What level of risk suits you best?

Sure, everyone wants to maximize their returns — but not everyone’s comfortable with the ups and downs that come with long-term investing. Whether you like to play it safe, take big bets, or both, how do you get the highest return for your comfort zone?

Find out why diversification is a recommended investing strategy and what the right balance of risk and return is for you.

Risk is different for everyone.

There is no one-size-fits-all approach to risk and your risk tolerance can shift over time.

Your investment goals and how you feel about potentially losing money help you understand how comfortable you are with the ups and downs of the market — and whether you’re better suited to low-risk or higher-risk investments.

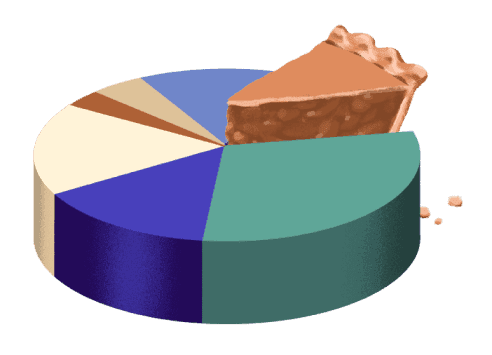

Defensive

Cautious

Balanced

Adventurous

Very Adventurous

A maximizer