For too many investors, tax season is a time filled with unwelcomed surprises. Not only can investment taxes be confusing and difficult to file, but at most traditional brokerages, you only realize a hefty tax bill is due when you receive your 1099 forms. At Wealthfront, we pride ourselves on our efforts to both minimize our clients’ taxes and make them as simple as possible to file. This year, we’re proud to say we have worked hard to make it even easier to file your 2015 taxes.

Automated TurboTax Integration for Stock-level Tax-Loss Harvesting

From a tax perspective, 2015 was an unprecedented year of tax savings for Wealthfront clients who took advantage of our Daily Tax-Loss Harvesting and Stock-level Tax-Loss Harvesting services. This past year Wealthfront lowered the minimum account balance required to take advantage of Stock-level Tax-Loss Harvesting to $100,000. In addition, we began to offer tax-loss harvesting to all our clients, regardless of their account balance. Fortunately, these moves came before the increased volatility we saw in global markets in the second half of the year, which meant many more opportunities to harvest losses for our clients.

Of course, you can only claim the benefit of these losses if you file them correctly on your tax return, and for some people, entering investment transactions on their tax forms can seem daunting and time consuming.

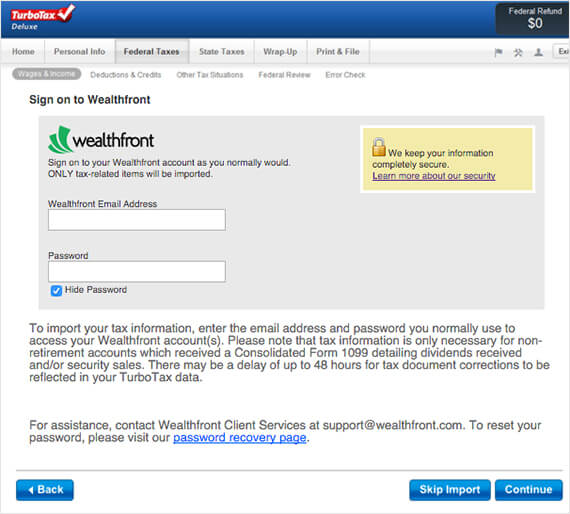

This year, we’re proud to announce that we have deepened our integration with TurboTax to automatically import and roll up all your Tax-Loss Harvesting and Stock-level Tax-Loss Harvesting transactions into a simple set of entries for easy tax filing. If you choose to use TurboTax for your filing needs, all you need to do is enter your Wealthfront credentials directly, and TurboTax will automatically download the relevant data from your Wealthfront accounts. The downloaded transactions will further be summarized to ensure that they are easy to deal with and easy to file. (For the tax geeks among us, these transactions are summarized according to Exception 1 & 2 in the IRS’s instructions for Form 8949)

Now that filing for these transactions is completely automatic and simple, there really is no reason anyone should hesitate to turn Tax-Loss Harvesting on in their Wealthfront account. Don’t miss out on another year of benefits these services can bring.

For clients who choose to use another software package or an accountant, a simple downloadable spreadsheet export of all relevant transactions will also be made available.

Make Sure You’re Prepared for April 18th

We’ve also redesigned the Taxes & Documents section of your web dashboard to improve and simplify access to all of your necessary documents and transactions. This new area will include a downloadable version of the consolidated 1099 form that you need to file with your federal tax return, along with further instructions on how to use TurboTax to simply import this form for electronic filing. We expect to publish all your tax documents by the end of February.

While tax forms like your W-2 from your employer and 1099-INT from your bank are made available by the end of January, the 1099-B, which includes details on investment transactions, is not made available until mid-February. Adding to the complexity, it is not unusual for ETF issuers to revise their tax filings after the initial date. As a result, it is usually prudent to wait until the end of February for revisions before filing one’s taxes. All Wealthfront clients will receive a detailed email outlining the availability of their relevant tax forms when their tax documents are ready.

Make Sure You Are Set Up for 2016

At Wealthfront, we pride ourselves on being the most tax-efficient automated investment service. We want to ensure that every client receives the full benefit from our services because Daily Tax-Loss Harvesting and Stock-level Tax-Loss Harvesting provide incredible value, especially in volatile markets. If you haven’t already, take a moment to make sure you have Daily Tax-Loss Harvesting and Stock-level Tax-Loss Harvesting turned on for your account for 2016.

While few truly enjoy filing their taxes every year, we do hope we’ve made the 2015 tax season the simplest and most transparent yet for Wealthfront clients.

Disclosure

Nothing in this article should be construed as tax advice, a solicitation or offer, or recommendation, to buy or sell any security. Financial advisory services are only provided to investors who become Wealthfront clients. This article is not intended as tax advice, and Wealthfront does not represent in any manner that the tax consequences described here will be obtained or that Wealthfront’s investment strategy will result in any particular tax consequence. Prospective investors should confer with their personal tax advisors regarding the tax consequences of investing with Wealthfront and engaging in a tax strategy, based on their particular circumstances. Projected returns do not represent actual accounts and may not reflect the effect of material economic and market factors. Past performance is no guarantee of future results. Actual investors on Wealthfront may experience different results from the results shown.

About the author(s)

The Wealthfront Team believes everyone deserves access to sophisticated financial advice. The team includes Certified Financial Planners (CFPs), Chartered Financial Analysts (CFAs), a Certified Public Accountant (CPA), and individuals with Series 7 and Series 66 registrations from FINRA. Collectively, the Wealthfront Team has decades of experience helping people build secure and rewarding financial lives. View all posts by The Wealthfront Team

![[160210] Tax Guide_updated](https://www.wealthfront.com/blog/wp-content/uploads/2016/02/160210-Tax-Guide_updated.jpg)