Starting this Friday, January 30, the base rate your cash earns in the Cash Account will increase to 3.30% APY (annual percentage yield) from program banks.

Our goal has always been to build high-quality products at a low cost, and share more of the savings with our clients—and that includes the Cash Account. The APY offered on the Cash Account typically changes in response to shifts in the federal funds rate, which is expressed as a target range. Today, that target range has not changed. But the effective federal funds rate, or EFFR, has recently stabilized at a higher rate within that target range, and that means we can pass along more interest to you as a result.

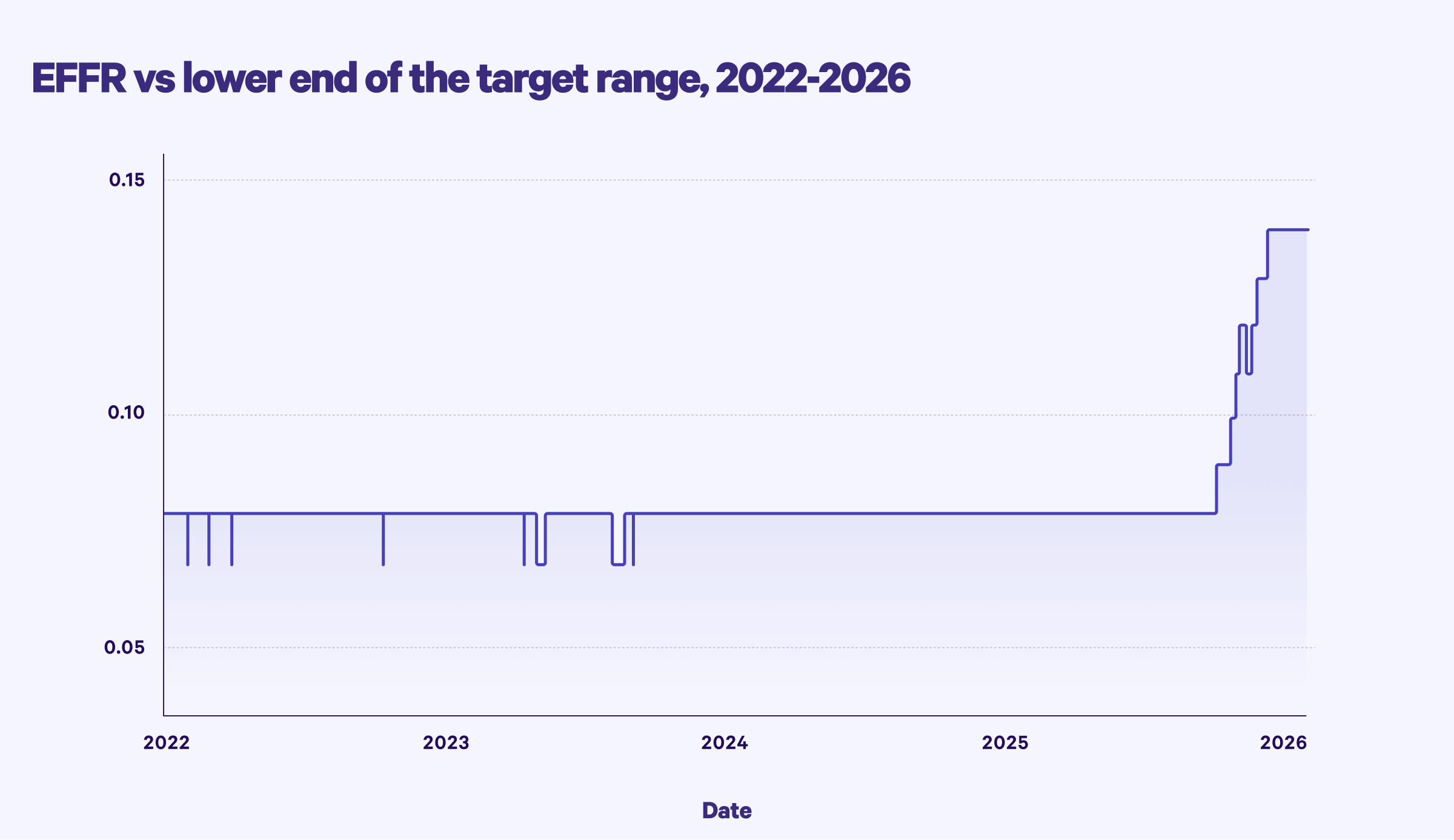

Our program banks, where we sweep Cash Account deposits, pay interest based on the EFFR. That means that when the EFFR moves a bit higher, so does the amount of interest these banks pay. The chart below shows the difference between the EFFR and the lower end of the target range since 2022. As you can see, the EFFR was close to the bottom end of the range for several years. However, within the last few months, the EFFR has climbed within the range.

