Consumers currently have a huge number of low-risk liquid accounts from which to choose, each belonging to financial institutions that will tell you theirs is the best. So how do you know which account is best?

Note: As of December 27, 2024, the Wealthfront Cash Account has a 4.00% APY. Read more about it here .

Since the beginning, Wealthfront has recommended that our readers and clients should save for their short-term needs — which we define as significant expenditures, like buying a home, that will arise in the next three to five years — in a low-risk liquid account. Consumers currently have a huge number of low-risk liquid accounts from which to choose, each belonging to financial institutions that will tell you theirs is the best. So how do you know which account is best?

Let’s start with the basic accounts you’re most likely to consider for low-risk cash savings. These are the four primary liquid vehicles that are promoted as ideal repositories for low-risk savings:

- A Wealthfront Cash Account

- A classic bank savings account

- A money market fund

- A bond ETF

These accounts vary in four main ways:

- The interest rate they pay

- The amount of FDIC insurance they offer

- Their risk of capital loss

- Their liquidity (the frequency with which you can withdraw money)

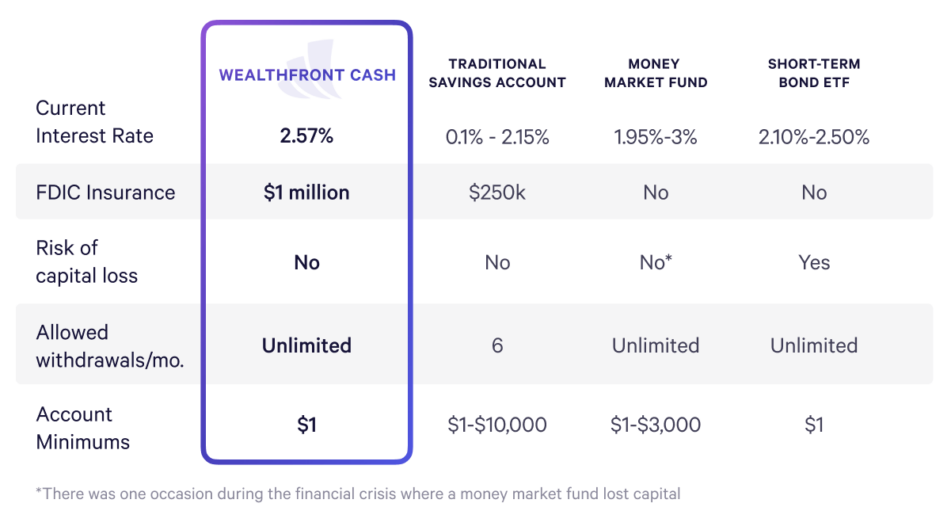

As you can see in the table below, the Wealthfront Cash Account is superior by every measure:

Now let’s talk about each of these dimensions in more detail.

Interest Rate

As we’ve explained before, there is no structural reason why Wealthfront can deliver a higher interest rate than traditional banks. The reason we are able to bring clients a higher-than-average interest rate on the Wealthfront Cash Account is simply that we choose to share more of the economics. We are not allowed to pay more than we earn due to broker/dealer regulations, so contrary to what some people may believe, we do not lose money on the account.

The banks to which we broker your deposits are contractually obligated to pay interest rates that have been consistently higher than money market funds and treasury bill (short-term bond) ETFs for a very long time. Money market funds and bond ETFs cannot just arbitrarily raise their rates. They can only pay the average rates of what the securities they own in their funds pay. Technically, they could raise their rates by buying higher-risk or longer-duration securities, but then they wouldn’t be appropriate for a low-risk savings account.

Another important note: the interest rate quoted for the bond ETF is what you would get if you bought the ETF directly. If you bought it through some robo advisors, the actual interest rate realized would be reduced by the amount of the advisory fee, which is usually on the order of 0.25%. In other words, the net rate you would earn on a bond fund that pays 2.20% bought through another robo advisor would be 1.95% (2.20% – 0.25%).

FDIC Insurance

Wealthfront is able to offer four times the amount of FDIC insurance offered through a savings account at most banks by brokering your deposits into four banks, each of which offers $250,000 of FDIC insurance, the maximum allowed per bank. If your money is in just one bank, that’s all the FDIC insurance you’re going to get. Additionally, only chartered banks can offer FDIC insurance, which is why money market funds and bond ETFs are not FDIC insured.

Money invested in a security — like a portfolio of bonds or commercial paper — is subject to capital loss risk. Money deposited into a Wealthfront Cash Account or a traditional savings account is not subject to any capital risk. Money market funds buy very short-term and very high-quality (low-risk) fixed-income securities. In the history of money market funds, the only time investors couldn’t get 100% of their money back was during the financial crisis in 2008 when The Reserve Primary Fund’s net asset value (NAV) fell to 97 cents per share.

Risk of Capital Loss

A bond ETF could increase its interest rate by buying longer-term securities than what it currently holds (longer duration bonds typically pay higher rates than shorter-term bonds, although not at the moment), but the longer the average duration of the securities held in the fund, the higher the volatility of the value and therefore the higher the risk of a capital loss.

Minimum Balances

Savings accounts at traditional banks require a minimum balance of $1 to $10,000. Money Market Fund minimums range from $1 to $3,000. The minimum on an ETF is practically $1, assuming you can buy a fraction of a share. In most cases higher minimums result in higher yields. The Wealthfront Cash Account has a minimum balance of $1.

Maximum Number of Allowed Withdrawals

A portfolio of securities, like a money market fund or bond ETF, allows an unlimited number of withdrawals each month. Regulations limit bank savings accounts to six withdrawals per month. Wealthfront is not a bank, therefore our cash account is not regulated in the same way, which means, we are allowed to offer unlimited withdrawals each month.

The Wealthfront Cash Account was designed to be superior to all other low-risk savings alternatives. We believe our product advantage will grow when we offer debit/ATM cards and the ability to auto-pay your bills from the cash account late this year. Our hope, as we evolve the Wealthfront Cash Account to include more features and functionality that you’ve told us you want and need, is that you are able to entirely leave behind traditional bank checking and savings accounts with their many comparative inefficiencies and downsides.

Disclosure

This blog is powered by Wealthfront Software LLC (“Wealthfront”) and has been prepared solely for informational purposes only. Nothing in this communication should be construed as an offer, recommendation, or solicitation to buy or sell any security or a financial product. Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Wealthfront Advisers or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

The Annual Percentage Yield (APY) for the Wealthfront Cash Account is as of June 26, 2019. The APY may change at any time, before or after the Cash Account is opened.

Investment management and advisory services are provided by Wealthfront Advisers LLC, an SEC registered investment adviser, and brokerage related products, including the cash account, are provided by Wealthfront Brokerage, a member of FINRA/SIPC. Neither Wealthfront Brokerage nor its affiliates is a bank. We convey funds to institutions accepting and maintaining deposits. Wealthfront Software LLC (“Wealthfront”) offers a free software-based financial advice engine that delivers automated financial planning tools to help users achieve better outcomes.

Wealthfront, Wealthfront Advisers LLC and Wealthfront Brokerage are wholly owned subsidiaries of Wealthfront Corporation.

© 2019 Wealthfront Corporation. All rights reserved.

About the author(s)