At Wealthfront, we’ve long said that tax-loss harvesting is the most compelling reason to use a robo-advisor. Tax-loss harvesting can lower your tax bill and boost your after-tax returns with no extra effort on your part, and it’s a task perfectly suited to software. We think it’s important to consistently publish the results of Wealthfront’s Tax-Loss Harvesting service so you can understand the benefits of investing with us. In this post, we’ll look at how the service performed in 2021.

By most accounts, 2021 was a good year for investors despite being the second full year of the Covid-19 pandemic. Tax-loss harvesting is often associated with market declines, but we’re thrilled to share that Wealthfront’s Tax-Loss Harvesting once again generated significant tax savings for our clients even in a year when the market had strong returns. On average, Wealthfront clients with Classic and Socially Responsible portfolios with a risk score of 8 who began using Tax-Loss Harvesting in 2021 received an estimated after-tax benefit worth 4 to 9 times our annual advisory fee last year.

How tax-loss harvesting works

Tax-loss harvesting is a tax minimization strategy that involves selling investments that have declined below their purchase price and replacing them with similar investments. When you do this, your portfolio keeps the same general risk and return profile, but you get to realize (or “harvest”) a loss. At tax time, you can use your harvested losses to offset capital gains and up to $3,000 of ordinary income for the year.

How Wealthfront’s Tax-Loss Harvesting performed in 2021

Tax-Loss Harvesting results for Classic and Socially Responsible portfolios

To measure the benefit of Wealthfront’s Tax-Loss Harvesting, we use what we call “harvesting yield.” Harvesting yield takes the amount of harvested losses in a given year and divides that number by the portfolio’s value at the beginning of the year.

We calculated the harvesting yield for the average client with a Classic or Socially Responsible portfolio who began using Tax-Loss Harvesting in 2021 and had a risk score of 8 (the average and most common risk score). On average, we harvested losses equal to 4.76% of their portfolio value last year. This translates to an estimated after-tax benefit worth between 1.19% and 2.38% of their portfolio value, depending on their tax rates and ability to use the losses. Put another way, this is between 4 and 9 times the 0.25% annual advisory fee Wealthfront charges.

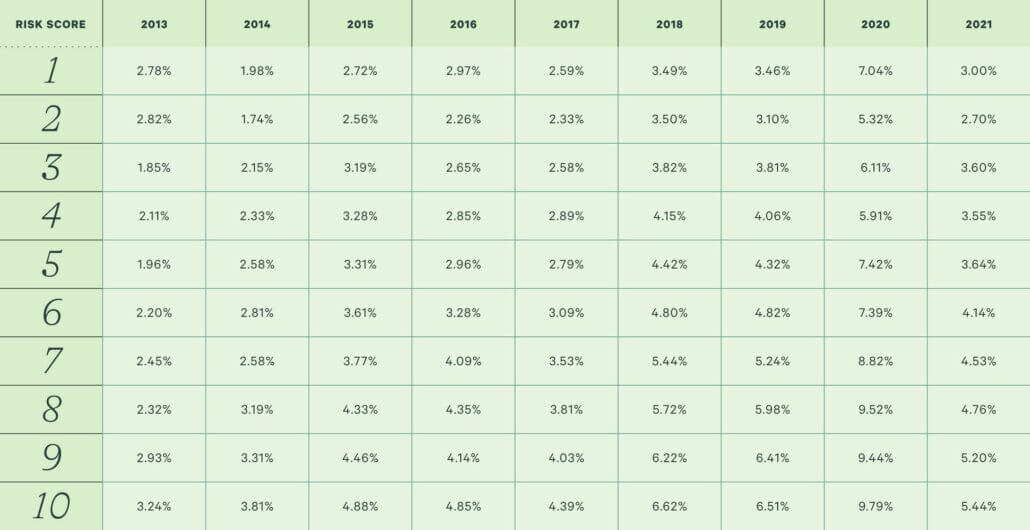

The table below shows the average annual harvesting yield for each portfolio risk score and “client vintage” (determined by when the client first started using Wealthfront’s Tax-Loss Harvesting). We included clients with unmodified Classic portfolios and Socially Responsible portfolios (which were launched in September 2021) in this analysis. A client who began using Tax-Loss Harvesting in a Classic portfolio in 2018 and switched to a Socially Responsible portfolio in late 2021 would be included in the 2018 client vintage. As you can see, our software harvested a significant amount of losses for clients across risk scores and client vintages in 2021 even though the market was up.

Average annual harvesting yield for Classic & Socially Responsible portfolios

We excluded the 2012 client vintage from these calculations because we launched the service late that year. And while the chart above combines Classic and Socially Responsible portfolios, we also conducted a separate analysis of the harvesting yield for clients who signed up for a Socially Responsible portfolio after we launched them in late September of 2021. The dollar-weighted average harvesting yield across risk scores for Socially Responsible portfolios from September 21, 2021 through December 31, 2021 is 2.76%. The dollar-weighted average for Classic portfolios over the same time period was nearly identical, at 2.70%.

Tax-Loss Harvesting results for customized portfolios

Wealthfront clients with customized portfolios also benefited from Tax-Loss Harvesting in 2021. Customized portfolios (from the 2021 client vintage) had an average harvesting yield of 4.34% last year, which translates to an estimated after-tax benefit of 1.09% to 2.17% of the portfolio’s value. Keep in mind that some of the most popular investments clients used to customize their portfolios in 2021 do not have an alternate ETF to use for Tax-Loss Harvesting, which reduces the harvesting yield in those accounts.

Factors that impact how much benefit you’ll get from Tax-Loss Harvesting

The numbers above are just averages—you could receive more or less benefit from Tax-Loss Harvesting depending on your particular situation. There are a few key factors that impact how much benefit you’ll get from Tax-Loss Harvesting.

