On December 31, 2015, my wife Katharine and I welcomed our first child Beatrix into the world. As anyone who has had the privilege of becoming a parent knows, we found ourselves overwhelmed by both the indescribable joy that comes with the birth of a child and a certain trepidation about the enormous responsibility for this little person’s life, well-being and future.

One of the most important ways that parents can provide for their child’s future is funding a quality college education. The challenge of setting aside large sums of money to fund a college degree is not news to any parent, but the price tag associated with higher education has become staggering. According to data compiled by the College Board, when the time comes in 2033, Beatrix and her friends can expect to rack up a total bill between $160,000 and $370,000 for college tuition alone.

This magnitude of investment will likely remain onerous for all parents, regardless of their resources. As a result, we believe that helping clients prepare for their children’s college education is a perfect opportunity for Wealthfront to address in software.

The Best Way to Save for College

This brings me to today’s exciting news. The team and I are proud to announce that Wealthfront will be the first automated investment service to launch its own tax-advantaged 529 account. So, what exactly is a 529 account? Simply put, it’s a tax-advantaged savings account similar to a Roth IRA that can be used by parents, grandparents and others to save for a child’s higher education. Basically, you invest after tax dollars in a 529 plan to save for higher education expenses similar to how you invest after tax dollars to save for retirement in a Roth IRA.

And like a Roth IRA, a 529 plan allows you to compound your earnings tax-free and not pay any taxes upon withdrawal so long as those earnings are used for qualified higher education expenses at an eligible institution. These tax advantages represent a significant difference between opening a 529 and simply “putting a little away every month” for college. With the latter approach, you’ll be missing out on the power of compounding your income tax-free and worse, be forced to pay capital gains tax on invested capital. Those capital gains taxes could easily amount to tens of thousands of dollars over the course of the 18 years you have to save for your child’s college education.

There are two ways to open a 529 account: via an advisor (advisor-sold) plan or direct (direct-sold) plan. Advisor sold plans are delivered with financial planning advice and employ portfolio strategies that are typically more sophisticated in nature. As a result, they charge higher fees than direct sold plans, which offer no advice or personalization and portfolios that are less sophisticated.

Higher Risk-Adjusted Returns, Net of Fees

The Wealthfront 529 College Savings Plan applies the power of software technology to offer the best attributes of both the advisor-sold plan and the direct-sold plan. Consistent with the vision of our Wealthfront 3.0 release, we plan on offering personalized, relevant advice that will recommend exactly how much to save and contribute each month for your college savings plan. We’ll even take into consideration the likely amount of financial aid for which you might qualify. This advice, combined with our renowned investment management capabilities, will be delivered at a price that rivals direct-sold 529 plans. It’s akin to getting boutique-quality product selection and informed recommendations at Amazon prices.

We are able to offer a compelling 529 college savings plan based on three attributes:

- More Personalized Risk Tolerance. In contrast to typical 529 plans that only offer one to three different paths through which your investment mix changes over time, we employ 20 different “glide paths” that are uniquely tailored to match the risk tolerance of each investor. The glide paths are automatically reallocated and provide protection for your savings in the event of a market downturn in the years leading up to your child’s college attendance. In addition, our glide paths transition asset allocations much more continuously than typical 529 plans, which again means you may be less likely to be hurt by a bad market. As a result, our approach more closely matches your investment plan with your particular risk tolerance.

- More Asset Classes for Higher Returns. We invest your 529 account in a portfolio comprised of up to 9 low cost relatively uncorrelated index based ETFs that is designed to optimize return for your unique tolerance for risk. Based on our analysis, we believe 9 properly chosen relatively uncorrelated asset classes should outperform the typical 529 portfolio that consists of only 3 – 4 asset classes by approximately 0.60% per year, risk-adjusted, over the long term.

- Lowest Cost. We charge a low 0.25% annual advisor fee. This will make the Wealthfront 529 by far the lowest cost advisor-sold plan. We’re even less expensive than a vast majority of the direct-sold plans!

Thus, Wealthfront is able to offer an advisor-sold 529 plan that is among the most personalized, diversified and lowest-cost in the market.

