Note: As of December 27, 2024, the Wealthfront Cash Account has a 4.00% APY. Read more about it here .

We all know that when it comes to earning interest on your cash, more is better. But not all financial institutions pay the same rate—not even close. Since we launched the Wealthfront Cash Account back in early 2019, many clients have asked us how we’re able to offer access to a rate that’s so much higher than what most other financial institutions offer. The answer is simple: those institutions are able to pay a high rate. They just don’t.

In this post, we’ll break down how the high APY on the Wealthfront Cash Account (which is currently 4.00%) does what most financial institutions refuse to do.

Most banks don’t share what they earn on your deposits

To understand why many banks could pay you more interest, you need to understand how they make money. Consumer-focused banks use your deposits to make loans—meaning that their profits are largely determined by the interest earned on the loans they offer to consumers. Commonly, these loans are home equity lines of credit, sometimes called HELOCs. A bank’s profit is the interest it earns on those loans minus the interest it pays on deposit accounts. Profit margins grow when the interest rate charged on loans goes up faster than the interest rate paid on deposits.

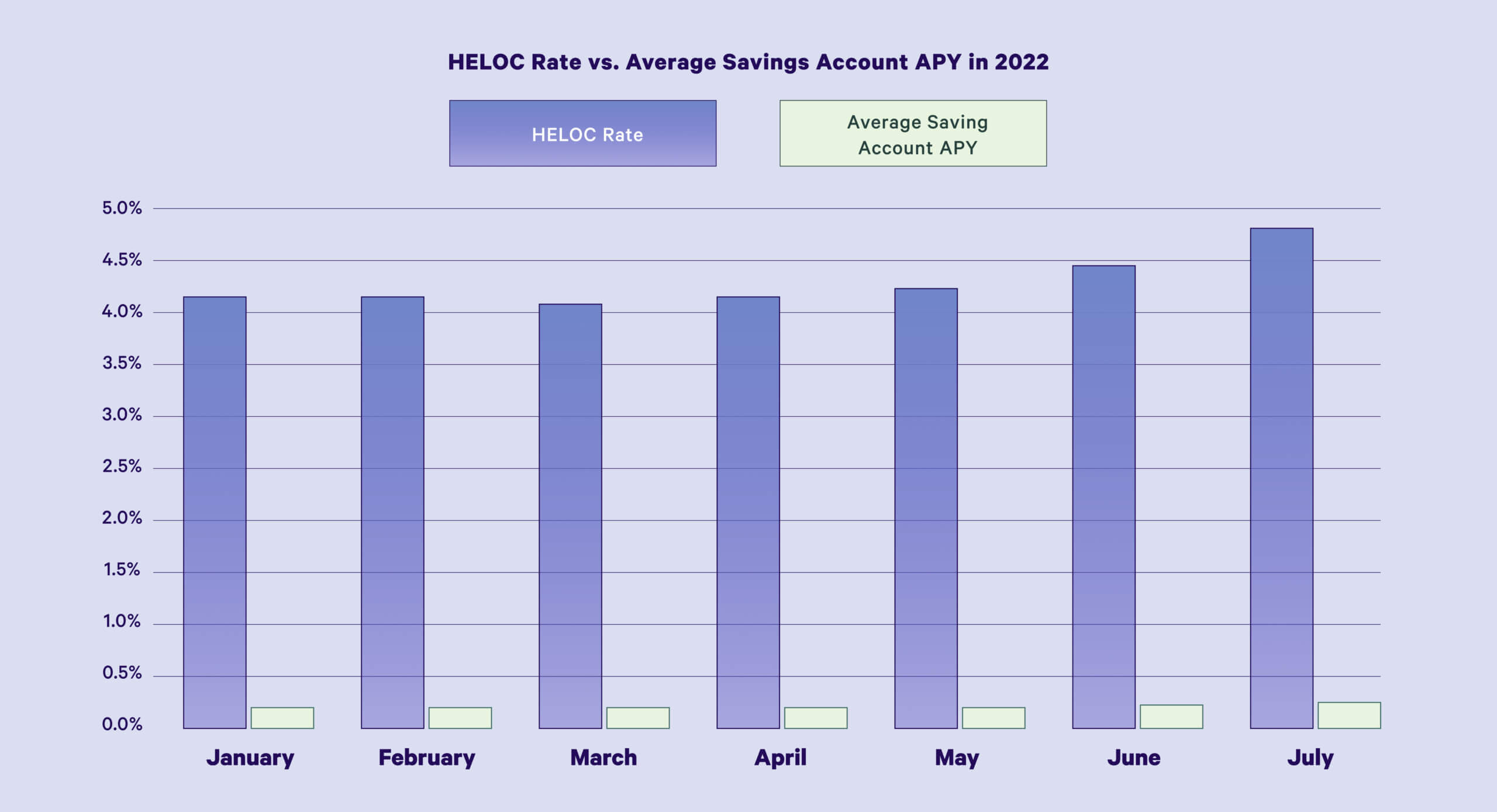

The chart below shows an example of this phenomenon at work in 2022 so far. The purple bars, which have been trending up this year, show average HELOC rates each month since the start of this year. The pale yellow bars which remain close to flat but also trend up slightly, show average savings account rates each month over the same time period. The gap between the height of the purple and pale yellow bars shows profit margin, which is obviously widening. In other words, many banks are increasing the interest rate they charge you to borrow while declining to pay you more for your deposits.

