There’s no doubt that these are unusual times. The coronavirus COVID-19 has been spreading across the globe and the markets have reacted with more volatility than usual. Last week, the Federal Reserve cut interest rates ahead of their scheduled meeting in mid-March, and some companies have revised their earnings outlooks because of concerns about their supply chains. If you’ve been reading the headlines, maybe you’re feeling spooked and wondering if you should change your investing strategy. You shouldn’t. Such volatility and uncertainty are inevitable characteristics of our markets and are not at all unprecedented historically. But it does scare investors, and unfortunately, it too often leads to big investing mistakes.

While there’s a lot of speculation, the reality is we just don’t know what’s ahead. But what we do know is that these are familiar market patterns we can learn from. So what’s our advice for worried or anxious investors? The same as always: Do nothing.

What history teaches us

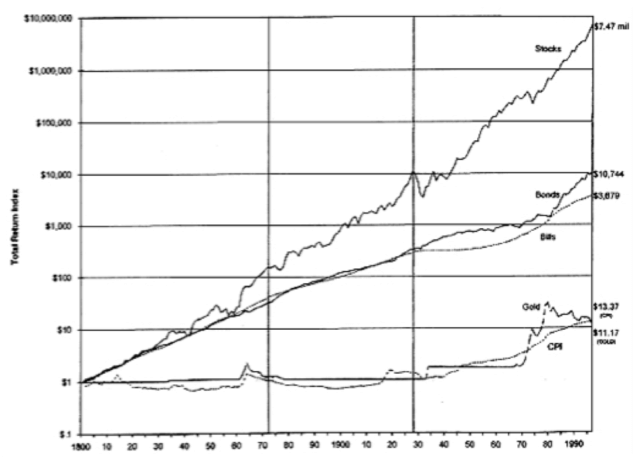

If there’s anything the day-by-day machinations of the market teach us, it’s that slow and steady wins the race. Investors have long known that staying the course is one of the most important things to do — it’s just emotionally hard to execute. Some of the best research on this topic comes from the so-called “Wizard of Wharton”, University of Pennsylvania professor Jeremy Siegel. In his New York Times best-selling book, Stocks for the Long Run, Siegel looked at the performance of equities from 1802 through 1997, the year the book was first published.

His findings were astonishing: Despite the day-to-day volatility that we all feel, the actual long-run returns of stocks are remarkably consistent.

Here’s how he summarized his findings:

Source: Jeremy Siegel. “Total Return Index.” Stocks for the Long Run, 1994

Despite extraordinary changes in the economic, social, and political environment over the past two centuries, stocks have yielded between 6.6 and 7.2 percent per year after inflation in all major subperiods. The wiggles on the stock return line represent the bull and bear markets that equities have suffered throughout history. The long-term perspective radically changes one’s view of the risk of stocks. The short-term fluctuations in market, which loom so large to investors, have little to do with the long-term accumulation of wealth.”

His last line bears repeating: The short-term fluctuations in market, which loom so large to investors, have little to do with the long-term accumulation of wealth.

Siegel found that almost no matter what period you looked at, stocks delivered about 7% after inflation. The Civil War, World War I, World War II, even the Great Depression (marked by the second black vertical line) were hiccups compared to the overall trend.

The pattern repeats in other countries, including those that have experienced catastrophic collapses. World War II, for example, sheared 90% off the value of German equities…but German stocks completely rebounded by 1958, rising 30% per year on average from 1948 to 1960. They went on from there to new highs. Averaged out over the long haul, their return is a consistent 6.6% annual real return, a figure that continues through this day.

The same is true for Japan, the UK, and all other markets that Siegel has studied: in the short-run, volatility, but in the long run, profits.

Don’t buy what they’re selling

The reason we don’t hear much about the power of long-term investing – and the truth about the futility of trading – is that long-term investing is boring and cheap. The financial media thrives by encouraging you to panic, and large parts of the financial industry make money only when you act. Big moves sell newspapers, and high trading activity means commissions for online brokers.

The only people who don’t profit from that activity are investors themselves, because as it turns out, we can’t predict the future. It’s hard to stare down a significant market correction and stick to your plan.

When the US government shut down in September 2013 during the budget showdown, we saw a large number of our clients refrain from continuing to add deposits. The same was true during the Greek Crisis, Brexit, and the 2016 U.S. Presidential election. People who stayed on the sidelines paid handsomely for missing out on the rebound. As our research showed in There’s No Need to Fear Stock Market Corrections, markets on average recover from corrections in 112 days. Far faster than almost everyone thinks. If you invest regularly, harvest your losses, and rebalance your portfolio, you’ll end up benefiting from market corrections in multiple ways. It won’t be easy. But over the long haul, it can really pay off.

Disclosure

The information contained in this communication is provided for general informational purposes only, and should not be construed as investment advice. Nothing in this communication should be construed as an offer, recommendation, or solicitation to buy or sell any security. Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Wealthfront Advisers or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Investment advisory services are provided by Wealthfront Advisors , an SEC-registered investment adviser, and brokerage products and services, are provided by Wealthfront Brokerage LLC, member FINRA / SIPC. Wealthfront Software LLC (“Wealthfront”) offers a free software-based financial advice engine that delivers automated financial planning tools to help users achieve better outcomes.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Please see our Full Disclosure for important details.

Wealthfront Advisers, Wealthfront Brokerage and Wealthfront are wholly owned subsidiaries of Wealthfront Corporation.

© 2020 Wealthfront Corporation. All rights reserved.

About the author(s)

Andy Rachleff is Wealthfront's co-founder and Executive Chairman. He serves as a member of the board of trustees and chairman of the endowment investment committee for University of Pennsylvania and as a member of the faculty at Stanford Graduate School of Business, where he teaches courses on technology entrepreneurship. Prior to Wealthfront, Andy co-founded and was general partner of Benchmark Capital, where he was responsible for investing in a number of successful companies including Equinix, Juniper Networks, and Opsware. He also spent ten years as a general partner with Merrill, Pickard, Anderson & Eyre (MPAE). Andy earned his BS from University of Pennsylvania and his MBA from Stanford Graduate School of Business. View all posts by Andy Rachleff