Built with Trusted Partners

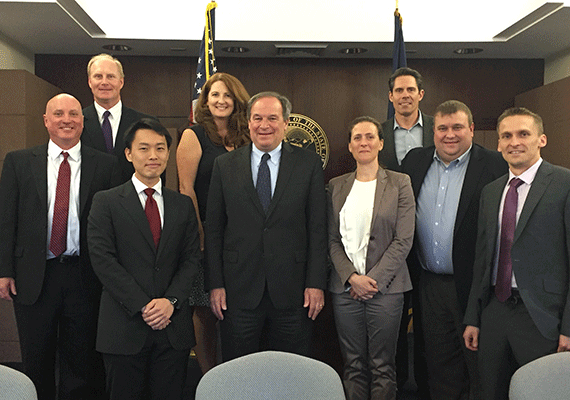

It’s only possible to offer a 529 plan if sponsored by a state, and I’d be remiss not to mention Dan Schwartz, Treasurer of the great State of Nevada, as our incredible partner in this new endeavor. Dan and his colleagues have a history of launching new and innovative ways to get Nevadans and more broadly all Americans saving for post-secondary education. In a nod to the State, Wealthfront will waive advisory fees on the first $25,000 managed for Nevadans.

We are also very fortunate to have partnered with Ascensus, the largest independent retirement and college savings services provider in the United States, as the record keeper of our plan.

The Only Financial Advisor Our Clients Will Ever Need

We want to make sure we provide the best possible advice for every stage of our clients’ lives. We accomplish this goal through relentless innovation. The launch of the Wealthfront 529 College Savings Plan brings us another step closer to fulfilling our goal of being the only financial advisor you will ever need.

And on a personal note, it pleases me to no end that our little Beatrix will be the beneficiary of college savings through the Wealthfront 529 College Savings Plan. Now, both of her parents can spend more time focused on the joys she brings to our lives, and worry less about her future.

Sign up for the launch of the Wealthfront College Savings Plan.

Disclosure

For more information about the Wealthfront 529 College Savings Plan (the “Plan”), download the Plan Description and Participation Agreement (to be made available on Plan launch) or request one by calling or emailing support@wealthfront.com or (650) 249-4250. Investment objectives, risks, charges, expenses, and other important information are included in the Plan Description and Participation Agreement; read and consider it carefully before investing. Wealthfront Brokerage Corporation serves as the distributor and the underwriter of the Plan.

Please Note: Before investing in any 529 plan, you should consider whether you or the beneficiary’s home state offers a 529 plan that provides its taxpayers with favorable state tax and other benefits that are only available through investment in the home state’s 529 plan. You also should consult your financial, tax, or other advisor to learn more about how state-based benefits (or any limitations) would apply to your specific circumstances. You also may wish to contact directly your home state’s 529 plan(s), or any other 529 plan, to learn more about those plans’ features, benefits and limitations. Keep in mind that state-based benefits should be one of many appropriately weighted factors to be considered when making an investment decision.

The Wealthfront 529 College Savings Plan (Plan) is administered by the Board of Trustees of the College Savings Plans of Nevada (Board).

Earnings on nonqualified withdrawals are subject to federal income tax and may be subject to a 10 percent federal tax penalty, as well as state and local income taxes. The availability of tax and other benefits may be contingent on meeting other requirements.

The information contained is provided for general informational purposes and should not be construed as investment advice. Nothing should be construed as tax advice, solicitation or offer, or recommendation, to buy or sell any security. Financial advisory services are only provided to investors who become Wealthfront clients. Wealthfront does not represent in any manner that the tax consequences described here will be obtained or will result in any particular tax consequence.

Prospective investors should confer with their personal tax advisors regarding the tax consequences of investing with Wealthfront, based on their particular circumstances

About the author(s)

As Wealthfront's VP of Strategic Partnerships, Ali Rosenthal brings with her a proven track record and passion for building world class companies through business development and partnerships. Ali joined Wealthfront from MessageMe, where she served as Chief Operating Officer. Previously, she was an Executive-in-Residence with Greylock Partners after serving almost six years at Facebook. Ali joined Facebook in early 2006 when it had less than 5 million users and 100 employees and drove business development efforts including Facebook's relationships with over 350 mobile operators and OEMs. During her tenure, Facebook Mobile's user base grew from under 100,000 to over 250 million users. Previously, Ali worked at Goldman Sachs and General Atlantic Partners. She currently serves as one of President Obama's Ambassadors for Global Entrepreneurship to help bridge the gap between the private sector and policy makers, and is on the board of AutoNation and KQED. Ali holds an MBA from Stanford and a BA from Brown University. View all posts by Ali Rosenthal