When I was getting ready to buy my first home, I found that shopping around and comparing mortgage rates wasn’t straightforward. For example, most lenders quoted me a rate with discount points included, but I wanted to see their rates without points. And none of the lenders I spoke with offered a way for me to explore their rates online, so I had to go back and forth with them many times (either by email or phone) to get personalized quotes for multiple scenarios. It was tedious to gather the information I needed to make a good decision.

Because of that experience, I’m now very aware of the common mistakes prospective homebuyers can make in the process of shopping for and comparing mortgage rates. Those mistakes can be consequential and add up to thousands or even tens of thousands of dollars over the life of your loan. In this post, I’ll explain what to watch out for so you can make a confident, informed decision.

Don’t compare an interest rate to an APR

When you’re shopping for a mortgage, you’ll likely see both APRs (annual percentage rate) and interest rates displayed, depending on where you do your research. It’s important to know that they are not the same thing.

The interest rate tells you how much interest you’ll pay on your loan, whereas the APR covers the interest rate plus various other costs associated with your mortgage—including origination fees, appraisal fees, mortgage insurance, closing fees, and discount points (more on that below). It’s worth noting that APRs can be somewhat inaccurate early on in the mortgage process, because lenders can’t always accurately estimate closing costs, which vary depending on which third parties (like title companies) are involved.

| Interest rate | APR | |

| Definition | The percentage of the loan amount you’ll pay the lender in interest annually | The percentage of the loan amount you’ll pay the lender in interest annually plus various other costs, expressed as a total percentage of the loan amount |

| What it includes | Just interest on your loan | Interest on your loan Mortgage insurance Origination fees Appraisal fees Closing fees Discount points |

