Note: As of March 21, 2024, Wealthfront uses the iShares Bitcoin Trust (IBIT) to represent the Bitcoin asset class instead of the Grayscale Bitcoin Trust (GBTC). As of September 9, 2024, Wealthfront uses the iShares Ethereum Trust (ETHA) to represent the Ethereum asset class instead of the Grayscale Ethereum Trust (ETHE). Read more here.

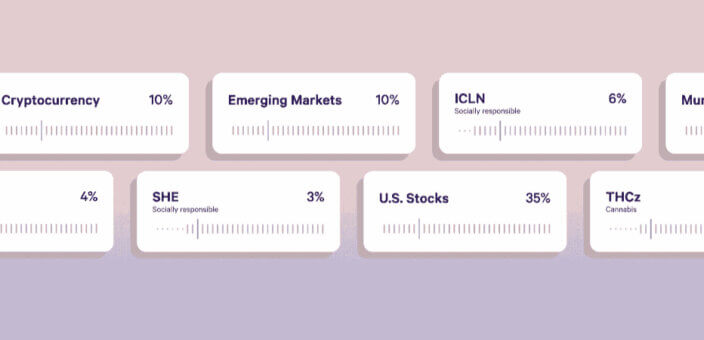

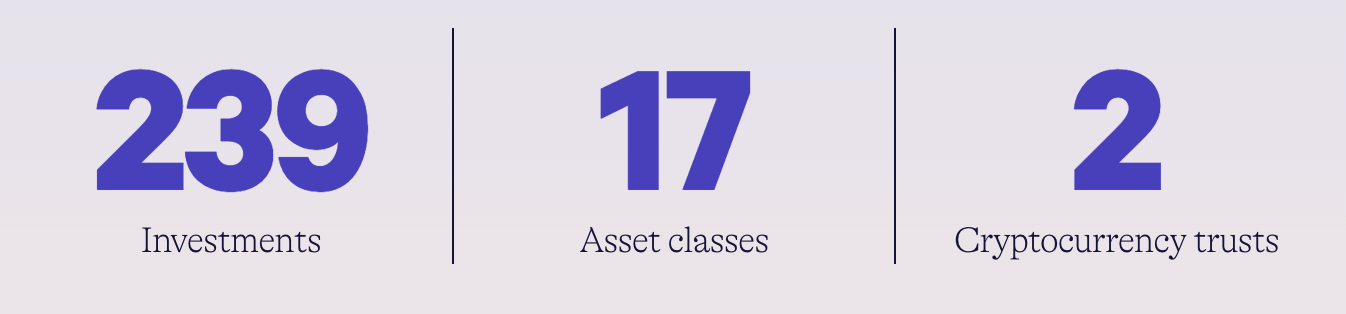

Your ideal portfolio doesn’t necessarily look like anyone else’s. That’s why over the last year, we’ve made it possible to customize your Wealthfront portfolio to match your individual preferences and beliefs with hundreds of investments from categories including clean energy, tech, and more.

Now, we’re making it even easier to explore our menu of investment options. You can browse investments by category (like tech and innovation or cryptocurrency trusts), search for a specific investment you’re bullish about, or simply research the ETFs in our expert-built (but still fully customizable) portfolios like our Socially Responsible portfolio. If you find a portfolio or investment you’d like to add, you can do it easily by logging into the Wealthfront web site or using the Wealthfront app.

Explore popular investments at Wealthfront

Curious about how other Wealthfront clients are customizing their portfolios? Here are the top five most popular investments Wealthfront clients added to their portfolios in 2021, ranked by the number of accounts to which they were added. Keep in mind that these aren’t recommendations, and you should evaluate whether any new investment makes sense for your particular goals and situation. For example, you should take into account the expense ratio of any new investment and consider how that investment contributes to (or detracts from) the overall diversification of your portfolio.

GBTC

The Grayscale Bitcoin Trust, or GBTC, was the most popular investment Wealthfront clients added to their portfolios in 2021. GBTC is unique in that it gives investors exposure to Bitcoin (the largest cryptocurrency by market capitalization) in a convenient, familiar package that trades like a stock. If you’re interested in gaining exposure to Bitcoin, this investment allows you to do it conveniently and without the hassle of setting up a cryptocurrency wallet and keys.

If you’re new to cryptocurrency and want to learn more about it, check out our blog post with our thoughts on investing in cryptocurrency.

ETHE

Given the popularity of GBTC, it’s not surprising that the Grayscale Ethereum Trust, or ETHE, was the second most popular investment for Wealthfront clients in 2021. Similar to GBTC, ETHE trades like a stock and gives investors exposure to cryptocurrency without actually owning coins – but instead of Bitcoin, investors get exposure to Ethereum.

QQQ

Invesco QQQ Trust Series 1, or QQQ, is one of the largest ETFs in the world. It tracks the NASDAQ 100, which contains the 100 largest non-financial companies listed on the NASDAQ stock exchange.

ARKK

The ARK Innovation ETF, or ARKK, is an active fund managed by Cathie Wood, who was named the best stock picker of the year by Bloomberg in 2020. As the fund’s name suggests, ARKK is focused on investing in innovative technologies that can “potentially [change] the way the world works.” ARKK’s holdings include companies like Tesla (TSLA), Coinbase (COIN), and Spotify (SPOT).

ESGU

The iShares ESG Aware MSCI USA ETF, or ESGU, is one of many socially responsible investments available to Wealthfront clients. This ETF minimizes your exposure to things like civilian firearms, thermal coal, and tobacco while maximizing your exposure to environmental, social, and governance (ESG) factors. You can add ESGU to your portfolio, or get it as part of Wealthfront’s Socially Responsible portfolio.

You can check out our YouTube video for more information about how to customize your Wealthfront portfolio.

Build long-term wealth on your own terms

We’re thrilled to make it easier to discover and research investments at Wealthfront so you can build the portfolio that’s right for you. In the future, you can count on us to offer even more new ways to customize your portfolio so you can confidently build a secure and rewarding financial future in a way that’s personalized to you.

Disclosure

The top five most popular investments are based on the number of accounts the security was allocated to and not based on the dollar amount that was allocated to that security as of January 21, 2022.

The information contained in this communication is provided for general informational purposes only, and should not be construed as investment or tax advice. Nothing in this communication should be construed as a solicitation, offer, or recommendation, to buy or sell any security. Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Wealthfront Advisers or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Investment management and advisory services–which are not FDIC insured–are provided by Wealthfront Advisers LLC (“Wealthfront Advisers”), an SEC-registered investment adviser, and financial planning tools are provided by Wealthfront Software LLC (“Wealthfront”). Brokerage products and services are offered by Wealthfront Brokerage LLC, member FINRA / SIPC. All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Please see our Full Disclosure for important details.

Wealthfront Advisers, Wealthfront Brokerage and Wealthfront are wholly owned subsidiaries of Wealthfront Corporation.

© 2022 Wealthfront Corporation. All rights reserved.