In times of uncertainty, like the current debate over the debt ceiling and looming possibility of a government shutdown, investors get rattled. As a result, they often stop making regular deposits to their investment accounts because they’re worried about the future. Unfortunately, hitting the brakes on your long-term investments because of short-term market fluctuations is one of the worst mistakes you can make as an investor.

Some background on the debt ceiling

The debt ceiling determines how much money the US Treasury can borrow, and as a result, how much money the federal government can spend. Raising the debt ceiling allows the government to continue to borrow money. Failing to raise the debt ceiling could cause a dramatic decrease in government spending, a government shutdown, or the US government could even default on its debt.

It’s understandable that investors feel concerned right now. Headlines about the current debt ceiling crisis describe “potential financial Armageddon” and a “catastrophic” time for the United States economy if the US fails to raise the debt limit and defaults on its loans. Take this with a grain of salt, and keep in mind that news outlets have an incentive to use strong (even apocalyptic) language to get you to click. You should also remember that the US has not defaulted on its debt during any previous debt ceiling crisis, and it’s highly unlikely to happen this time around.

How long before the market recovers from a government shutdown?

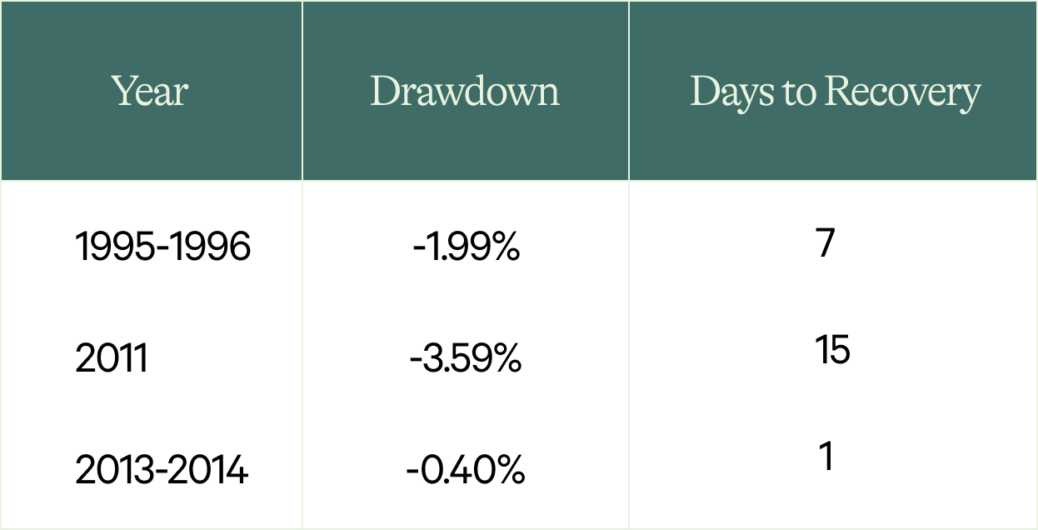

Debt ceiling negotiations don’t always lead to government shutdowns, but if the debate is especially contentious, they can. Here we’ll look at market drawdowns during the three most recent government shutdowns caused by debt ceiling negotiations, and calculate how long it took for the market to recover.

When the government shuts down, financial markets react — but market declines associated with government shutdowns have historically resolved very quickly. We studied these declines and recoveries using VTSMX (a Vanguard mutual fund which tracks the performance of the US stock market). As the table below shows, during the three recent shutdowns we analyzed, it took 15 days or less for the market to recover from its maximum drawdown. In two out of the three cases, recovery took a week or less. In the 2013/2014 government shutdown, the market only took a day to recover.

Maximum drawdown and time to recovery during previous government shutdowns:

In each of the three periods we examined, government shutdowns caused short-term market declines that bounced back within days or weeks. These declines were just blips on the radar with no long-term impact on the US economy. We hope this analysis gives you some peace of mind about adding to your investments even during periods of volatility.

