Wealthfront Joint Accounts

Build wealth

as one.

$85,000.00

Combined net worth

Joint Cash Account

Joint Investing Account

Mitch's Checking Account

Taylor's External 401(k)

Seamlessly manage your cash, save, and invest together, with a shared vision for every goal—big or small. See your pooled money and personal money, all in one place.

joint cash account

Earn 3.30% APY*

from program banks on your combined cash

joint investing account

Invest with expert-built portfolios and strategies

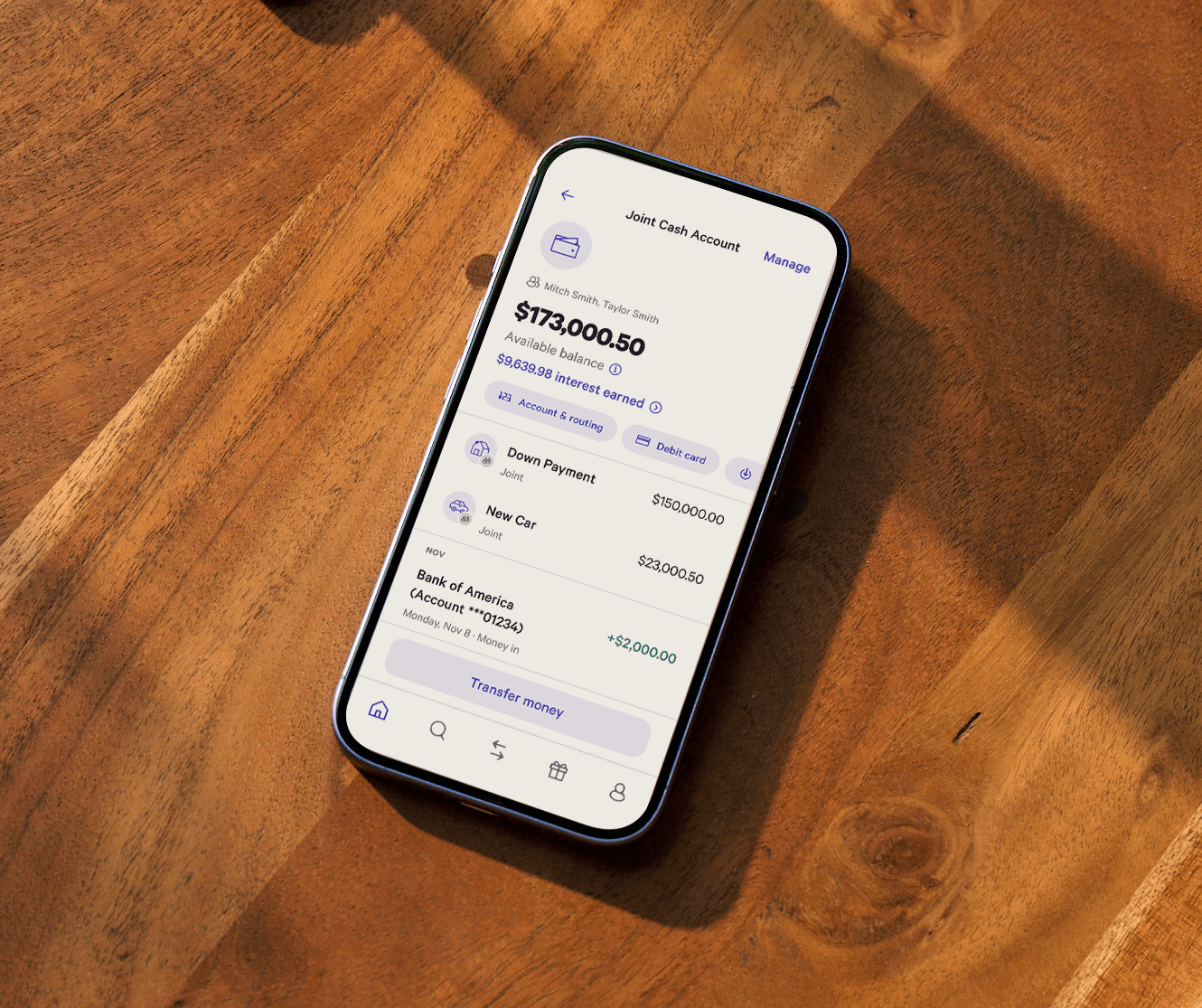

Joint Cash Account

No compromises.

Just 3.30% APY

on all your cash.

Wealthfront

Now

Mitch deposited $2,000 to your Joint Cash Account.

Wealthfront

Now

Taylor contributed $3,500 to Down Payment. 🏡

Your combined cash earns 3.30% annual percentage yield (APY) from our program banks while it stays ready to spend, withdraw, or transfer to invest with us in minutes. No account fees. No minimums. No maximums.

Free, 24/7 instant withdrawals

Pay bills, deposit checks, and direct deposit your paychecks

Up to $16M in FDIC insurance through program banks

Set customized goals as you save together

Get cash and shop with debit cards

Joint Investing Account

Invest together with confidence.

All of our joint investing accounts are designed to make big decisions refreshingly simple (and smart). We focus on automating wealth-building strategies that keep your money working through the market’s ups and downs—so you can focus on working toward your goals together.

Automated Investing Account

Get an expert-built, globally diversified portfolio of index funds, personalized for you.

S&P 500 Direct

Invest in individual stocks of the S&P 500® index and take advantage of automatic Tax-Loss Harvesting.

Automated Bond Ladder

Lock in current yields—and no state income taxes—with a ladder of US Treasuries.

Automated Bond Portfolio

Earn dividends from a diversified mix of bonds—including higher yield corporate bond ETFs—without the lock-ups.

See your total net worth as a couple

across all your accounts.

Link your external accounts (assets, liabilities, investments, crypto, etc.) and you both get an overview of your shared finances on a single screen. From the big-picture perspective to the smallest daily transactions, both co-owners can easily stay on the same page—helping you see where you stand today and plan with greater clarity for tomorrow.

Why couples choose us:

“

What really drew me to Wealthfront was the ability to share and integrate my wife’s finances into the platform. Before it didn’t feel like she had true access, and it made it kind of hard to budget, plan and get a picture of where we’re at.

Anna & Bill

The testimonials above are by clients of Wealthfront Advisers and Wealthfront Brokerage. No compensation was provided. These testimonials may not be representative of other clients’ experience. Past performance is no guarantee of success.

Questions?

Browse these Joint Account FAQs, or visit our searchable help center. You can also dive deep in our whitepapers to learn more about our products.