Wealthfront is committed to helping you do more with your money, and we’re always working to make our existing products even better. That’s why we’re so excited to announce that our portfolio rebalancing is now more sensitive to both short- and long-term capital gains taxes to further minimize your tax bill. You don’t have to do anything at all to take advantage of this upgrade — our software is now better at minimizing capital gains taxes, leaving more money in your pocket.

What is rebalancing, anyway?

Rebalancing is the process of buying and selling investments in your portfolio to bring it into closer alignment with your target allocation. Wealthfront periodically compares all investment accounts to their target allocations to make sure clients’ portfolios reflect their tolerance for risk. When you first set up your investment account, you may remember answering questions designed to assess your tolerance for risk, which we express as a risk score. Your risk score determines your target allocation, which is the ideal mix of different asset classes for your preferences given that some asset classes are riskier than others.

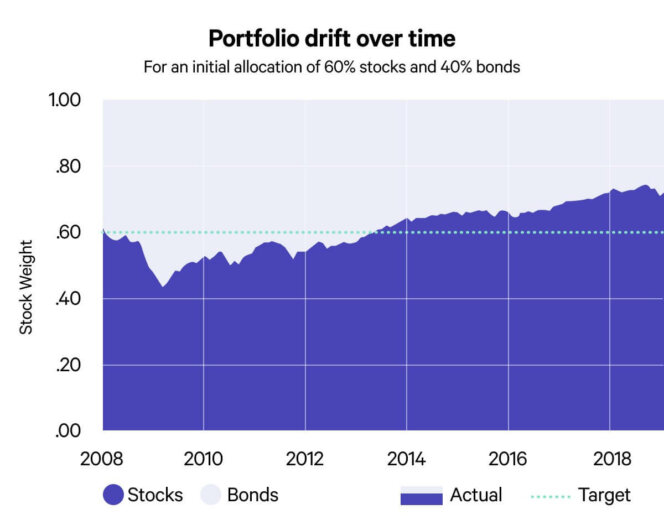

Once we’ve determined your target allocation, we start putting your money to work. But over time, your portfolio will naturally change as some investments outperform others. If any asset class drifts too far from your target allocation, that’s when we evaluate rebalancing your portfolio. We also do this when you change your risk score.

As you can see from the graph above, this simple sample portfolio of stocks and bonds strays a lot from its target allocation of 60% stocks and 40% bonds when it isn’t rebalanced. Over the decade pictured here, the portfolio drifts as far as 42% stocks all the way to 73% stocks. That’s a big deviation from the target allocation and means this portfolio wouldn’t do a good job reflecting this investor’s risk tolerance. That’s exactly why rebalancing is so important.

When we rebalance your portfolio, we sell investments from one or more asset classes (typically those that have been performing well and now make up too much of your portfolio) and buy investments from others to move your portfolio back to its target. Of course, if we sell something from your portfolio at a gain, you’ll end up owing taxes. In general, that’s fine — capital gains taxes mean you’re making money. And the taxes associated with rebalancing are part of getting back to a target allocation that makes sense for your risk score.

What’s changed?

Our software has gotten even smarter. Our new rebalancing methodology is finely tuned to consider the tradeoff between moving your portfolio all the way back to your target allocation and the taxes you’ll incur along the way.

Our software can now recognize when the likely tax cost to bring you back to your target is too high relative to the benefit of having a more optimal risk profile. In those cases, we stop short of your target to keep your tax bill lower. Over time, other events can help naturally rebalance your portfolio including deposits, dividends, and tax-loss harvesting.

What does this mean for you?

It’s all good news, and you don’t have to do a thing. Our software is now better at minimizing your long- and short-term capital gains taxes. If you keep a close eye on your portfolio, you might notice you’re not right at your target allocation.

For example, let’s look at a sample investment account with a balance of just over $32,000 where the client has just changed their risk score from 3.5 to 4.5 (by the way, we do not recommend changing risk scores due to market conditions!). Because of portfolio drift and the change in risk score, the account deviates from its target allocation by 7% in one asset class, nearly 6% in another, and several percentage points in most others, for a total deviation of over 25%. In this particular scenario, our optimized rebalancing would buy and sell investments to get the account nearer to its target allocation while remaining sensitive to the taxes the client would incur. The client would realize $4.03 of losses and not incur any taxes as as result of the rebalancing. The portfolio would still have a total deviation of 21% from its target allocation, but we believe it’s worth it to keep more money in the client’s pocket. A complete rebalance would bring this portfolio all the way to its target and the client would incur $184.50 in tax cost along the way.

Incurring taxes is part of investing, and it means you’re making money! We’re here to help minimize what you owe. We already do this with our unparalleled suite of tax-minimization features including Tax-Loss Harvesting, Stock-level Tax-Loss Harvesting, minimizing your taxes while transferring between brokerage accounts, and minimizing your taxes when you make withdrawals. We’re thrilled to be able to rebalance clients’ portfolios in an even more intelligent and tax-sensitive way.

Wealthfront is committed to clients’ financial wellbeing and we’re constantly innovating to find more ways to help you have a more secure and rewarding future. Our optimized rebalancing is just one of the many ways we do that. This feature, like Wealthfront’s Tax-Loss Harvesting, would be virtually impossible for an individual investor to perform on her own — another case where software truly is better than people.

Disclosure

This blog is powered by Wealthfront Advisers LLC (“Wealthfront Advisers”). The information contained in this blog is provided for general informational purposes only, and should not be construed as investment advice. Nothing in this communication should be construed as an offer, recommendation, or solicitation to buy or sell any security. Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Wealthfront Advisers or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise. This blog is not intended as tax advice, and Wealthfront and its affiliates do not provide tax advice nor do they represent in any manner that the tax consequences described here will be obtained or will result in any particular tax consequence. Investors are encouraged to consult with their personal tax advisors.

Investment advisory services are provided by Wealthfront Advisors LLC (“Wealthfront Advisers”), an SEC-registered investment adviser, and brokerage products and services, are provided by Wealthfront Brokerage LLC (formerly known as Wealthfront Brokerage Corporation), member FINRA / SIPC. Wealthfront Software LLC (“Wealthfront”) offers a free software-based financial advice engine that delivers automated financial planning tools to help users achieve better outcomes.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Please see our Full Disclosure for important details.

Wealthfront Advisers, Wealthfront Brokerage and Wealthfront are wholly owned subsidiaries of Wealthfront Corporation.

© 2019 Wealthfront Corporation. All rights reserved.

About the author(s)

The Wealthfront Team believes everyone deserves access to sophisticated financial advice. The team includes Certified Financial Planners (CFPs), Chartered Financial Analysts (CFAs), a Certified Public Accountant (CPA), and individuals with Series 7 and Series 66 registrations from FINRA. Collectively, the Wealthfront Team has decades of experience helping people build secure and rewarding financial lives. View all posts by The Wealthfront Team