Automated Investing Account

Serious investing

made seriously easy

Build wealth with best-practice investing

Designed to maximize long-term, after-tax returns

Managed automatically, so you don’t need to talk to anyone

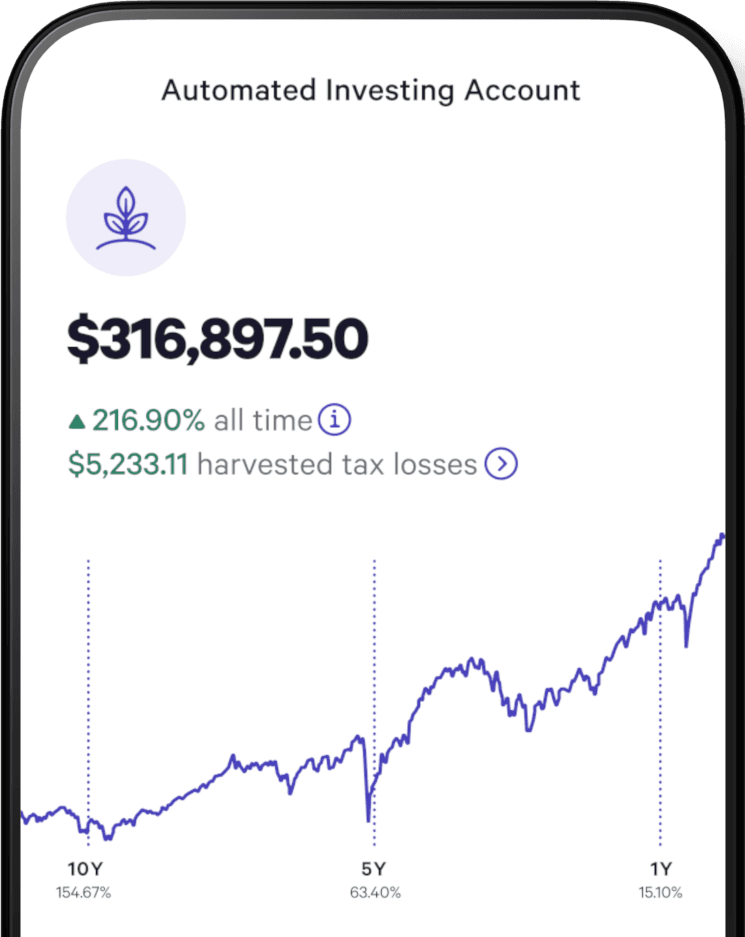

The chart represents actual performance for one-, five-, and ten-year periods through 11/20/2025 for investors in Wealthfront’s Classic Automated Investing Account, with a composite risk score of 9 (Ranges 0.5-10).

Managed by us, built for you.

The Automated Investing Account is designed to make time-tested investing strategies accessible to everyone. We build and automatically manage a globally diversified portfolio for you in one account, utilizing low-cost index funds and proven best practices aimed at keeping your returns steady in volatile markets—and the proof is in the numbers.

1.3M+

Trusted clients 1

$90B+

In client funds 1

Best Robo-advisor, Portfolio Options, 2022-25 2

Best Investing App, 2023-24 2

Our average annual return since inception

annualized returns

1Y

21.40%

5Y

10.20%

10Y

11.43%

Annualized returns reflect actual pre-tax performance for client accounts invested in Wealthfront’s Classic Automated Investing Account, with a composite risk score of 9 (Ranges 0.5-10). The performance shown is the average annual rate of return, which compounds the daily returns of client accounts from the time they were initially funded until the as of date provided above, assuming compounding through annual reinvestment of returns earned over the full period, and is calculated net of advisory fees and expenses. It represents one-, five-, and ten-year periods as well as returns since inception through the as of date provided above. This is not hypothetical or model results. Past performance does not guarantee future results.

See for important information.

Easy enough

for first-timers

Easy enough

for first-timers

The chart represents actual performance for one-, five-, and ten-year periods through 11/20/2025 for investors in Wealthfront’s Classic Automated Investing Account, with a composite risk score of 9 (Ranges 0.5-10).

