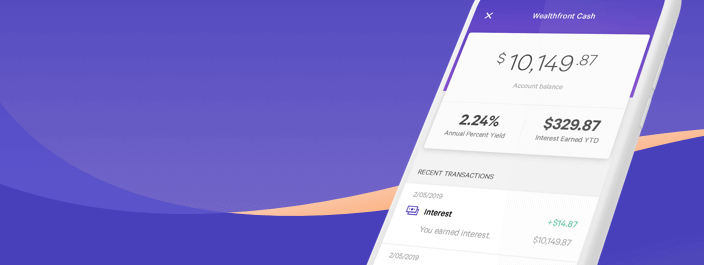

Today we are excited to announce the Wealthfront Cash Account — the perfect complement to our free financial planning and long-term investing. Our cash account currently pays an interest rate of 1.78%, is FDIC insured for up to $1 million, and has a minimum of only $1.

Note: As of November 3, 2023, the Wealthfront Cash Account has a 5.00% APY. Read more about it here .

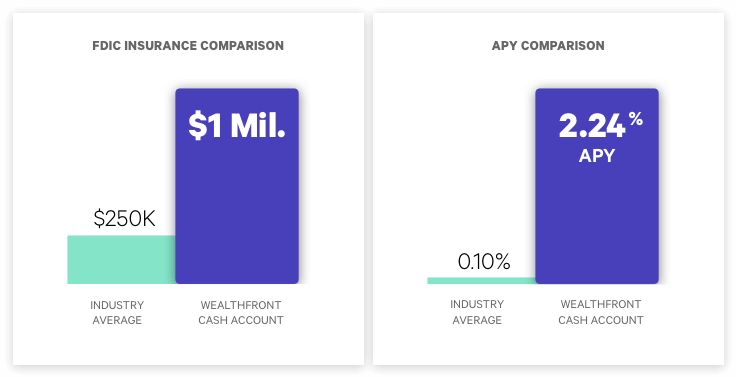

Today we are excited to announce the Wealthfront Cash Account — the perfect complement to our free financial planning and long-term investing. It’s the ideal way to address your short term goals like creating an emergency fund, saving for a car or even a home. Our cash account currently pays an interest rate of 2.24%, is FDIC insured for up to $8 million, and has a minimum of only $1. That’s nearly 20 times the interest rate and 32 times the insurance you receive at a traditional bank.

And while we always recommend staying the course in long-term investing, we understand if the recent market volatility is making you hesitant to invest right now. Our cash account is the perfect place to stash your cash until you’re ready again. You can’t beat the security and return our cash account offers. Additionally, unlike your bank account, we charge no fees, our service has no market risk, you get more interest as interest rates rise, and you have unlimited free transfers each month.

$260 million in your pockets

When designing our cash account, we saw an enormous opportunity to build a new model that actually benefits you. In 2018 the four largest banks in the U.S. made over $300 billion in revenue while your deposits just sat in your checking and savings accounts and earned almost nothing — your money makes money for your bank while doing nothing for you. What do you get in exchange? Overdraft fees, account maintenance fees, and confusing services that force you to go into a branch or dial a call center. Not exactly an equal relationship.

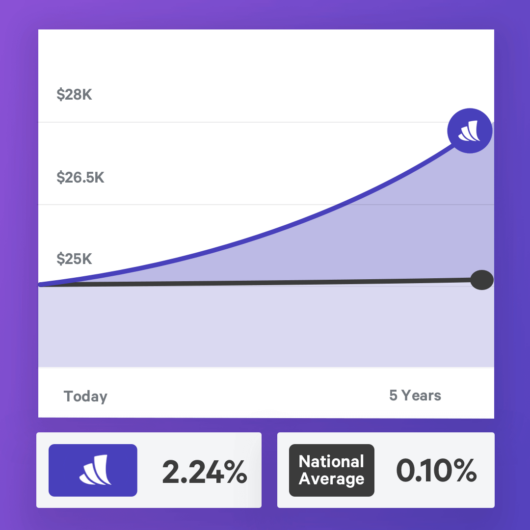

The line graph is shown for illustrative purposes only. The line graph shows the growth of your principal over a 5-year period, and assumes that the APY for both the Wealthfront cash account and the national average remains the same for each year during this period.

