Getting started with investing can seem intimidating, and we know many investors worry about jumping in when prices seem too high. Instead, many people hold onto cash and wait for a market downturn to start investing. Waiting for a market pullback might feel like the right thing to do, but it’s likely to lead to worse outcomes. In this post, we’ll use an example to illustrate why you shouldn’t wait for the “right time” to start investing, and why doing so could cost you big over the long run.

What happens when you wait for a market decline to invest

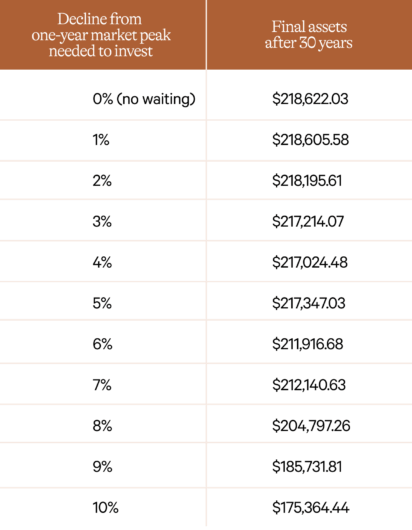

If you’re worried about investing when the market is “too hot,” you might be tempted to invest only when the market has declined a certain amount from a recent high. In this example, we’ll look at what would happen if you waited for a market decline of 1-10% from the previous year’s peak to invest your money, and compare the results to what would happen if you didn’t wait.

To do this, we’ll assume you set aside $100 at the end of each month for investing. Each market day, you check for a market decline and decide whether or not you want to invest. If you don’t invest, your money earns daily interest equal to a one-month treasury bill (which is more than most traditional savings accounts would actually pay you). If you decide to invest, you invest all of the money you’ve set aside since the last time you invested, plus any interest you’ve earned since then. We’ll use 30 years of S&P total return index returns and treasury rates, beginning on October 1, 1991, and ending on September 30, 2021, to understand how your investment would have performed. Using these assumptions, the table below shows your portfolio’s pre-tax value at the end of that 30-year period if you invested your $100 regularly at the end of each month versus if you waited for a market decline of up to 10% to invest.

As you can see in this example, the general trend is that the larger the market decline you wait for to invest, the worse your outcome after 30 years. If you had waited for a 10% decline, you would have missed out on a staggering $43,257.59 of returns. You get the highest return when you don’t wait at all.

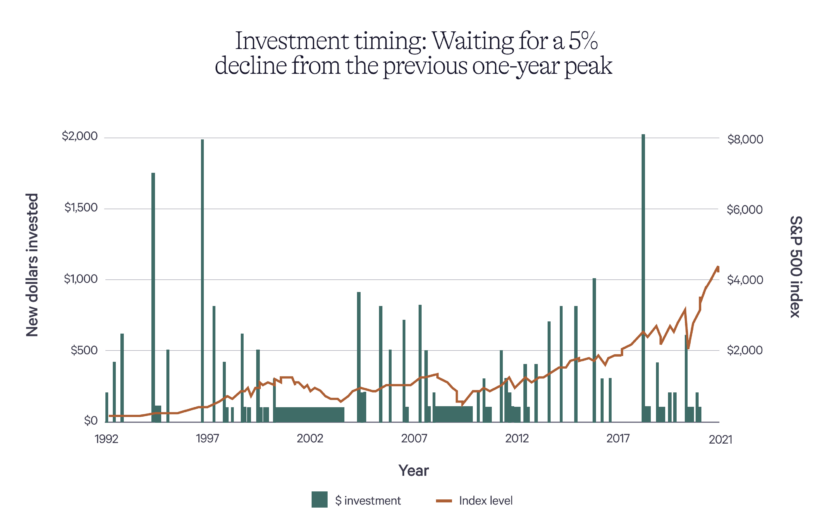

Let’s take a closer look at deposit timing associated with one of the scenarios described above. The chart below shows when you would have put money in the market if you were waiting for a 5% decline from the previous year’s peak, plotted against the S&P 500’s index level.