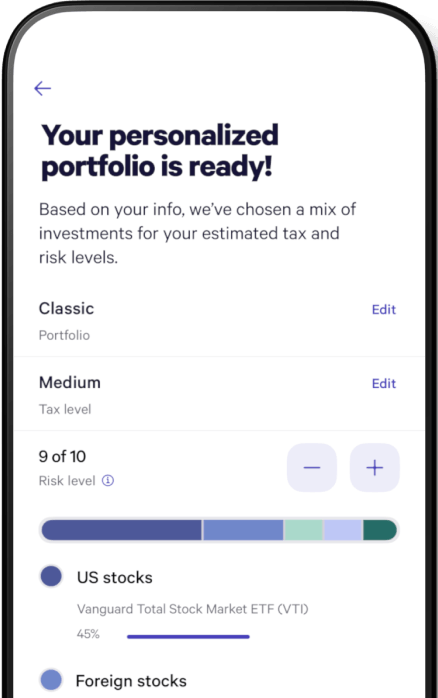

Beats high-yield savings over time

While high-yield savings offer a stable way to grow your cash, stocks have consistently rewarded investors who take on the added risk with better returns over time. To start, just answer a few questions and we’ll build you a diversified portfolio of index funds based on your situation and goals, that aims for lower risk than most single stocks or ETFs.

Managed for you to keep things simple

We put the best practices of investing to work for you every day. Our automation ensures your portfolio stays balanced to your risk level, dividends are reinvested, and everything runs smoothly in the background. That means you can invest on your own time, without ever having to talk to (or wait on) anyone else.

The ideal way to learn how to invest

“I should have been more diversified” is a lesson most investors learn the hard way. The smartest ones learn it from the start. For as little as $500, this account helps you start investing the right way. As you build wealth, you’ll also build confidence and knowledge by watching our automation—and your diversified portfolio—work to make the most of your money.

Advanced enough

for seasoned index investors

Advanced enough

for seasoned index investors

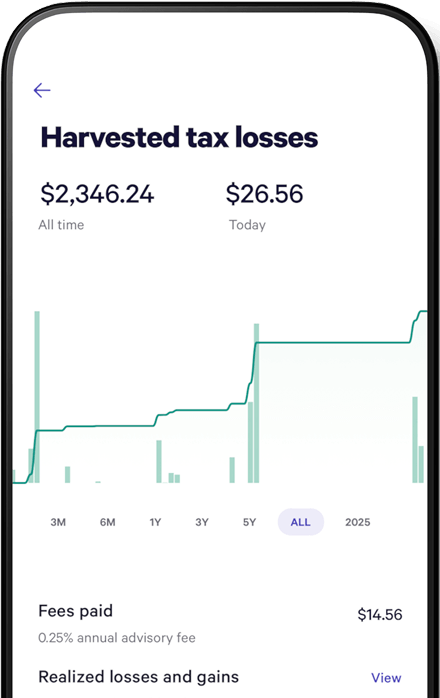

Product images are for illustrative purposes only and not intended to reflect any individual’s actual experience or tax loss harvested. There’s no guarantee clients will have similar experiences or results.

Improve your after-tax returns with Tax-Loss Harvesting

We believe the only way to reliably outperform the market is to improve your after-tax returns, and in 2012 we pioneered automation with the goal to do just that. Our award-winning software automatically captures daily losses from market movement—unlocking tax savings that, by our estimates, have covered our advisory fee more than 7x over.

Boost tax savings with direct indexing

For accounts over $100,000, you can incorporate direct indexing to further increase your potential tax savings. We’ll replace your US equities ETF with the individual stocks and completion ETFs that make up a large portion of the total US equity market. By owning hundreds of stocks instead of a single ETF, our software can find more opportunities to collect tax savings and lower your tax bill, further boosting your after-tax performance.

Customize without compromising

If you ever need to fine-tune your portfolio, you can change allocation weights and even add, remove and swap ETFs of your choosing. We’ll continue to manage your investments for you, and even apply Tax-Loss Harvesting to your chosen eligible ETFs too—something other platforms don’t offer.

Start investing with ease

We’re here to help when you need us

Our app makes managing your portfolio easy, but sometimes, it’s just easier to talk to a person. That’s why we have a merry band of certified professionals standing by to answer your questions.

FAQ

Still deciding if we’re right for you?

These frequently asked questions may help.