Today, we’re excited to announce three updates to Wealthfront’s Smart Beta service. These updates are designed to improve your expected risk-adjusted returns, remove some unnecessary complexity for accounts over $1 million, and reduce tracking error.

Smart Beta is an advanced version of Wealthfront’s US Direct Indexing that applies time-tested research to optimize your allocation to specific stocks and further improve your returns without increasing risk. If your portfolio contains US Direct Indexing, Smart Beta automatically becomes active when your account balance approaches $500,000.

What’s changing?

Here’s a detailed look at the three updates we’re making to our Smart Beta offering.

We’re updating our Smart Beta factors

Smart Beta uses what are known as investment “factors” to weight your holdings of US stocks more intelligently once your account balance reaches $500,000. Every so often, based on intensive research, we believe it makes sense to update the factors we use.

We’ll no longer use the “value” factor in our service, as research suggests it is no longer as effective as it once was. Value is measured using a company’s book equity to market value ratio, which doesn’t account for a company’s investment in intangible assets like research and development, brand value, and patents — all of which are becoming increasingly important in today’s economy. Instead, we’ll now use “profitability” as a factor when optimizing your allocation to specific stocks, which means companies with strong operating profitability will get relatively more weight in your portfolio. Research indicates that the profitability factor has better risk and return characteristics than the underlying index, and it offers diversification because it’s relatively uncorrelated to the other factors we use. We expect this change should improve your risk-adjusted returns.

We’ll continue using the other investment factors we’ve historically used in our implementation of Smart Beta: beta, dividend yield, momentum, and volatility.

We’re simplifying Smart Beta

Historically, we’ve offered two versions of Smart Beta:

- Smart Beta with 500 individual stocks for accounts of $500,000 to $1 million

- Smart Beta with 1,000 individual stocks for accounts of more than $1 million

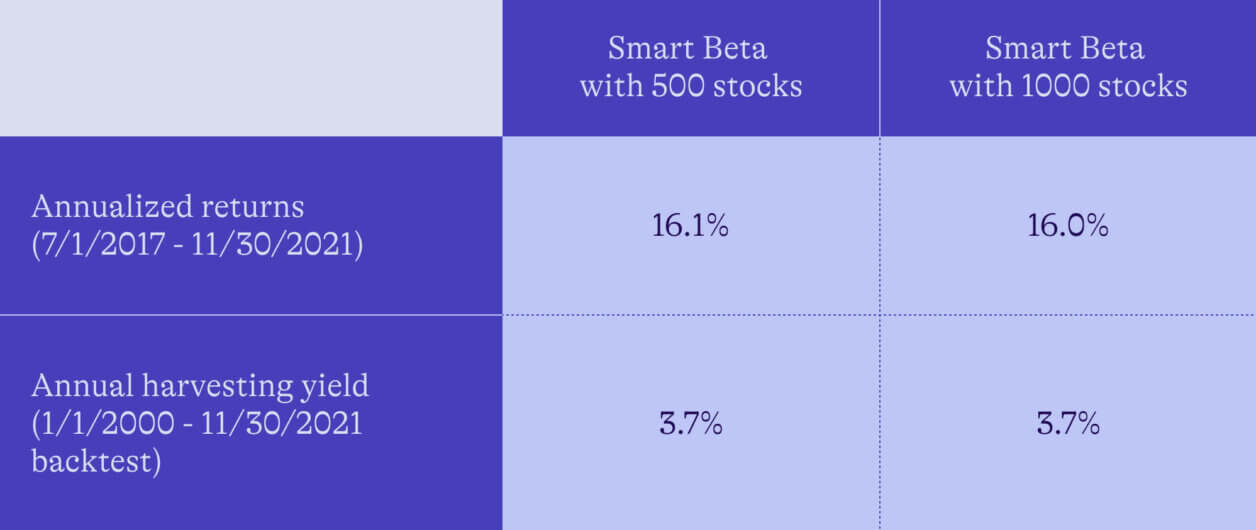

These tiers were based on the dollar amounts required to hold a reasonable collection of individual US stocks while continuing to track the performance of the broad US market. One way we measure their success is with “annual harvesting yield.” This is the quantity of losses harvested in a year divided by the value of the portfolio at the beginning of that period. We believed the version with 1,000 stocks would have a significantly better harvesting yield than the version with 500 stocks. However, this wasn’t the case.

