It’s been a little over a year since we launched Wealthfront’s S&P 500 Direct, our first standalone direct indexing product. We built this product to help clients generate tax savings while getting exposure to stocks within a popular stock market index. One year later, we’re excited to share a closer look at how S&P 500 Direct has already helped generate significant estimated tax savings for our clients while tracking the index very closely, all for a low 0.09% advisory fee—the same as the expense ratio for SPY, one of the most widely used S&P 500® ETFs.

Here’s how S&P 500 Direct performed in its first year.

Estimated tax savings and tracking difference

If you’re opening up an S&P 500 Direct account, you expect it to accomplish two main goals: Harvest losses that you can use to lower your tax bill, and offer similar performance to the underlying index. The product is designed to balance these two objectives and, ideally, achieve both. Results from our first year show that the product delivered on these goals: It generated over $16 million in estimated tax savings while delivering very similar returns to the index. Let’s look at both of the goals in more detail.

- S&P 500 Direct unlocked valuable tax savings: From December 1, 2024 to November 30, 2025, S&P 500 Direct harvested nearly $46 million in losses across all accounts. Based on our clients’ current self-reported income, state of residence, and tax-filing status, we infer a combined federal and state tax rate for each client—and we can then multiply each client’s rate by their harvested losses to calculate their total estimated tax savings. Using this method, we estimate S&P 500 Direct has saved clients over $16 million in taxes in its first year alone. On average, clients received estimated after-tax benefit equal to 4.54% of their S&P 500 Direct portfolio value.