As you can see, in this scenario, you managed to “buy the dip.” You might think this kind of behavior would yield better returns compared to regular deposits, but it doesn’t. Because the market was rising overall, you would have missed out on earnings and left hundreds of dollars on the table.

This pattern, where waiting to invest costs you returns in the long run, holds true even if you use different criteria for identifying a market decline. For example, we also looked at what would happen if an investor waited for a market decline of 10% from the previous month (which we defined as 21 market days ago) to invest instead of waiting for a decline relative to the previous year’s peak. We kept all of the other assumptions the same, including the 30-year time period, the amount of interest earned on uninvested cash, and the amount of cash available to invest each month. In that scenario, waiting for a 10% decline from the previous month before investing would cost you $54,276.66 of returns after 30 years.

Why waiting to invest doesn’t work

Buying low sounds great in theory, and it’s not surprising that so many investors think they should wait for the right moment to get into the market. But time in the market is one of the most powerful ways to increase your returns because of the way compounding works. When you wait to invest, you give up time in the market and your returns have less time to compound.

If you zoom out and look at the market’s overall historical performance over a long period of time, the trend is clear: it goes up. If you wait to invest, you might succeed at finding a relative low point, but in the meantime, history has shown you’ll miss out on a bunch of good days when the market was rising. You’re also likely to miss some of the key market days that have an outsized impact on your overall returns.

On the other hand, if you put money in the market as early as possible and keep adding to it over time, you can typically benefit from the overall upward trend (not to mention the time you’ll save by not monitoring the market closely). This also means you won’t wait around with your excess cash in a bank account where it is unlikely to even keep up with inflation.

The only “right time” to invest is now

We get it — it can be uncomfortable to invest when the market seems hot. Unfortunately, when it comes to investing, what feels right seldom is, and if you wait for a market decline to invest, you are unlikely to come out ahead. Don’t waste time and effort trying to buy the dip or pick the “right time.” Instead, we encourage you to start investing excess cash for the long term (which we define as at least 3-5 years) as soon as possible to give your returns more time to compound.

If you’re nervous about getting started with a big initial deposit, you can use a behavioral tool called dollar-cost averaging to help get past that fear. Dollar-cost averaging involves breaking up a large initial investment into smaller chunks that you invest on a regular basis. So instead of depositing the $5,000 you saved up today, you might invest $1,000 every week for five weeks to lessen your fear of picking the “wrong day” to get started. At Wealthfront, we make it easy to set up automated recurring deposits to your Wealthfront Investment Account to help you build long-term wealth with very little effort.

Disclosure

The information contained in this communication is provided for general informational purposes only, and should not be construed as investment or tax advice. Nothing in this communication should be construed as a solicitation, offer, or recommendation, to buy or sell any security. Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Wealthfront Advisers or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Investment management and advisory services–which are not FDIC insured–are provided by Wealthfront Advisers LLC (“Wealthfront Advisers”), an SEC-registered investment adviser, and financial planning tools are provided by Wealthfront Software LLC (“Wealthfront”). Brokerage products and services are offered by Wealthfront Brokerage LLC, member FINRA / SIPC. All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Please see our Full Disclosure for important details.

Wealthfront Advisers, Wealthfront Brokerage and Wealthfront are wholly owned subsidiaries of Wealthfront Corporation.

Copyright 2021 Wealthfront Corporation. All rights reserved.

About the author(s)

Fang Rui is a Chartered Financial Analyst (CFA) and an investment researcher at Wealthfront. Prior to Wealthfront, Fang spent nearly a decade at BlackRock where she worked in ETF and index research as well as risk management. She earned a Master of Science in Industrial Engineering and Operations Research from University of California, Berkeley and earned a Bachelor of Science in Engineering with a major in Operations Research and Financial Engineering from Princeton University. View all posts by Fang Rui, CFA