By our estimate, if all our clients moved their cash balances to a Wealthfront Cash Account today, they could collectively earn over $260 million in interest in this year alone compared to the majority, who are currently earning practically nothing. That’s money that would otherwise be going straight to the banks. And according to the Wall Street Journal, there is $8 trillion in cash sitting in commercial banks. If consumers moved that cash to a service like Wealthfront instead, that would mean an additional $170 billion in consumers’ pockets. Imagine the impact that could have on people’s lives. It really is as big as it feels.

Understand your short-term objectives

With our new cash account, you’ll also receive free financial advice. Answers to over 10,000 financial questions – without ever having to pick up the phone or schedule a meeting. We want you to know which trade-offs are right for you, so your money ends up in the most appropriate accounts.

Our free financial planning service provides a holistic view of your finances today and gives you an understanding of your entire financial picture, allowing you to make informed decisions and learn how to save for both your short- and long-term goals. Depending on your unique goals and time horizon, we’ll recommend how much to save — and in which accounts — to help you build exactly the life you want.

Start earning more today

The best news: We’ve made this whole thing painless and easy. All current clients can open a Wealthfront Cash Account today and start earning 20 times more interest on their cash balances immediately, while consolidating their short-term savings under one roof. Not a Wealthfront client yet? Sign up on our waitlist to be the first to know when it’s available for you.

UPDATE: The Wealthfront Cash Account is now available to everyone!

Disclosure

The Annual Percentage Yield (APY) for the Wealthfront Cash Account is as of February 14, 2019. The APY may change at any time, before or after the Cash Account is opened.

The national average according to Bankrate: 0.10% APY, as of February 14, 2019.

Cash Account is offered by Wealthfront Brokerage LLC (“Wealthfront Brokerage”), a member of FINRA/SIPC. Neither Wealthfront Brokerage nor its affiliates is a bank. The cash balance in the Cash Account is swept to one or more banks (the “program banks”) where it earns a variable rate of interest and is eligible for FDIC insurance. FDIC insurance is not provided until the funds arrive at the program banks. FDIC insurance coverage is limited to $250,000 per qualified customer account per banking institution. Wealthfront uses more than one program bank to ensure FDIC coverage of up to $8 million for your cash deposits. For more information on FDIC insurance coverage, please visit www.FDIC.gov. Customers are responsible for monitoring their total assets at each of the program banks to determine the extent of available FDIC insurance coverage in accordance with FDIC rules. The deposits at program banks are not covered by SIPC. This is not an offer, or solicitation of any offer to buy or sell any security, investment or other product.

Wealthfront Software LLC (“Wealthfront”) offers Path, a free software-based financial advice engine that delivers automated financial planning tools to help users achieve better outcomes. All information provided by Wealthfront’s financial planning tool is for illustrative purposes only and you should not rely on such information as the primary basis of your investment, financial, or tax planning decisions. No representations, warranties or guarantees are made as to the accuracy of any estimates or calculations provided by the financial tool.

Investment management and advisory services are provided by Wealthfront Advisers LLC, an SEC registered investment adviser, and brokerage related products, including the cash account, are provided by Wealthfront Brokerage LLC, a member of FINRA/SIPC. Wealthfront, Wealthfront Advisers LLC and Wealthfront Brokerage are wholly owned subsidiaries of Wealthfront Corporation.

© 2019 Wealthfront Corporation. All rights reserved.

About the author(s)

The Wealthfront Team believes everyone deserves access to sophisticated financial advice. The team includes Certified Financial Planners (CFPs), Chartered Financial Analysts (CFAs), a Certified Public Accountant (CPA), and individuals with Series 7 and Series 66 registrations from FINRA. Collectively, the Wealthfront Team has decades of experience helping people build secure and rewarding financial lives. View all posts by The Wealthfront Team