You can't save the world with a click.

But you can start.

Open an Automated Investing Account and get started with a Socially Responsible portfolio designed around sustainability, diversity, and equity — so you can do well and do good without actually having to do much of anything.

Get startedSRI Portfolios built for Y-O-U.

Save the world. And your time.

It’s ridiculously easy to start making a difference.

It only takes one click to start investing with a portfolio built from the ground up around equity, sustainability, and diversity. Because building a better future doesn’t have to mean breaking a sweat.

Get started

Meet our stock investing account

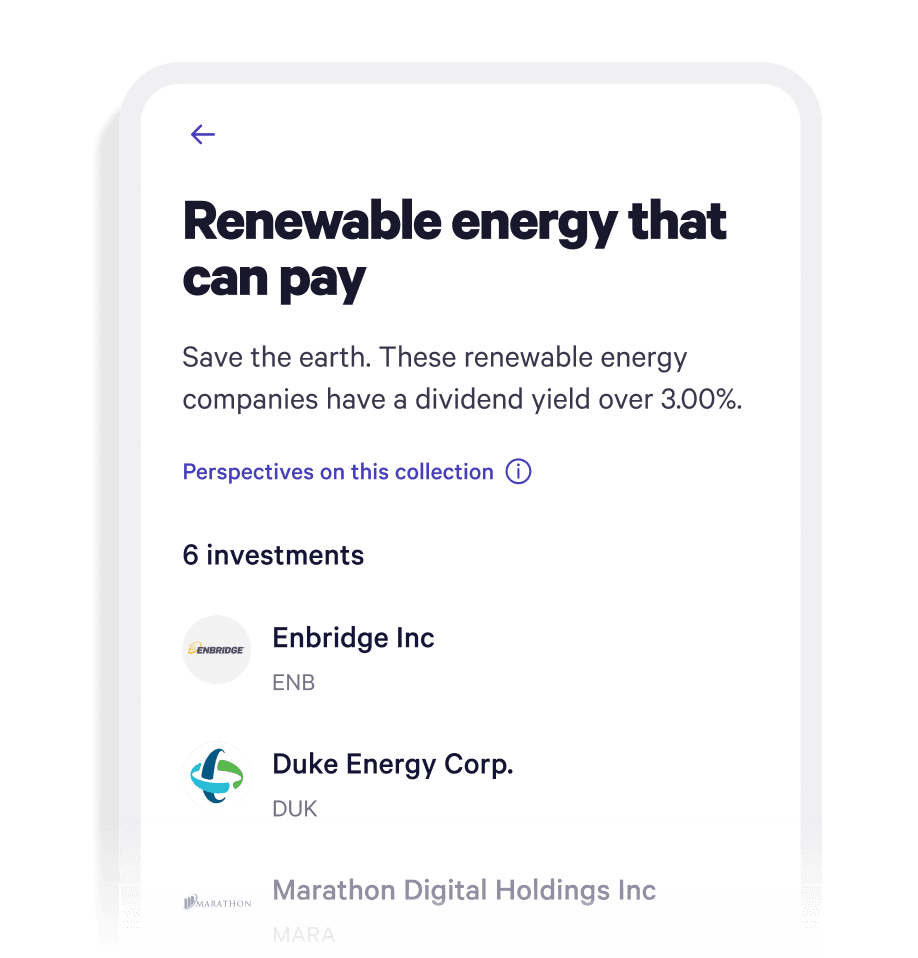

Want a little more control?

Invest in individual stocks.

Fractional shares. No commissions. $1 to get started.

Other investing apps might focus on what’s trending, but our Stock Investing Account lets you skip the endless hours of research, to help you make smarter investing decisions, faster. Browse 45+ pre-built collections and invest in companies you love without the advisory or management fees.

Check out these FAQs on SRI

These frequently asked questions may help:

Say less. How do I get this?

Wait. Can I make a socially responsible portfolio with a Stock Investing Account?

How do I know your picks are actually, like, socially responsible?

So, there’s a Socially Responsible alternative for everything?

But what if I don’t like your picks?

Is this like how organic strawberries cost twice as much as regular?

As well written as this website is, I still have questions.

Learn about our Product Specialists