In last week’s post we provided the logic for why you should not try to invest in individual real estate properties (beyond your home) or try to pick which real estate market is likely to outperform the real estate market. This week we’ll explain how real estate as an asset class compares to alternative investments, specifically stocks.

In last week’s post we provided the logic for why you should not try to invest in individual real estate properties (beyond your home) or try to pick which real estate market is likely to outperform the real estate market. This week we’ll explain how real estate as an asset class compares to alternative investments, specifically stocks. However, this analysis should not be used when evaluating whether you should buy a home to live in. As we explained in Sizing Up Your Home As An Investment, the factors that go into making that decision are far more broad than just its investment characteristics.

Looking Sharpe

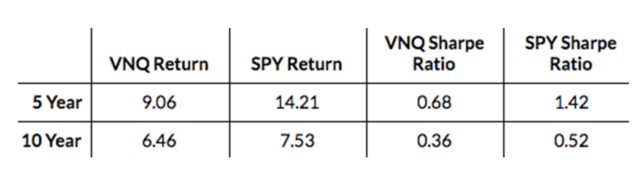

I often hear people opine that investing in real estate is superior to buying stocks. That’s certainly not supported by the data. As you can see from the table below, VNQ, the Vanguard ETF that tracks the most popular real estate index (the MSCI US REIT index), has significantly underperformed the S&P 500 over the past five and 10 years (ending August 31, 2017).

Source: Wealthfront

The difference is more staggering when you look at the risk adjusted returns for each asset class expressed in terms of their Sharpe ratios. The purpose of the Sharpe Ratio is to allow an investor to analyze how much greater a return she is earning relative to level of additional risk needed to generate that return. It specifically measures the average return for an investment minus the risk-free return divided by the standard deviation of investment’s returns. The higher the Sharpe Ratio, the better. As you can see, the S&P 500 outperforms the VNQ in both scenarios — by 2x for the 5 year comparison and just under 2x for the 10 year case.

It’s Taxing

The difference is even greater still when you factor taxes into the analysis. The returns listed in the table are pre-tax. REITs, the primary pooled investment vehicle through which individuals invest in real estate, are required by law to distribute at least 90% of their earnings in the form of dividends. These dividends are taxed at ordinary income rates, while dividends on stocks are taxed at the much lower long-term capital gains rate. Further, the REIT dividends represent a larger percentage of a REIT’s annual return than the typical stock that makes up the S&P 500. Therefore, if REITs and stocks generate equivalent pre-tax returns, then stocks will have much higher after-tax returns.

The tax inefficiency of real estate index funds (which are comprised solely of REITs) usually causes them not to be included in a taxable investment account’s optimal diversified investment mix. But that’s not to say that real estate shouldn’t be part of any diversified portfolios. In fact, because real estate returns are not very correlated (less than 0.7 on a scale of 0 – 1) with the returns of stocks, it is actually a good diversifying asset class for non-taxed or taxed-deferred accounts like an IRA, 401(k) or a 529 College Savings Plan. Real estate is also a pretty good hedge on inflation. But despite its advantages, the optimal allocation to the real estate asset class in a tax deferred portfolio is generally less than a quarter of what you allocate to stocks.

The Final Verdict

Real estate is one of the six components we suggest for a diversified portfolio (the others are U.S. Stocks, Foreign Stocks, Emerging Markets Stocks, Natural Resources and Bonds). But compared to stocks, it is not nearly as attractive an asset class. Even the premier university endowments — the most sophisticated diversified portfolio managers in the world — typically have a small allocation to real estate and consider real estate to be their most challenging asset class. Our advice for people who still feel the desire to invest in individual properties is the same as what we advise for people who want to buy individual stocks: if you’re going to do it, try to keep the aggregate investment to less than 10% of your total liquid net worth.

Disclosure

Nothing in this communication should be construed as an offer, recommendation, or solicitation to buy or sell any security. Wealthfront’s financial advisory and planning services, provided to investors who become clients pursuant to a written agreement, are designed to aid our clients in preparing for their financial futures and allow them to personalize their assumptions for their portfolios. Additionally, Wealthfront and its affiliates do not provide tax advice and investors are encouraged to consult with their personal tax advisors.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Wealthfront and its affiliates rely on information from various sources believed to be reliable, including clients and third parties, but cannot guarantee the accuracy and completeness of that information.

The S&P 500® (“Index”) is an index of 500 stocks seen as a leading indicator of U.S. equities and a reflection of the performance of the large cap universe, made up of companies selected by economists. The S&P 500 is a market value weighted index and one of the common benchmarks for the U.S. stock market.

The S&P 500 (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Wealthfront. Copyright © 2015 by S&P Dow Jones Indices LLC, a subsidiary of the McGraw-Hill Companies, Inc., and/or its affiliates. All rights reserved. Redistribution, reproduction and/or photocopying in whole or in part are prohibited Index Data Services Attachment without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein.

About the author(s)

Andy Rachleff is Wealthfront's co-founder and Executive Chairman. He serves as a member of the board of trustees and chairman of the endowment investment committee for University of Pennsylvania and as a member of the faculty at Stanford Graduate School of Business, where he teaches courses on technology entrepreneurship. Prior to Wealthfront, Andy co-founded and was general partner of Benchmark Capital, where he was responsible for investing in a number of successful companies including Equinix, Juniper Networks, and Opsware. He also spent ten years as a general partner with Merrill, Pickard, Anderson & Eyre (MPAE). Andy earned his BS from University of Pennsylvania and his MBA from Stanford Graduate School of Business. View all posts by Andy Rachleff