Because the EFFR has been stable at a higher rate within its target range, we want to share that increase with you.

We know you have many choices about where to build your wealth, and we work hard to ensure Wealthfront is the easy answer. One way we do this is by offering a high APY for your cash in the Cash Account, so your savings can earn an industry-leading rate until you’re ready to invest. We also share savings in other ways, like offering free instant transfers (which other institutions often charge extra for), reimbursing up to two out-of-network ATM fees per month (for those times when you can’t get to one of the 19,000+ free in-network ATMs), and charging no monthly fees. We’re glad to have this opportunity to make the Cash Account an even better place to save and manage your every day finances. Thank you for choosing Wealthfront.

Disclosure

The Cash Account is offered by Wealthfront Brokerage LLC (“Wealthfront Brokerage”), Member of FINRA/SIPC. Neither Wealthfront Brokerage nor any of its affiliates are a bank, and the Cash Account itself is not a deposit account. The Annual Percentage Yield (“APY”) on cash deposits as of January 30, 2026, is representative, requires no minimums, and may change at any time. The APY for the Wealthfront Cash Account represents the weighted average of the APY on the aggregate deposit balances of all clients at insured depository institutions that participate in our cash sweep program (the “Program Banks”). Wealthfront sweeps available cash balances to Program Banks where they earn a variable rate of interest. A list of current Program Banks can be found here: www.wealthfront.com/programbanks. Deposit balances are not allocated equally among the participating program banks.

Instant and same day withdrawals may be processed through the Real-Time Payments (RTP) network or the FedNow service, enabling same day withdrawals. Real-Time Payments (RTP) transfers and FedNow instant payment transfers may be limited by destination institutions, daily transaction caps, and by participating entities such as Wells Fargo, the RTP® Network, and FedNow® Service. New Cash Account deposits are subject to a 2-4 day holding period before becoming available for transfer. Wealthfront doesn’t charge for transfers, but some receiving institutions may impose an RTP or FedNow fee. Processing times may vary.

Fees and Eligibility requirements may apply to certain checking features, please see the Wealthfront Customer Debit Agreement for details.

Fee-free ATM access applies to in-network ATMs only. For out-of-network ATMs and bank tellers a $2.50 fee will apply, plus any additional fee that the owner or bank may charge. Fees and Eligibility requirements may apply to certain checking features, please see the Wealthfront Customer Debit Agreement for details. Copyright 2025 Green Dot Corporation. All rights reserved.

The domestic out-of-network ATM fee reimbursement program (the “Program”) allows Wealthfront Brokerage clients with open and funded Individual and Joint Wealthfront Brokerage Cash Accounts (“Cash Account”) who have requested and received an accompanying debit card(s) (“Debit Card”) issued by Green Dot Bank to be eligible for certain account benefits when using their Debit Card for a domestic out-of-network ATM cash withdrawal of US dollars (“ATM Transactions”) when their Wealthfront accounts, Green Dot Bank accounts (collectively, “Accounts”), and Debit Card remain open, active, and in good standing.

Each calendar month, current eligible clients with ATM Transactions will receive a reimbursement of certain fees associated with their first two ATM Transactions on a per-card, per account basis. Please note, replacement debit cards aren’t eligible for additional reimbursements above that limit. Wealthfront Brokerage will utilize its best efforts to reimburse Green Dot Bank’s $2.50 “out-of-network fee” and up to $5.00 of any operator or owner’s fee for your ATM Transactions, up to a maximum reimbursement of $7.50 per ATM Transaction (the “Reimbursement”). Your maximum total monthly Reimbursement shall be $15.00 ($7.50 + $7.50) per card, per account. If an ATM operator charges fees other than out-of-network fees and/or owner’s fees, Wealthfront Brokerage will not reimburse any portion of those fees. Once the maximum total monthly Reimbursement has been reached, no subsequent out-of-network ATM fees or charges that occur that calendar month will be reimbursed. ATM Transactions completed before September 16, 2024 are not eligible for Reimbursement in connection with this Program. Wealthfront Brokerage reserves the right to modify or terminate the Program at any time without notice. For full details please review the Out-of-Network ATM Fee Reimbursement Terms and Conditions.

Wealthfront Advisers and Wealthfront Brokerage are wholly-owned subsidiaries of Wealthfront Corporation.

© 2026 Wealthfront Corporation. All rights reserved.

About the author(s)

David Fortunato is Wealthfront’s Chief Executive Officer. He joined Wealthfront in 2009 as the company’s inaugural CTO and was instrumental in launching the company to its first clients in 2011. Previously to his role as CEO, David was the President of Wealthfront. David holds a BS in computer science and economics from Amherst College. View all posts by David Fortunato