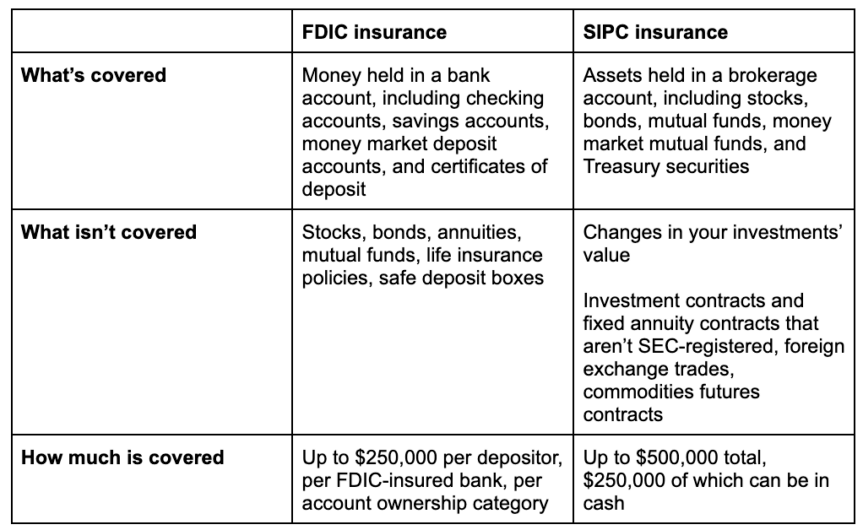

You’ve probably noticed when you go to a bank there’s usually a sign or placard announcing that deposits at that bank are FDIC insured. But what does FDIC insurance mean for you, and how is it different from SIPC insurance, the insurance you receive on your brokerage account? Here, we’ll break down what each kind of insurance covers and why it matters.

What is FDIC insurance?

The Federal Deposit Insurance Corporation (FDIC for short) was founded in 1933 as an independent agency of the U.S. government. It protects the cash being held in bank accounts up to $250,000 per depositor, per FDIC-insured bank, per account category. So if your bank were to suddenly lose all your money, the FDIC would pay you as soon as possible, via either a new account at another insured bank or a check in the amount of your insured balance.

If you have accounts at multiple FDIC-insured banks, you’re covered for up to $250,000 at each bank. If you and your partner have a joint account at one bank, you’re covered up to $500,000 for that account, plus $250,000 per individual account. There are, however, some exceptions: the Wealthfront Cash Account, for example, offers up to $8 million in FDIC insurance per depositor (more on that below).

As a rule, FDIC insurance covers things like:

- Checking accounts

- Savings accounts

- Money market deposit accounts

- Certificates of deposit

However, FDIC insurance does not cover the following:

- Stocks

- Bonds

- Mutual funds

- Annuities

- Life insurance policies

- Safe deposit boxes

You can see a full list of everything covered by FDIC insurance here.

What is SIPC insurance?

The Securities Investor Protection Corporation (SIPC), on the other hand, is a non-profit membership corporation that provides insurance that protects the assets in your brokerage accounts. This coverage is limited to $500,000 in total value per customer, of which $250,000 can be cash (either from selling securities or for buying them).

Covered assets include:

- Stocks

- Bonds

- Treasury securities

- Certificates of deposit (those issued by a broker, not a bank)

- Mutual funds

- Money market mutual funds

However, this protection only applies to SIPC-insured brokerages that are in financial trouble. It does not protect against decreases in the value of your investments due to market fluctuations or bad investment advice. But if your investment firm goes belly-up and doesn’t move your assets to another protected firm, SIPC will have your back up to the insured limits.

SIPC does not cover the following kinds of investments:

- Commodities futures contracts

- Foreign exchange trades

- Non SEC-registered investment contracts and fixed annuity contracts

Some investors might feel nervous if their account value exceeds $500,000 because they’re only insured up to that amount. We don’t think you should worry. As we’ve written before, it’s very rare for SIPC insurance to come into play. Because of the financial safeguards required by regulators (including a requirement to keep investors’ securities separate from the brokerage’s assets), it’s highly unusual for an investor to lose their securities or cash when a brokerage goes out of business. It’s only in situations when assets are missing that SIPC has to step in to oversee the liquidation of the firm. For perspective, SIPC only had two new cases between 2014 and 2020 where they had to get involved because client assets were not fully available.

You can see a full list of everything covered by SIPC insurance here.

SIPC vs. FDIC: Deciding which is right for you

When thinking about SIPC and FDIC insurance, you want to make sure you have the right kind of insurance for the right account. Both are important. It’s wise to seek out FDIC-insured accounts for your cash, and to make sure your brokerage account has SIPC insurance. That way, you’re covered in case your bank or your brokerage experiences financial trouble.

Does Wealthfront have FDIC or SIPC insurance?

We have both. Investments in your Wealthfront Investment Account are SIPC insured, and the Wealthfront Cash Account comes with up to $8 million in FDIC insurance — 32 times the coverage offered by traditional banks. We are able to offer $8 million of FDIC insurance by sweeping your money into up to 32 banks that are protected by the FDIC. Because we use multiple banks, we can provide more insurance than the $250,000 offered at single banks. Don’t worry: this doesn’t mean your cash gets held up in transit when you try to move it around. You can easily access your cash whenever you need it, either for a big purchase or an investment. You can even see which banks are holding your funds on your monthly statement.

We hope this information gives you some peace of mind and empowers you to bank and invest with institutions with the right kinds of insurance. Odds are you won’t need it, but it’s still nice to know you’re covered in the event of an emergency.

Disclosure

The information contained in this communication is provided for general informational purposes only, and should not be construed as investment or tax advice. Nothing in this communication should be construed as a solicitation or offer, or recommendation, to buy or sell any security. Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Wealthfront Advisers or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

The cash balance in the Cash Account is swept to one or more banks (the “program banks”) where it earns a variable rate of interest and is eligible for FDIC insurance. FDIC insurance is not provided until the funds arrive at the program banks. FDIC insurance coverage is limited to $250,000 per qualified customer account per banking institution. Wealthfront uses more than one program bank to ensure FDIC coverage of up to $8 million for your cash deposits. For more information on FDIC insurance coverage, please visit www.FDIC.gov. Customers are responsible for monitoring their total assets at each of the program banks to determine the extent of available FDIC insurance coverage in accordance with FDIC rules. The deposits at program banks are not covered by SIPC.

Cash Account is offered by Wealthfront Brokerage LLC (“Wealthfront Brokerage”), a Member of FINRA/SIPC. Neither Wealthfront Brokerage nor any of its affiliates are a bank, and Cash Account is not a checking or savings account. We convey funds to partner banks who accept and maintain deposits, provide the interest rate, and provide FDIC insurance. Investment management and advisory services–which are not FDIC insured–are provided by Wealthfront Advisers LLC (“Wealthfront Advisers”), an SEC-registered investment adviser, and financial planning tools are provided by Wealthfront Software LLC (“Wealthfront”).

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Please see our Full Disclosure for important details.

Wealthfront Advisers, Wealthfront Brokerage and Wealthfront are wholly owned subsidiaries of Wealthfront Corporation.

© 2021 Wealthfront Corporation. All rights reserved.

About the author(s)

The Wealthfront Team believes everyone deserves access to sophisticated financial advice. The team includes Certified Financial Planners (CFPs), Chartered Financial Analysts (CFAs), a Certified Public Accountant (CPA), and individuals with Series 7 and Series 66 registrations from FINRA. Collectively, the Wealthfront Team has decades of experience helping people build secure and rewarding financial lives. View all posts by The Wealthfront Team