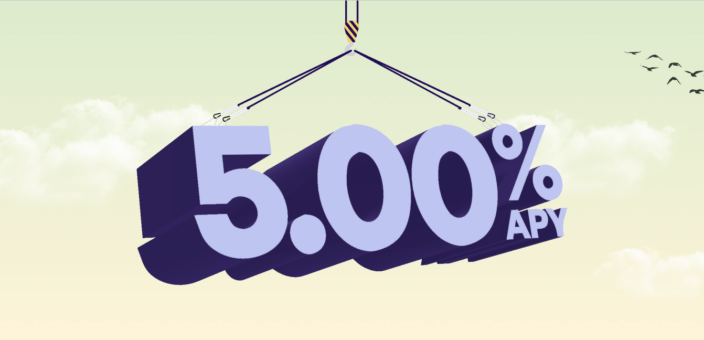

At Wealthfront, we are proud to offer our Cash Account, which has one of the highest APYs on the market and access to up to $8 million in FDIC insurance through our partner banks. Today, we’re raising the APY on the Wealthfront Cash Account from 4.80% to 5.00% APY. This means your cash will earn 10x more interest at Wealthfront than it would earn in a regular savings account.

Our high APY doesn’t come with any requirements like minimum or maximum account size, required direct deposit, required debit card transactions, or subscription fees. The Cash Account has no account fees and comes with unlimited fee-free withdrawals, making it an ideal place to keep your short-term savings until you’re ready to invest to build long-term wealth.

Why is the Cash Account APY going up?

Wealthfront isn’t a bank, and that’s a good thing because it allows us to partner with multiple banks where we broker deposits to offer you a Cash Account with a high APY. Because we broker our deposits, we’re able to offer you access to wholesale interest rates — the interest rates that banks offer to broker-dealers like Wealthfront for deposits, which can be higher than the rates banks offer individual customers. When our partner banks pay a high rate on your deposits, we pass along a high rate to you.

To make sure we’re consistently offering the best product we can, we have ongoing discussions with current and prospective partner banks where we talk about things like wholesale rates and deposit levels. These conversations are always going on in the background — they’re why we were able to increase the number of banks in our program, enabling you to access up to $8 million in FDIC insurance. These discussions with partner banks also enable us to pass along more interest to you now.

We’re delighted to be able to raise our APY, and we’ll keep looking for opportunities to make the Cash Account even better in the future.

Grow your cash faster with no account fees

We’re proud to offer a Cash Account that allows you to earn more interest on your deposits so your cash can grow faster with no extra effort, no account fees, and no market risk. The Cash Account is an ideal home for your short-term savings until you’re ready to invest, and it comes with best-in-class automation features so you can organize your savings into categories, track your progress against your goals, and invest your money within minutes during market hours.

When you need to access the money in your Cash Account, it’s always available on your terms. You get access to a debit card, 19,000 free ATMs, and outgoing wires for just $10. Plus, you can send and deposit checks, send and receive money with your favorite payment apps (Venmo, CashApp, PayPal, Apple Pay, Google Pay), and use your account and routing numbers to pay bills and businesses.

Disclosure

We’ve partnered with Green Dot Bank. The checking features offered on your Wealthfront Cash account are provided by and the Wealthfront Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. Visa is a registered trademark of Visa International Service Association. Checking features for the Cash Account are subject to identity verification by Green Dot Bank and the Wealthfront Visa® Debit Card is optional and must be requested. Wealthfront products and services are not provided by Green Dot Bank. Green Dot Bank operates under the following registered trade names: GO2bank, GoBank and Bonneville Bank. All of these registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage.

Fee-free ATM access applies to in-network ATMs only. For out-of-network ATMs and bank tellers a $2.50 fee will apply, plus any additional fee that the owner or bank may charge. Fees and Eligibility requirements may apply to certain checking features, please see the Deposit Account Agreement for details. Copyright 2023 Green Dot Corporation. All rights reserved.

Cash Account is offered by Wealthfront Brokerage LLC (“Wealthfront Brokerage”), a Member of FINRA/SIPC. Neither Wealthfront Brokerage nor any of its affiliates are a bank, and Cash Account is not a checking or savings account. We convey funds to partner banks who accept and maintain deposits, provide the interest rate, and provide FDIC insurance. Investment management and advisory services–which are not FDIC insured–are provided by Wealthfront Advisers LLC (“Wealthfront Advisers”), an SEC-registered investment adviser, and financial planning tools are provided by Wealthfront Software LLC (“Wealthfront”).

The Annual Percentage Yield (APY) for the Cash Account is as of November 3, 2023 and may change at any time, before or after the Cash Account is opened. The APY for the Wealthfront Cash Account represents the weighted average of the APY on the aggregate deposit balances of all clients at the program banks. Deposit balances are not allocated equally among the participating program banks.

The cash balance in the Cash Account is swept to one or more banks (the “program banks”) where it earns a variable rate of interest and is eligible for FDIC insurance. FDIC insurance is not provided until the funds arrive at the program banks. FDIC insurance coverage is limited to $250,000 per qualified customer account per banking institution. Wealthfront uses more than one program bank to ensure FDIC coverage of up to $8 million for your cash deposits. For more information on FDIC insurance coverage, please visit www.FDIC.gov. Customers are responsible for monitoring their total assets at each of the program banks to determine the extent of available FDIC insurance coverage in accordance with FDIC rules. The deposits at program banks are not covered by SIPC.

The information contained in this communication is provided for general informational purposes only, and should not be construed as investment or tax advice. Nothing in this communication should be construed as tax advice, a solicitation or offer, or recommendation, to buy or sell any security. Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Wealthfront Advisers or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Wealthfront, Wealthfront Advisers and Wealthfront Brokerage are wholly owned subsidiaries of Wealthfront Corporation.

Copyright 2023 Wealthfront Corporation. All rights reserved.