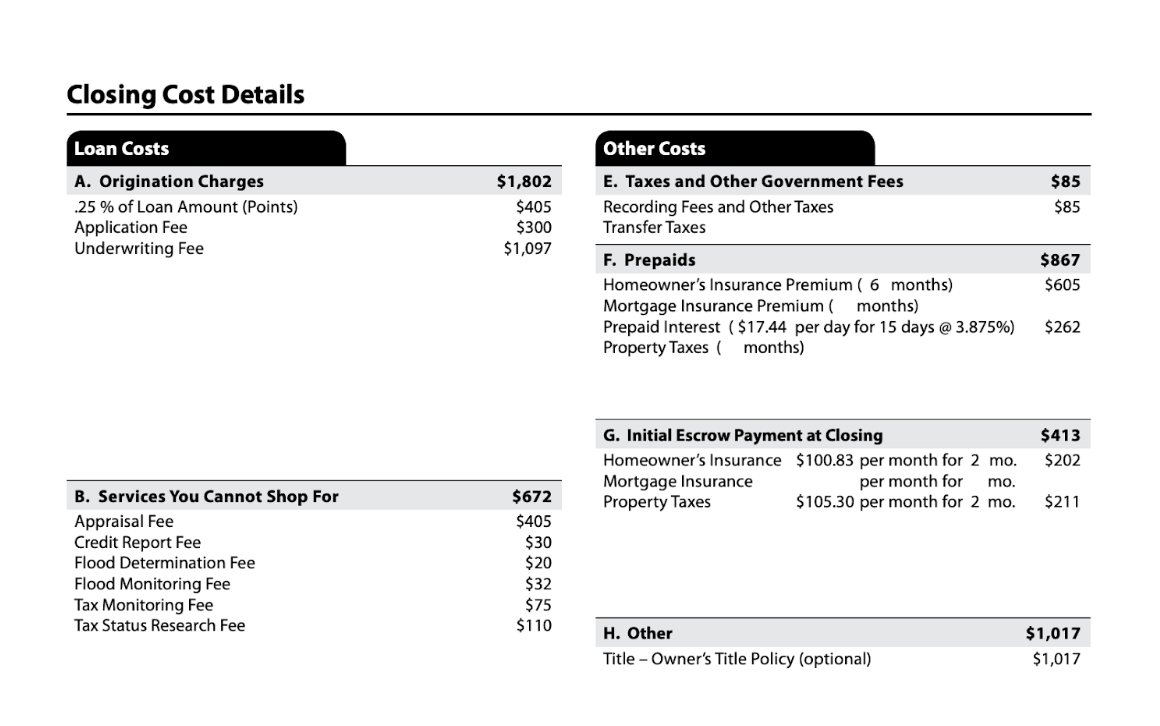

When you’re making a comparison, we think it makes sense to focus primarily on the interest rate and costs from the lender known as “section A” costs (named for the section of the loan estimate form where they typically appear, shown in the top left corner of the example image below) instead of APR. Section A costs are not the only costs you’ll pay to get your loan, but they are established and charged by the lender—meaning if they seem unreasonably high, you can pick another lender. It’s also smart to glance at section B costs (which are costs associated with third-party vendors, chosen by the lender) like the appraisal fee. While these costs vary less (and you can’t shop for them) you can still pick another lender if they seem unusually high relative to another lender’s section B costs.

Example loan estimate form from the Consumer Financial Protection Bureau

For a more detailed breakdown of how to interpret the costs on a loan estimate, we recommend checking out this helpful interactive tool from the Consumer Financial Protection Bureau.

Don’t compare a fixed rate and an adjustable rate

Some mortgages offer the same interest rate over the life of the loan (this is called a fixed-rate mortgage) while others offer interest rates that move up or down over time (called an adjustable-rate mortgage, or an ARM). The initial rate on an ARM may be lower than the rate you’ll pay once it starts to adjust, depending on market conditions.

That’s why when you compare interest rates, we generally think it’s smart to avoid comparing fixed-rate mortgages with ARMs. You might make an exception to this rule if you are very confident you will sell your home before the rate on your ARM begins to adjust.

Don’t forget to factor in discount points

Discount points allow you to pay more cash up front to get a lower interest rate on your mortgage. As a result, you can’t really learn much from comparing a mortgage interest rate with discount points to a mortgage interest rate without discount points. Instead, it’s smart to compare mortgages without points and then evaluate the cost of discount points across lenders if you decide paying discount points is right for your situation. For more information on points (which can get complicated!), we suggest checking out this helpful explainer about discount points from the Consumer Finance Protection Bureau.

A word of warning: In the process of taking out a mortgage, you might also encounter “origination points.” These are not the same thing as discount points, but the distinction can be confusing for borrowers. Origination points are just fees—they’re a way for lenders to express origination fees as a percentage of the amount you’re borrowing.

Don’t ignore term length

Finally, not all mortgages have the same term length, which means they vary in how long they give you to pay off your loan. The term length of a mortgage affects the interest rate: In general, you can expect a shorter-term mortgage to come with a lower interest rate than a longer one. You should also remember that, all else equal, the payment on a shorter-term mortgage will be higher than a longer one, even if the rates are the same.

To get a helpful comparison between interest rates from two lenders, you should make sure you’re comparing mortgages with the same term length—for example, two 30-year mortgages, not a 30-year mortgage and a 15-year mortgage.

Key takeaways

Choosing a mortgage is a big decision, and the interest rate will have a significant impact on the total amount you pay for your home. That’s why it’s important to be able to get a good comparison so you can confidently choose your lender and loan.

To recap, here’s what we think you should keep in mind:

- It’s important to make an apples-to-apples comparison. Try to avoid comparing interest rates on mortgages with different term lengths and loan structures.

- APRs and interest rates are not the same thing. Stick to interest rates whenever possible, and be sure to ask your lender about section A costs—you’ll want to keep those low. It’s smart to glance at section B costs like the appraisal fee, too.

- Discount points can help you lower the interest rate on your mortgage, but they can make comparison more difficult. Try to compare interest rates without points, at least to start.

We hope this helps!

Disclosure

This communication is for information purposes only, should not be construed as legal, tax, or mortgage advice, and does not constitute a solicitation for a loan or an offer to lend or extend credit.

About the author(s)

Michael Young is a Director of Product at Wealthfront. He studied Economics at Stanford University. View all posts by Michael Young