Retirement Accounts

Saving for retirement can be as easy as dreaming about retirement

Build wealth with best-practice investing in a tax-advantaged account

Customize your portfolio (unlike a target date fund)

Managed automatically, so you don’t need to talk to anyone

- Save, invest, and track your net worth in our award-winning app

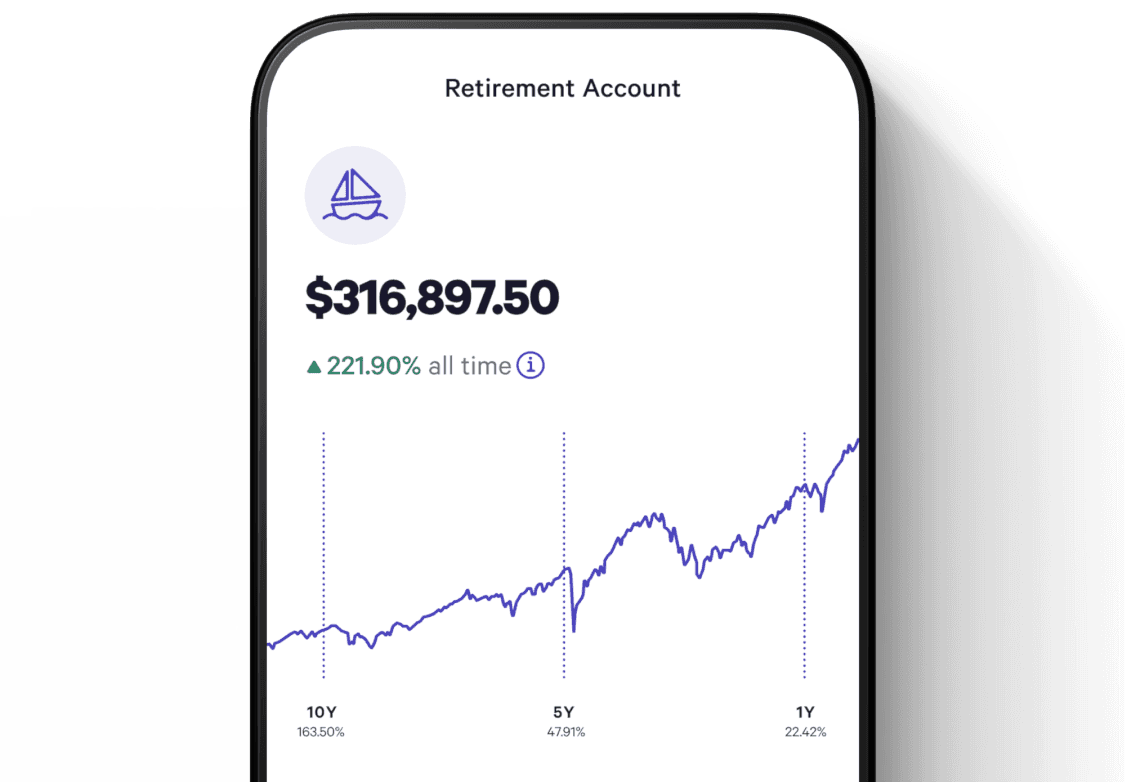

The chart represents actual performance for 1, 5, and 10-year periods through 01/13/2026 for investors in Wealthfront’s tax advantaged version of the Classic Automated Investing Account, with a composite risk score of 9 (Range is 0.5–10).

Managed by us, built for you.

Unlike a target date fund, your Wealthfront IRA is personalized around your risk tolerance and customizable to your interests. Like our award-winning Automated Investing Account, we’ll build you a globally diversified portfolio with low-cost index funds and proven best practices to help you maximize returns in any kind of market.

An IRA for anyone who wants to do less work

The chart represents actual performance for 1, 5, and 10-year periods through 01/13/2026 for investors in Wealthfront’s tax advantaged version of the Classic Automated Investing Account, with a composite risk score of 9 (Range is 0.5–10).

Skip the guesswork

We’ll build a globally diversified, tax-advantaged portfolio designed for optimal exposure to any market condition and manage it for you. If you want to customize your portfolio, you can add or remove funds of your choosing and adjust your asset allocation weights.

Stress-free investing, managed for you

Our software never stops working to help you maximize your retirement savings (and minimize fees along the way). We make all the trades when you deposit and withdraw, reinvest any excess cash you’re holding, and rebalance your portfolio to keep you in line with your ideal risk tolerance, automatically. We’ll even monitor trades across all of your eligible Wealthfront investing accounts to avoid wash sales, maximizing the benefit from Tax-Loss Harvesting applied to your non-retirement accounts.

See all your accounts in one place

With a clear view of all your finances, it’s easier to see your progress and understand how much you can afford to invest. You can even link your external accounts to track your net worth in one view and transfer money from your Wealthfront Cash Account to invest in minutes. And, in case you earn more than the income threshold, you can convert to a backdoor Roth IRA in just a few taps.

If you like paying less taxes, this is your chance

Unlike a taxable investing account, a tax-advantaged retirement account means you’ll pay taxes once, not twice—when you contribute or when you withdraw, based on the IRA you choose. If you need help deciding, try our retirement calculator.

Traditional IRA

Contribute pre-tax dollars today and pay taxes on withdrawals in retirement.

Roth IRA

Contribute already-taxed dollars and pay no taxes on withdrawals.

SEP IRA

Contribute pre-tax dollars like a Traditional IRA. This special IRA is designed for the self-employed and has a much higher annual contribution limit—the lesser of $72,000 or 25% of your annual compensation.

Automated Investing Account

IRA too restrictive? Build long-term wealth with a diversified portfolio and save money on taxes with Tax-Loss Harvesting. Learn more

Retirement may be years off, but you can have the answers now

Still deciding if we’re right for you?

These frequently asked questions may help.