a premium for access to better education.

If your job is in the city, moving to the suburbs will mean increased time and money spent traveling every day.

The cost for groceries, utilities, and other services can also vary widely between urban and suburban areas.

Given the magnitude of the purchase, you may understandably want to wait for the ideal time to buy.

Timing the real estate market is like trying to time the stock market––it’s very hard to do. Home prices will go up and home prices will go down. Plus supply and demand varies regionally, making any attempt to time the market even more challenging.

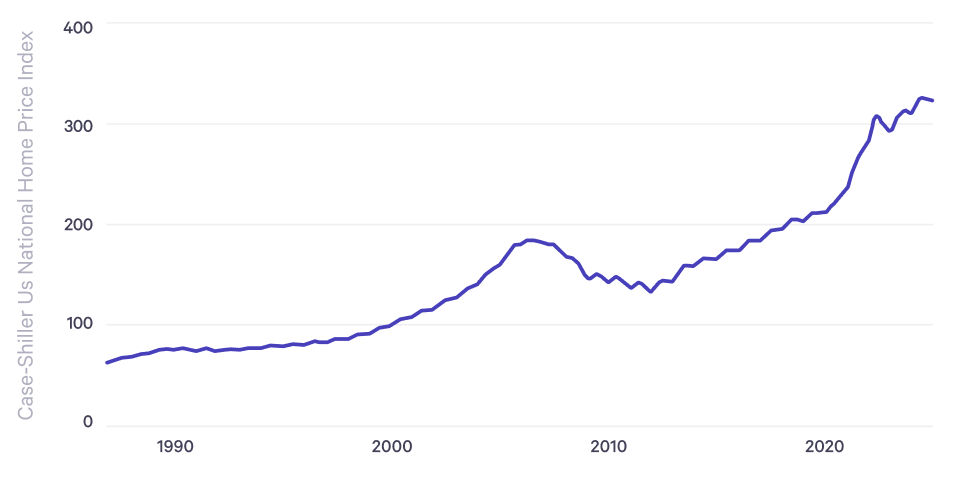

As evident from the Case-Shiller Home Price Indices, a leading measure of US residential real estate prices, while home prices in the US have increased over time, real estate market volatility is hard to avoid.

Keep in mind there’s also an implicit cost to waiting. Even if you don’t move forward with buying a home, that doesn’t mean you’re not incurring housing expenses. For instance, waiting a year to buy a home means paying a year of rent to your landlord instead of building equity in a home. Find out how to compare renting versus owning.

Once you understand the all-in costs of homeownership and determine your home budget, you can start making decisions on the details — what neighborhood, what size home, what time frame

Looking to buy a home in CO, TX, or CA? Join the waitlist to get updates about Wealthfront’s new home lending offering.