What happens to the market during other funding gaps

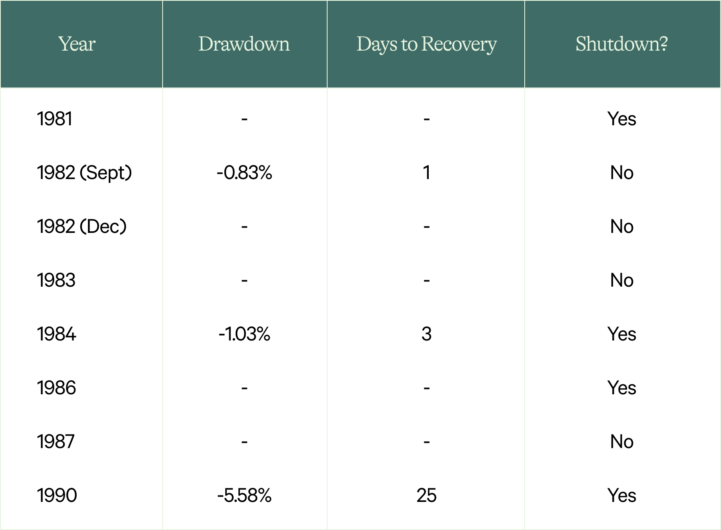

We also looked at market drawdowns and the time to recovery during other government funding gaps since 1980. These gaps were unrelated to debt ceiling negotiations, but instead were situations in which Congress hadn’t passed an appropriations bill and temporary measures expired. The table below shows the maximum drawdown during each funding gap, the number of days the market took to recover, and whether or not the government shut down.

Maximum drawdown and time to recovery during government funding gaps 1980-1995:

As you can see, most of these funding gaps didn’t cause the market to decline at all, even in cases when the government shut down. When the market did decline, the longest time to recovery was a mere 25 days and the shortest was just one day.

History tends to repeat itself

We know it’s hard to ignore the news and keep investing for the long term in uncertain times — but history has shown time and time again that it’s the right thing to do. If you study long-term trends in the US stock market (as the so-called “Wizard of Wharton” Jeremy Siegel did in his bestselling book Stocks for the Long Run) you’ll see that short-term volatility is a common occurrence, but the long-term upward trend of the market is remarkably consistent.

Despite the looming deadline to raise the debt ceiling by early December, we encourage you to stick to your investment strategy, keep making any regular deposits you would typically make, and ignore the noise. If history repeats itself, you’ll be glad you did.

Disclosure

Returns prior to 1993 use daily data on market returns from Kenneth French’s website. Data from 1993 to 2014 uses VTSMX. “Time to recovery” is the number of days it took the market to return to the level it was before the beginning of the “event” in question.

The information contained in this communication is provided for general informational purposes only, and should not be construed as investment or tax advice. Nothing in this communication should be construed as a solicitation, offer, or recommendation, to buy or sell any security. Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Wealthfront Advisers or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Investment management and advisory services–which are not FDIC insured–are provided by Wealthfront Advisers LLC (“Wealthfront Advisers”), an SEC-registered investment adviser, and financial planning tools are provided by Wealthfront Software LLC (“Wealthfront”). Brokerage products and services are offered by Wealthfront Brokerage LLC, member FINRA / SIPC. All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Please see our Full Disclosure for important details.

Wealthfront Advisers, Wealthfront Brokerage and Wealthfront are wholly owned subsidiaries of Wealthfront Corporation.

Copyright 2021 Wealthfront Corporation. All rights reserved.

About the author(s)

Alex Michalka, Ph.D, has led Wealthfront’s investment research team since 2019. Prior to Wealthfront, Alex held quantitative research positions at AQR Capital Management and The Climate Corporation. Alex holds a B.A. in Applied Mathematics from the University of California, Berkeley, and a Ph.D. in Operations Research from Columbia University. View all posts by Alex Michalka, Ph.D

Andy Rachleff is Wealthfront's co-founder and Executive Chairman. He serves as a member of the board of trustees and chairman of the endowment investment committee for University of Pennsylvania and as a member of the faculty at Stanford Graduate School of Business, where he teaches courses on technology entrepreneurship. Prior to Wealthfront, Andy co-founded and was general partner of Benchmark Capital, where he was responsible for investing in a number of successful companies including Equinix, Juniper Networks, and Opsware. He also spent ten years as a general partner with Merrill, Pickard, Anderson & Eyre (MPAE). Andy earned his BS from University of Pennsylvania and his MBA from Stanford Graduate School of Business. View all posts by Andy Rachleff