Digging into the hard details of your taxes may not be as fun as, say, that upcoming ski trip to Tahoe — but it is important. Plus, learning about what deductions and credits are available to you could save you a serious amount of money, and that’s never something to be bummed about. Follow these five simple steps to optimize your tax return.

Feeling ready to swing into tax season? Is anyone ever ready? Take a breath — we’ve got you covered.

First things first: Make sure you’ve read part 1 of our Tax Time Guide, which discusses everything from documents and dates to filing and payment methods. (It even has a discount code for $15–$20 off TurboTax!)

Alright, everyone ready to power forward? Not at all? Wishing you could be kids again and not pay taxes? Cool, let’s go. Digging into the hard details of your taxes may not be as fun as, say, that upcoming ski trip to Tahoe — but it is important. Plus, learning about what deductions and credits are available to you could save you a serious amount of money, and that’s never something to be bummed about.

Follow these five simple (eh, we tried at least) steps to optimize your tax return.

1. Get to know the new tax bill

The Tax Cuts and Jobs Act went into effect on January 1, 2018 — here are some of the major changes that might affect you.

- Standard deductions nearly doubled, jumping from $6,350 to $12,000 for single filers, and from $12,700 to $24,000 for joint married filers. Translation: If you have less than $12,000 in deductions, you won’t have to itemize!

- State and local tax (SALT) deductions are now limited to $10,000. This will hit you hardest if you live in a high-tax state like California, New York, or New Jersey.

- The mortgage interest deduction is now capped at $750,000. Luckily, if you purchased your house before November 2017, you’re grandfathered in at the former limit of $1 million. (If you refinance your house, however, you’ll lose that privilege.)

- The estate and gift tax exemption doubled to $11 million. Unless you’re giving away lots of money right now, you probably don’t need to worry about this.

- The use of 529 plans expanded. You can now use $10,000 per year toward your children’s elementary and secondary education. Read more about 529 plans here.

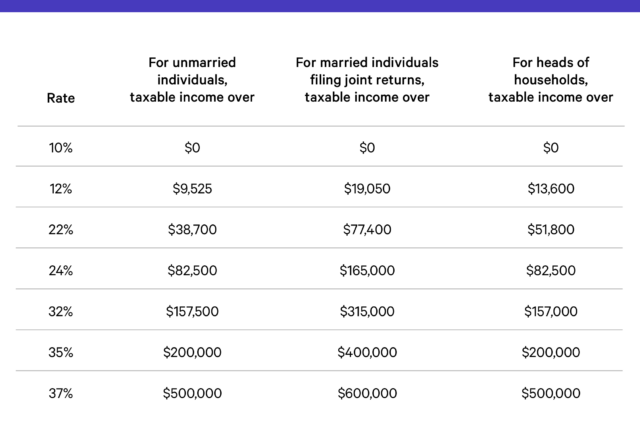

Everyone still with us? Awesome. So, the tax brackets are different this year, too. The range of each bracket has expanded, and overall tax rates decreased. Find your new federal income tax rate in the chart below.

2. Reflect on the past year

Think back on 2018: What happened? Did you go through any major life changes that might alter your tax bill?

And no, though adopting a dog certainly counts as a major life event, it doesn’t really affect your taxes — but a lot of situations do:

In 2018, did you…

- Buy a house: While new homeownership comes with a landslide of costs, you can make the blow slightly more bearable by taking advantage of deductions for mortgage interest (on mortgages up to $750,000) and property taxes (part of your SALT burden; limited to $10,000 per year).

- Have a baby: Congrats! In addition to your bundle of joy, you’ll probably get a $2,000 refundable tax credit. (That starts phasing out when your income is above $400,000 for married joint filers.) You could also get tax credits for child care. And don’t forget to fill out a new W-4 with your employer, as you have an additional withholding allowance.

- Get hitched: If you’re newly married, you’ll have to decide whether to file separately or jointly. While it usually makes financial sense to file jointly, one common reason for filing separately is if one of you has an income-based student loan. In that case, filing separately will prevent your payment from spiking with your new spouse’s income added in.

3. Decide whether you’ll itemize

An easy figure to file away in your brain: The “standard deduction” is now $12,000 for single filers. That means every person can automatically deduct $12,000 from their taxable income.

If you choose to “itemize” your deductions instead, you’ll use form Schedule A (Form 1040) to tally up your charitable contributions, mortgage interest payments, medical bills, educational expenses, state and local taxes, investment fees, etc. The total is what you’ll deduct from your taxes.

Since you can’t itemize and take the standard deduction, itemizing usually only makes sense if you have more than $12,000 to deduct. (Note: If your spouse itemizes, you can’t take the standard deduction, even if you’re filing separately.)

If you choose to take the standard deduction, that doesn’t mean all other deductions are off limits. You can still take “above-the-line deductions,” which reduce your adjusted gross income (AGI) even if you don’t itemize.

These include IRA contributions, health savings account (HSA) deductions, student loan interest payments, and unreimbursed moving expenses for a job.