The riskiness of your portfolio

Riskier portfolios are usually more volatile. More volatility in your portfolio’s value typically means there are more opportunities for our software to harvest losses. (That said, we don’t think it’s wise to increase your risk score for the purpose of harvesting more losses.)

Deposit timing and add-on deposits

In order for our software to harvest a loss, an investment in your portfolio must decline below its purchase price. If you make one deposit and never purchase additional investments, it becomes harder to harvest losses over time because markets tend to rise over the long run. However, if you make frequent add-on deposits, there will be more tax lots in your portfolio and it’s more likely our software will be able to harvest losses.

Your marginal tax rate

Your after-tax benefit from Tax-Loss Harvesting is a function of your marginal tax rate. We estimate the range of possible after-tax benefit by multiplying harvesting yield by 25% and 50% to approximate the range of marginal tax rates you could pay. If you live in a high-tax state or are in a higher tax bracket, you’re likely to get more after-tax benefit from our Tax-Loss Harvesting than if you live in a low-tax state or are in a lower tax bracket. However, you will receive significant benefit even if you live in a state with no income tax.

Your ability to use the losses

Depending on the amount of capital gains you realize, you might not be able to use all of your harvested losses in a given year. That’s okay! Unused losses just roll over to the next year. You can also use harvested losses to offset up to $3,000 in ordinary income each year, so you don’t even need to realize capital gains for Tax-Loss Harvesting to lower your tax bill.

Wash sales

Occasionally, some of the benefit of Tax-Loss Harvesting can be lost due to wash sales. A wash sale is when you sell and buy a “substantially identical” security within 30 days. It doesn’t matter if the purchase and sale happen in different portfolios held at different institutions—it’s still a wash sale. Wash sales happen pretty rarely at Wealthfront (typically they affect about 0.15% of trades, excluding withdrawals which sometimes force Wealthfront to sell an investment that creates a wash sale) because our software is designed to avoid them across all of your accounts with us. If a wash sale does occur, it’s not the end of the world—you just have to wait a year to realize the loss, but just for the transactions that are considered wash sales.

Suitable alternates

Not all of the investments available at Wealthfront have a suitable alternate ETF for Tax-Loss Harvesting. If you customize your portfolio with investments that have no alternate ETFs, your portfolio’s overall harvesting yield is likely to be lower. You can always check to see if an ETF available at Wealthfront has a Tax-Loss Harvesting alternate by searching for specific investments here.

Tax-loss harvesting lowers your taxes

There’s a common misconception that tax-loss harvesting is just a form of tax deferral and isn’t valuable because you have to pay up eventually. This is wrong for two reasons.

One, tax-loss harvesting lowers your taxes through tax-rate arbitrage. You can offset short-term capital gains (which are currently taxed at a maximum federal rate of 37%) today and pay long-term capital gains rates (which currently top out at 20% at the federal level) when you eventually sell your investments in the future, as long as you hold them for at least a year.

Two, tax-loss harvesting also lowers your taxes through the time value of money. In other words, you come out ahead because it’s more expensive to pay taxes today than it is in the future.

A task perfectly suited to software

At Wealthfront, we use software and automation to save you time and hassle. It’s true that you could conduct tax-loss harvesting yourself, but it would take a lot of effort —and software does a better job, anyway. That’s because you’re highly unlikely to look for opportunities to harvest losses every day, but software can check for these opportunities on a daily basis, which leads to greater benefit.

We’re proud to make our Tax-Loss Harvesting available in all Automated Investing Accounts at no additional cost. We know of no other robo-advisor that publishes its tax-loss harvesting results, which we think might tell you something about how their services perform. Wealthfront’s powerful Tax-Loss Harvesting service is just one of the ways we help you build long-term wealth on your own terms.

Disclosure

The effectiveness of the Tax-Loss Harvesting strategy to reduce the tax liability of the client will depend on the client’s entire tax and investment profile, including purchases and dispositions in a client’s (or client’s spouse’s) accounts outside of Wealthfront Advisers and type of investments (e.g., taxable or nontaxable) or holding period (e.g., short- term or long-term).Tax loss harvesting may generate a higher number of trades due to attempts to capture losses. There is a chance that trading attributed to tax loss harvesting may create capital gains and wash sales and could be subject to higher transaction costs and market impacts. In addition, tax loss harvesting strategies may produce losses, which may not be offset by sufficient gains in the account and may be limited to a $3,000 deduction against income. The utilization of losses harvested through the strategy will depend upon the recognition of capital gains in the same or a future tax period, and in addition may be subject to limitations under applicable tax laws, e.g., if there are insufficient realized gains in the tax period, the use of harvested losses may be limited to a $3,000 deduction against income and distributions. Losses harvested through the strategy that are not utilized in the tax period when recognized (e.g., because of insufficient capital gains and/or significant capital loss carryforwards), generally may be carried forward to offset future capital gains, if any.

The information contained in this communication is provided for general informational purposes only, and should not be construed as investment or tax advice. Nothing in this communication should be construed as a solicitation, offer, or recommendation, to buy or sell any security. Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Wealthfront Advisers or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Investment management and advisory services–which are not FDIC insured–are provided by Wealthfront Advisers LLC (“Wealthfront Advisers”), an SEC-registered investment adviser, and financial planning tools are provided by Wealthfront Software LLC (“Wealthfront”). Brokerage products and services are offered by Wealthfront Brokerage LLC, member FINRA / SIPC. All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Please see our Full Disclosure for important details.

Wealthfront Advisers, Wealthfront Brokerage and Wealthfront are wholly owned subsidiaries of Wealthfront Corporation.

© 2022 Wealthfront Corporation. All rights reserved.