The table below shows annualized returns for both tiers of Smart Beta, as well as annual harvesting yield in a backtest from 2000-2021. We use backtest data to measure harvesting yield because harvesting yield is impacted by deposit and withdrawal behavior — so comparing realized harvesting yield between the two tiers isn’t an apples-to-apples comparison.

As a result, we’ve decided we will no longer offer the version of Smart Beta with 1,000 individual stocks because it offers no meaningful benefit compared to the version with 500 stocks. It was also making our product unnecessarily complicated.

Instead, all Smart Beta accounts of $500,000 or more will now hold approximately 600 individual stocks. If you currently have Smart Beta in an account of $1 million or more, we won’t sell any positions that are at a gain, and we’ll use new deposits to move you closer to your new target allocation. There should be no meaningful impact on your long-term returns or your taxes.

These changes will make the product simpler for us to manage. But more importantly, they will also make it easier to understand and eliminate unnecessary complexity for clients. We believe this streamlined approach will lead to broader adoption — and as a fiduciary, we think this is in our clients’ best interest.

We’re focusing on a slightly larger number of individual stocks

As we explained above, we’ll now focus on a slightly larger number of individual stocks — roughly 600 instead of 500 — in our implementation of Smart Beta. Accounts with Smart Beta will still hold what’s known as a completion index ETF to ensure you get exposure to the broad US stock market, but we will switch from using the Vanguard Extended Market ETF (VXF) to Vanguard’s Small-Cap ETF (VB). Together, these shifts will reduce your portfolio’s tracking error from the CRSP US Total Market Index (on which the Vanguard Total Stock Market Index Fund ETF (VTI) is based).

Tracking error measures how closely your holdings track the underlying investment. In the case of Smart Beta, we measure tracking error to the Vanguard Total Stock Market Index Fund ETF (VTI), the ETF used to represent the US stocks asset class in Wealthfront Classic portfolios. Put more simply, a portfolio with low tracking error is a more accurate portfolio.

Grow your long-term wealth

You don’t need to take any action to benefit from these updates — our software will handle it automatically. There should be no meaningful impact on your tax bill and there will be no impact on the fees you pay to Wealthfront.

We’re excited to make these updates to Smart Beta and you can count on us to keep making our products better over time. For a more detailed discussion of how our Smart Beta works, we encourage you to check out our Smart Beta white paper.

Disclosure

¹Annualized returns are calculated based on the value-weighted average for clients in Smart Beta in the designated time period. Annualized returns and Annual harvesting yield are presented gross of fees. Annual Harvesting Yield performance was obtained through back-tested strategies and not from actual trading and there is no market risk involved in these results. The results are created with the benefit of hindsight. The time period and the data set chosen may not be indicative of present or future market conditions. Future performance may also deviate from past results due to changes in recommended asset allocations, as well as differences in future market returns.

The information contained in this communication is provided for general informational purposes only, and should not be construed as investment or tax advice. Nothing in this communication should be construed as a solicitation, offer, or recommendation, to buy or sell any security. Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Wealthfront Advisers or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Wealthfront Advisers and its affiliates do not provide legal or tax advice and do not assume any liability for the tax consequences of any client transaction. Clients should consult with their personal tax advisors regarding the tax consequences of investing with Wealthfront Advisers and engaging in these tax strategies, based on their particular circumstances. Clients and their personal tax advisors are responsible for how the transactions conducted in an account are reported to the IRS or any other taxing authority on the investor’s personal tax returns. Wealthfront Advisers assumes no responsibility for the tax consequences to any investor of any transaction.

Investment management and advisory services–which are not FDIC insured–are provided by Wealthfront Advisers LLC (“Wealthfront Advisers”), an SEC-registered investment adviser, and financial planning tools are provided by Wealthfront Software LLC (“Wealthfront”). Brokerage products and services are offered by Wealthfront Brokerage LLC, member FINRA / SIPC. All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Please see our Full Disclosure for important details.

Wealthfront Advisers, Wealthfront Brokerage and Wealthfront are wholly owned subsidiaries of Wealthfront Corporation.

Copyright 2022 Wealthfront Corporation. All rights reserved.