Here are a few deductions and credits everyone should be aware of:

- Renewable energy tax credits: Being green can also get you green. You could receive a 10% tax credit for energy-efficient home improvements, a 30% tax credit for installing renewable energy sources, or $2,500 to $7,500 for purchasing an electric vehicle.

- Saver’s Credit: If you’re in a lower tax bracket, the IRS will give you money for investing in a retirement plan. This credit phases out completely for single filers who earn more than $32,000 per year.

- Student loan interest: Student loans are the worst, so let’s just hold our breaths and get through this: You can deduct up to $2,500 of interest per year. If your modified adjusted gross income is less than $80,000 / year as a single filer, or less than $165,000 / year as a joint filer, the deduction allows you to save up to $625 per year.

4. Max out your 2018 IRA contribution

You have until April 15, 2019 to make contributions to your IRA for 2018.

While maxing out your IRA is almost always a good idea, its potential tax benefits depend on two things: whether you have a retirement plan at work and how much your modified adjusted gross income (MAGI) is.

- If you have a 401(k) plan through your employer, and your MAGI is $63,000 or less, you can deduct your entire IRA contribution. You can still deduct part of it if your MAGI is between $63,000 and $73,000.

- If you don’t have a retirement plan at work, you can deduct all of your IRA contribution, no matter your income.

Since you might not benefit from contributions every year, you should make the most of your IRA when you can. If you have a Wealthfront IRA (or would like to open one, hint hint), read more about contribution limits and deadlines here.

Not sure what your contribution max is or whether you’d qualify for deductions? Take this calculator for a spin.

5. Leverage your harvested losses

Did you lose money on your investments this year? Well that’s no fun, but hey, you can remove some of the sting with “tax-loss harvesting.” This involves selling investments that have declined below their purchase price, thereby generating a loss that can lower your tax burden.

If you have a Wealthfront investment account, we automatically harvest your losses for you, like any good friend should always do. And if you use TurboTax to file your taxes, we’ll help you automatically import your tax-loss harvesting. Click here to learn more about how tax-loss harvesting can help lower your tax bill.

And, if you receive a 1099-B, cue a sigh of relief: You don’t need to type in all of those numbers. Remind your tax preparer that the IRS form instructions changed in 2014 to allow for summarized totals, meaning you no longer have to enter every transaction.

That’s all for now! You made it through! Hopefully it wasn’t too bad, especially since, uh, we are not done yet: We’ve got one more post in this series on how to prepare for next year’s taxes today. Definitely read it, especially if you’ll be receiving a windfall or IPO in 2019, or if you just want to pay your future self a favor.

Disclosure

This blog is powered by Wealthfront Software LLC (“Wealthfront”) and has been prepared solely for informational purposes only. Nothing in this material should be construed as a solicitation or offer, or recommendation, to buy or sell any securities. This article is not intended as tax advice, and Wealthfront and its affiliates do not provide tax advice nor do they represent in any manner that the tax consequences described here will be obtained or will result in any particular tax consequence. Investors are encouraged to consult with their personal tax advisors.

Wealthfront offers Path, a software-based financial advice engine that delivers automated financial planning tools to help users achieve better outcomes. All information provided by Wealthfront’s financial planning tool is for illustrative purposes only and you should not rely on such information as the primary basis of your investment, financial, or tax planning decisions. No representations, warranties or guarantees are made as to the accuracy of any estimates or calculations provided by the financial tool or the information provided in this article.

Investment advisory services are provided by Wealthfront Advisors LLC (“Wealthfront Advisers”, the successor investment adviser to Wealthfront Inc.), an SEC-registered investment adviser, and brokerage products and services are provided by Wealthfront Brokerage LLC (formerly known as Wealthfront Brokerage Corporation), member FINRA / SIPC. Please see our Full Disclosure for important details.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Historical returns, expected returns, and probability projections are provided for informational and illustrative purposes, and may not reflect actual future performance.

Wealthfront, Wealthfront Advisers and Wealthfront Brokerage LLC are wholly owned subsidiaries of Wealthfront Corporation.

TurboTax and TurboTax Online are registered trademarks and/or service marks of Intuit Inc. in the United States and other countries.

© 2019 Wealthfront Corporation. All rights reserved.

About the author(s)

Scott has practiced public accounting since 2009. He focuses on the tax aspects of estate planning, including gift planning and trust taxation, to help his clients achieve their financial goals and manage their tax liabilities efficiently. His clients include individuals, families, and closely held businesses. Scott can be reached at scott.peterson@mossadams.com or (408) 558-3274. Assurance, tax, and consulting offered through Moss Adams LLP. ISO/IEC 27001 services offered through Moss Adams Certifications LLC. Investment advisory offered through Moss Adams Wealth Advisors LLC. View all posts by Scott Peterson, CPA

The Wealthfront Team believes everyone deserves access to sophisticated financial advice. The team includes Certified Financial Planners (CFPs), Chartered Financial Analysts (CFAs), a Certified Public Accountant (CPA), and individuals with Series 7 and Series 66 registrations from FINRA. Collectively, the Wealthfront Team has decades of experience helping people build secure and rewarding financial lives. View all posts by The Wealthfront Team