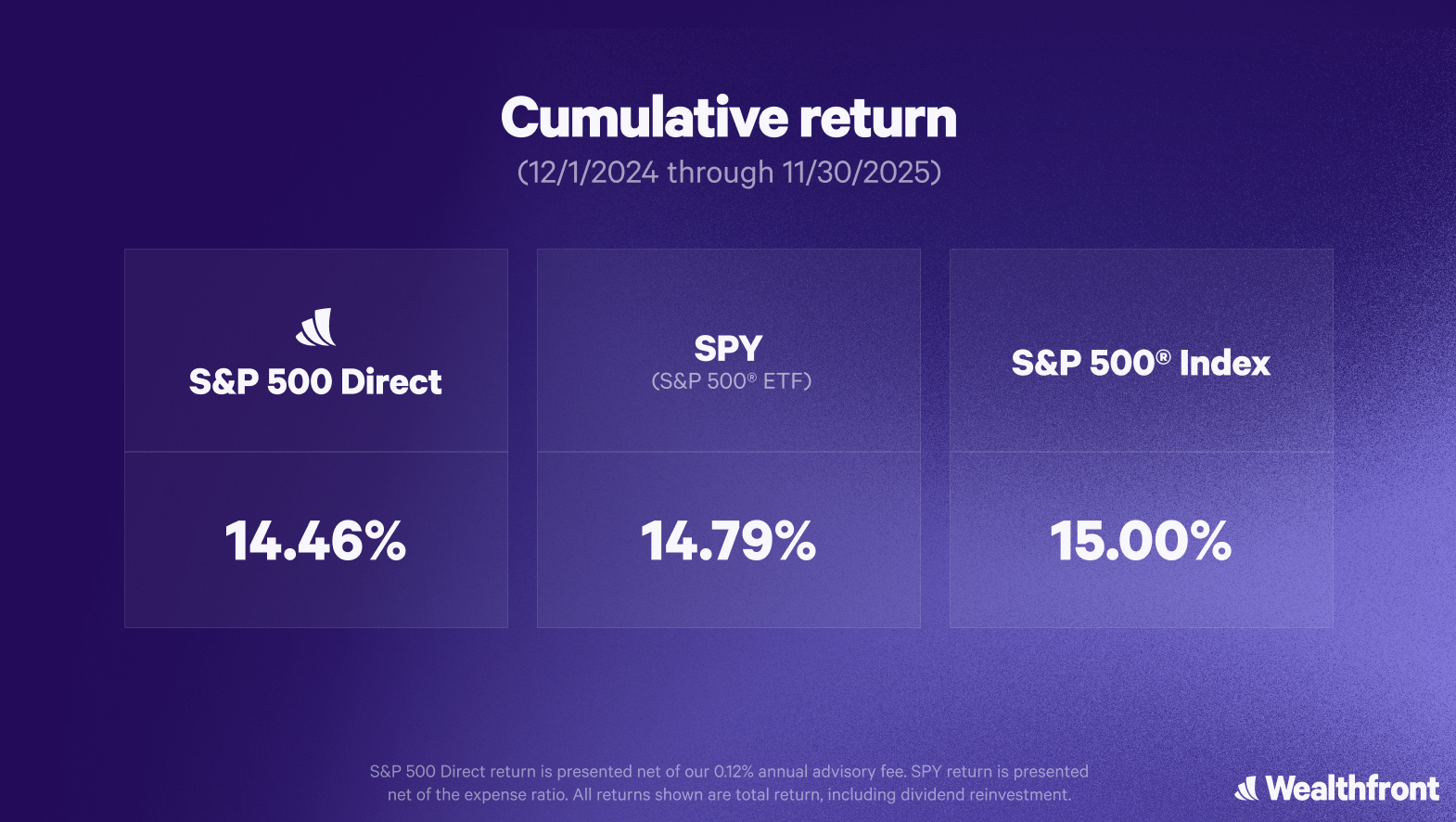

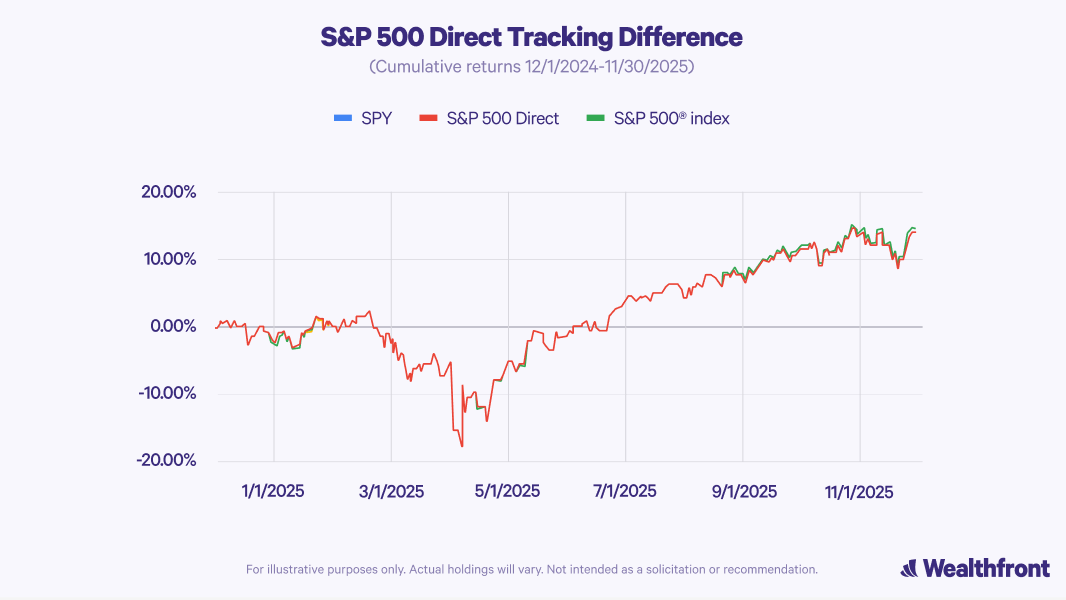

- S&P 500 Direct offered very similar performance to the S&P 500® index: You should expect to see some performance differences (which could be either positive or negative) between S&P 500 Direct and the underlying index. Even so, they have been very small to date. These performance differences have three main causes: 1) the fact that the product is balancing two goals at once (tracking the index and conducting tax-loss harvesting), 2) account size, because smaller portfolios will hold fewer stocks compared to much larger ones, and 3) any stock exclusions a client might have requested (particularly if those exclusions include lots of large-cap stocks). As you can see in the table below, S&P 500 Direct delivered very similar performance to SPY (a popular S&P 500® ETF) and the index itself (although indices are not investable and would not include management fees).

