Wealthfront has grown rapidly by bringing the benefits of sophisticated investment management to a huge new generation of investors. For many of our clients, investing with Wealthfront is their first direct exposure to the stock and bond markets, and unlike savings accounts, stock and bond markets can rise and fall.

For new investors, reviewing your account to find less money than you put in can be a rude shock. Where did the money go? Rationally, we all know that markets go up and down, but it feels different when you see the impact in your own account. It can even lead new investors to wonder why they made their investments in the first place – or whether services like Wealthfront are worthwhile.

This buyer’s regret is made worse by the Wall Street marketing machine, which trots out so-called experts after each market pullback to explain how you could have avoided the pullback if you had only listened to them! (See Beware Snake Oil Salesmen During Market Downturns).

With the benefit of decades of experience and data sets that go back more than a century, there are some lessons that every new investor should take to heart.

Passive Investing Means a Market Based Return

Passive investing means investing in funds that track broad market indexes rather than attempting to outperform the market. Wealthfront offers a service based on passive investing because overwhelming academic research has shown it is almost impossible to consistently outperform the market over the long term. Our Chief Investment Officer, Burt Malkiel, literally wrote the book on this, called A Random Walk Down Wall Street.

You don’t hear much about index funds because they are cheap and not sexy, and they generate far less in revenue for financial service firms than other products. Wall Street loves to sell the hope and hype of actively managed products, because their fees are 10x those of index funds. Unfortunately, the data overwhelmingly show that active funds consistently come up short over the long term. Time and time and time again.

Worse, one of the biggest reasons individual investors underperform the markets is they consistently buy when the markets rise and sell when they decline. DALBAR, a market research firm that has studied this issue over the past 40 years, has found that the average investor underperforms the overall markets by an average of approximately 4% per year due to this bad behavior.

Passive Investing Can Lose Money in The Short Term

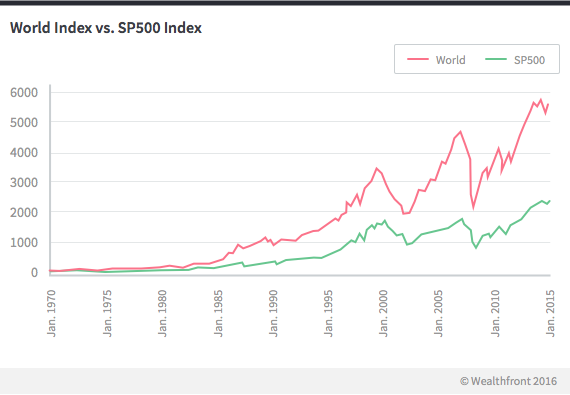

Passive investing maximizes your returns over the long run, but that doesn’t mean your returns will always be positive. Securities markets can, and often do, temporarily decline in value – as they did last year. In many cases they can be down for an extended amount of time. But as you can see from the chart below, stocks, both international and US, have consistently been up over the long term (35 years) – even with two major downdrafts.

In There’s No Need to Fear Stock Market Corrections, we showed it usually takes markets a similar amount of time to recover as it does to fall in a down draft, whether it be a correction (10% decline) or bear market (20%). Over the past 50 years, it has only taken on average less than four months to recover from a correction.

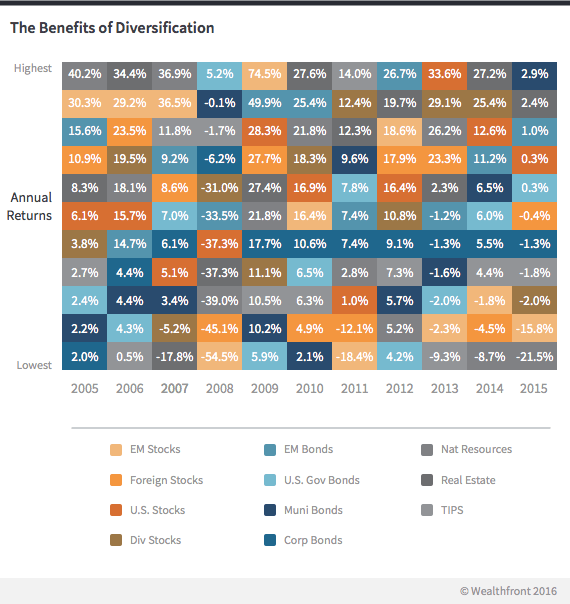

Unfortunately most investors feel like the best course of action when the market declines is to double down on whatever asset class most recently performed the best. As you can see from the table below, there is very little consistency in which asset class (i.e. broad securities market) performed the best each year.

That means doubling down on your winners could be a very bad idea. It also means selling your losing asset classes also doesn’t make sense. The best approach is to do what the world’s largest institutions do: Stick to your overall asset allocation and rebalance periodically. That means buy the asset classes that perform the worst and sell the ones that performed the best on a relative basis. We know that might not feel right, but as we have often explained, good investing seldom feels right.

Tax-Loss Harvesting Is The Silver Lining

A tool that can significantly lessen the pain of weathering down markets is tax-loss harvesting. Introduced by Wealthfront in 2012, tax-loss harvesting has become a standard feature of many automated investment services. The primary benefit of tax-loss harvesting is you can capture current losses in your portfolio without changing the risk and return characteristics of your portfolio. These recognized losses can be used to reduce your taxes. They can be applied to up to $3,000 of ordinary income and an unlimited amount of capital gains each year. Unused losses may even be carried forward indefinitely.

Very few investors realize their true account value is the aggregate value of their securities plus the aggregate tax savings from their harvested losses (i.e. their harvested losses * their marginal federal + state ordinary tax rate). For example, if you invested $10,000 and harvested losses of $2,000, and your marginal tax rate is 40% and your account has traded down to $9,500 then you are actually above water despite appearing to have lost 5%. That’s because you should add the $800 of tax savings ($2,000 * 40%) to your securities value of $9,500 to get a total tax adjusted value of $10,300 – greater than the $10,000 you invested. This is why tax-loss harvesting provides an opportunity for an offsetting economic benefit.

Slow and Steady Wins the Race

The greatest advantage young investors have is the inherently long time frames they have to invest and take advantage of compounding their capital. Unfortunately, investing in public markets can be very frustrating over short periods of time. That’s because risk and reward are so closely correlated. In other words, you can’t earn higher returns without taking more risk.

Avoid the mistakes that too many investors make when investing for the long term. Do your best to ignore the Wall Street marketing machine. Automate your savings with scheduled deposits. And make sure your account is properly diversified with low cost broad market index funds that are managed in a tax efficient fashion and stride ahead.

Disclosure

Nothing in this article should be construed as tax advice, a solicitation or offer, or recommendation, to buy or sell any security. This article is not intended as investment advice, and Wealthfront does not represent in any manner that the circumstances described herein will result in any particular outcome. Financial advisory services are only provided to investors who become Wealthfront clients. Past performance is no guarantee of future results.

About the author(s)

Andy Rachleff is Wealthfront's co-founder and Executive Chairman. He serves as a member of the board of trustees and chairman of the endowment investment committee for University of Pennsylvania and as a member of the faculty at Stanford Graduate School of Business, where he teaches courses on technology entrepreneurship. Prior to Wealthfront, Andy co-founded and was general partner of Benchmark Capital, where he was responsible for investing in a number of successful companies including Equinix, Juniper Networks, and Opsware. He also spent ten years as a general partner with Merrill, Pickard, Anderson & Eyre (MPAE). Andy earned his BS from University of Pennsylvania and his MBA from Stanford Graduate School of Business. View all posts by Andy Rachleff