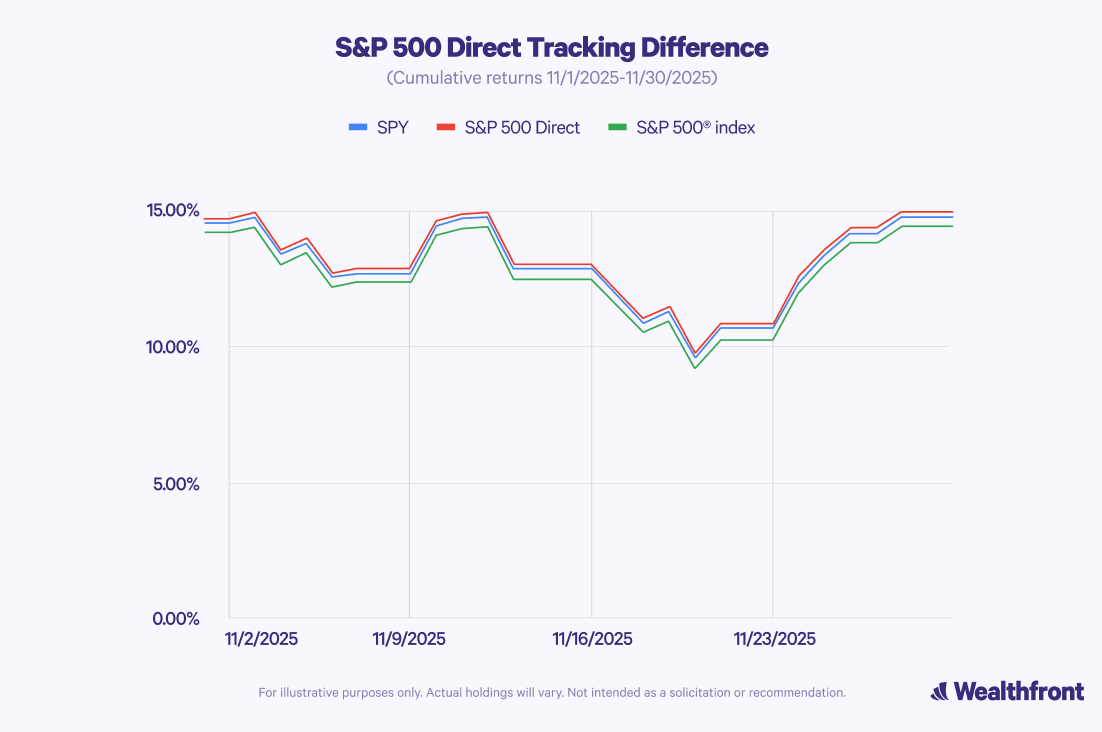

The chart below shows cumulative return for the index, SPY, and all S&P 500 Direct accounts. As you can see, all three lines are so close together that it’s fairly hard to distinguish between them. This is what low tracking difference looks like. To make the very close correlation easier to see, the second graph zooms in on the final month of this period.

Who is likely to get the most benefit from S&P 500 Direct?

At Wealthfront, we often say that tax-loss harvesting is likely to have the most benefit for long-term investors in high tax brackets—and this is also true of S&P 500 Direct.

We’ll illustrate why, all else being equal, a higher marginal tax rate translates into more potential tax savings with a very simplified example. Let’s imagine you’ve harvested $10,000 of losses and will be able to use all of them in the same tax year. You can calculate estimated tax savings by multiplying your harvested losses by your marginal tax rate. So:

- At a marginal tax rate of 20%, your estimated tax savings would be $10,000 x 0.20, or $2,000

- At a marginal tax rate of 40%, your estimated tax savings would be $10,000 x 0.40, or $4,000

And while direct indexing with tax-loss harvesting can benefit virtually anyone who has (or expects to have) a lot of capital gains, here are some specific use cases where S&P 500 Direct might be especially valuable for you:

- You have a lot of incentive stock options (ISOs) and your company is about to go public, meaning you could realize a large capital gain

- You have large mutual fund holdings that are required to make capital gains distributions

- You are interested in diversifying a concentrated position in a single stock (possibly because of vesting RSUs), and you want to get exposure to a broad index instead

For more information about how and why to use direct indexing, check out our blog post on the subject.

Keep more of what you earn

At Wealthfront, a core tenet of our investing philosophy is minimizing your taxes to improve your after-tax returns. Consistent with this philosophy, we were an early pioneer in the direct indexing space for retail investors, because we knew that pairing the strategy with our tax-loss harvesting software could be incredibly powerful.

S&P 500 Direct is only a year old, but we are thrilled that it is already allowing many clients to get similar performance to a popular index while generating future tax savings, all for a low advisory fee of 0.09%. It’s just one of the many ways we work to help you build wealth on your own terms.

Disclosure

The information contained in this blog is provided for general informational purposes only, and should not be construed as investment or tax advice. Nothing in this communication should be construed as a solicitation, offer or recommendation to buy or sell any security or to open any account. Historical returns, expected returns, and probability projections are provided for informational and illustrative purposes, and may not reflect actual future performance. Investors may experience different results from the results shown. Future performance may deviate from past results due to changes in recommended asset allocations, as well as differences in future market or economic conditions.

The effectiveness of the tax-loss harvesting strategy to reduce the tax liability of the client will depend on the client’s entire tax and investment profile, including purchases and dispositions in a client’s (or client’s spouse’s) accounts outside of Wealthfront Advisers and type of investments (e.g., taxable or nontaxable) or holding period (e.g., short- term or long-term).

Tax-loss harvesting involves certain risks, including, among others, the risk that the new investment could have higher costs than the original investment and the strategy could introduce portfolio tracking error into your account. Tracking error is a measure of financial performance that determines the difference between the return fluctuations of an investment portfolio and the return fluctuations of a chosen benchmark. There may also be unintended tax implications.

Wealthfront Advisers’ investment strategies, including portfolio rebalancing and tax loss harvesting, can lead to high levels of trading. High levels of trading could result in (a) bid-ask spread expense; (b) trade executions that may occur at prices beyond the bid ask spread (if quantity demanded exceeds quantity available at the bid or ask); (c) trading that may adversely move prices, such that subsequent transactions occur at worse prices; (d) trading that may disqualify some dividends from qualified dividend treatment; (e) unfulfilled orders or portfolio drift, in the event that markets are disorderly or trading halts altogether; and (f) unforeseen trading errors. The performance of the new securities purchased through the tax-loss harvesting service may be better or worse than the performance of the securities that are sold for tax-loss harvesting purposes.

Tax loss harvesting may generate a higher number of trades due to attempts to capture losses. There is a chance that trading attributed to tax loss harvesting may create capital gains and wash sales and could be subject to higher transaction costs and market impacts. In addition, tax loss harvesting strategies may produce losses, which may not be offset by sufficient gains in the account and may be limited to a $3,000 deduction against income. The utilization of losses harvested through the strategy will depend upon the recognition of capital gains in the same or a future tax period, and in addition may be subject to limitations under applicable tax laws, e.g., if there are insufficient realized gains in the tax period, the use of harvested losses may be limited to a $3,000 deduction against income and distributions. Losses harvested through the strategy that are not utilized in the tax period when recognized (e.g., because of insufficient capital gains and/or significant capital loss carryforwards), generally may be carried forward to offset future capital gains, if any.

Wealthfront Advisers and its affiliates do not provide legal or tax advice and do not assume any liability for the tax consequences of any client transaction. Clients should consult with their personal tax advisors regarding the tax consequences of investing with Wealthfront Advisers and engaging in these tax strategies, based on their particular circumstances. Clients and their personal tax advisors are responsible for how the transactions conducted in an account are reported to the IRS or any other taxing authority on the investor’s personal tax returns. Wealthfront Advisers assumes no responsibility for the tax consequences to any investor of any transaction.

“4.54% estimated after-tax benefit”: Daily estimated tax savings (in dollars) are calculated for each client by multiplying the actual amount of harvested losses for each client with their implied tax rate. We then aggregate these daily estimated tax savings across all participating accounts to determine the total daily estimated tax savings for the S&P 500 Direct strategy as a whole. From this, the daily benefit yield is calculated by dividing this total daily estimated tax savings by the total S&P 500 Direct market value of that day. Summing the daily benefit yield over all days (12/1/24-11/30/25), we arrive at the 4.54% estimated after-tax benefit (tax alpha).

In summary, the estimated 4.54% after-tax benefit indicates that clients in aggregate saved tax dollars that is estimated to be 4.54% of their total market value over the past year. The actual tax savings realized by any individual client will vary based on their specific tax situation, investment activity, and market performance. This figure is an estimate of potential tax benefits and is not guaranteed. Investors should consult with a tax professional regarding their specific circumstances.

Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

The S&P 500® Index (Standard & Poor’s® 500) is a stock market index that tracks the stock performance of 500 of the largest publicly traded companies in the United States. It is a float-adjusted, market-capitalization-weighted index, meaning larger companies have a greater impact on the index’s value, and it serves as a leading indicator of the overall U.S. stock market and economic health

The S&P 500® index is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”) and has been licensed for use by Wealthfront Advisers LLC. Standard & Poor’s®, S&P®, S&P 500®, US 500 and The 500 are trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Wealthfront Advisers LLC. Wealthfront’s S&P 500 Direct Portfolio is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates and none of such parties make any representation regarding the advisability of investing in such product nor do they have any liability for any errors, omissions, or interruptions of the S&P 500® index.

S&P 500 Direct invests in many of the stocks in the S&P 500®, but it may not invest in all the stocks in the index. As a result, its performance may deviate from that of the S&P 500® index due to tracking error, market conditions, and the limitations of Tax-Loss Harvesting. Account size and customization options, such as excluding individual stocks, may affect your portfolio’s ability to track the S&P 500® index. Neither Wealthfront nor any of its affiliates guarantees the performance of the S&P 500 Direct or any other investment product. Returns are subject to market fluctuations and cannot be predicted or guaranteed.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Please see our Full Disclosure for important details.

Investment management and advisory services are provided by Wealthfront Advisers LLC (“Wealthfront Advisers”), an SEC-registered investment adviser, and brokerage related products, including the Cash Account, are provided by Wealthfront Brokerage LLC, a Member of FINRA/SIPC.

Wealthfront, Wealthfront Advisers and Wealthfront Brokerage are wholly owned subsidiaries of Wealthfront Corporation.

Copyright 2026 Wealthfront Corporation. All rights reserved

About the author(s)

Alex Michalka, Ph.D, has led Wealthfront’s investment research team since 2019. Prior to Wealthfront, Alex held quantitative research positions at AQR Capital Management and The Climate Corporation. Alex holds a B.A. in Applied Mathematics from the University of California, Berkeley, and a Ph.D. in Operations Research from Columbia University. View all posts by Alex Michalka, Ph.D