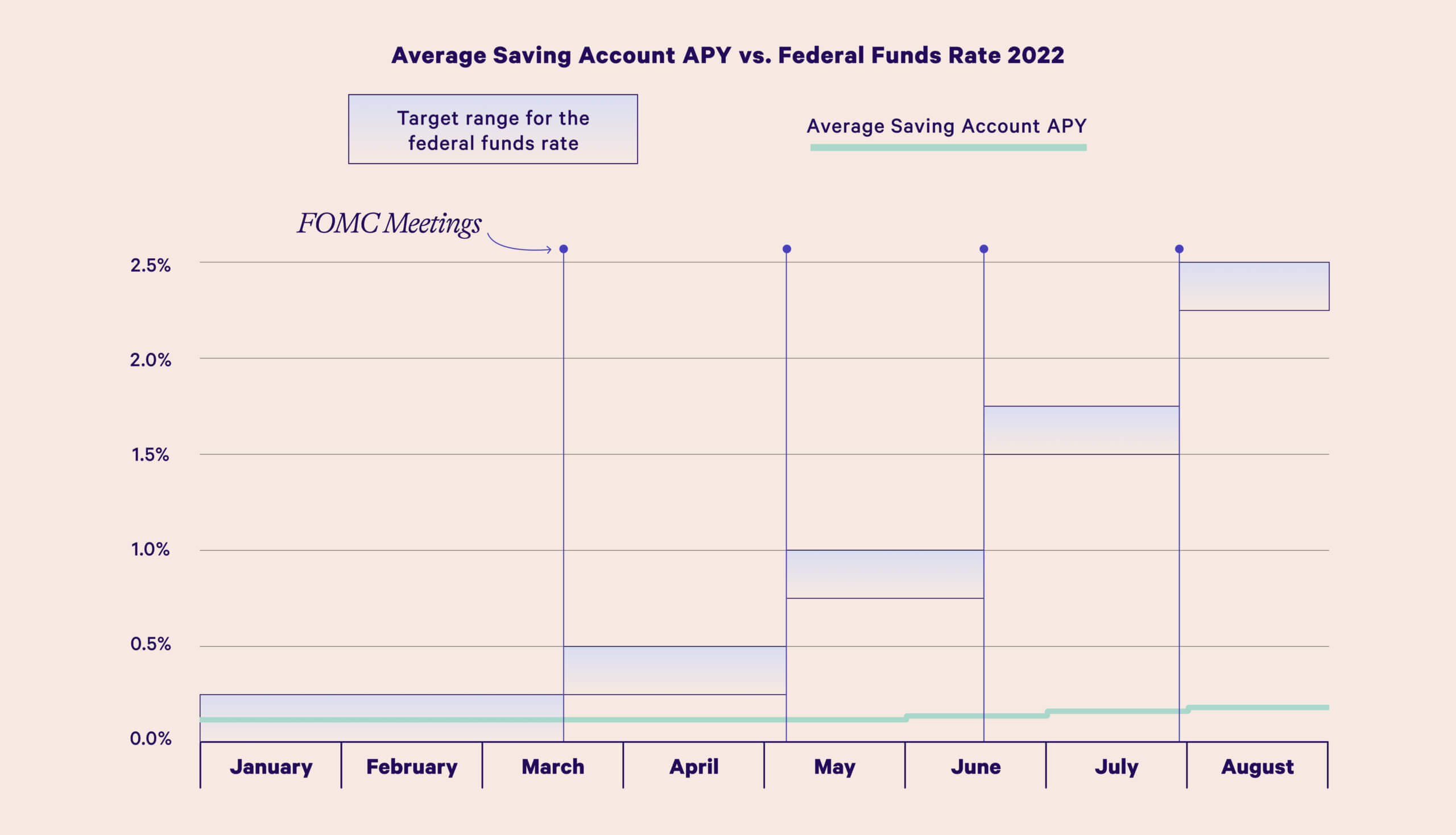

It’s also illuminating to compare the federal funds rate with the average savings account APY—this comparison tells you how much money banks are making when they loan out your money to other financial institutions. The federal funds rate is the rate at which banks loan money to one another, and it falls within a target range set by the Federal Reserve’s Federal Open Market Committee (FOMC). The FOMC has raised the target range for the federal funds rate four times so far in 2022 in an effort to combat inflation. When the fed funds rate goes up, banks earn more when they loan out your deposits, so in theory they can pass along at least a chunk of that increase to you. In practice, this isn’t usually the case. As you can see in the chart below, the average savings account APY has barely budged in 2022 even though the target range for the federal funds rate has increased dramatically.

Why do banks do this? We believe many banks pay you a low rate on your deposits because they’ve learned they can generally get away with it. Back around the start of the 2008 financial crisis, banks lowered interest rates to nearly zero and learned that they didn’t lose depositors. As a result, even when rates go up, many banks tend not to pass that along to clients.

You can see this trend even more clearly in the table below, which shows each increase in the target range for the federal funds rate in 2022, along with the percentage of that increase that Wealthfront, Ally (a popular high-yield savings account), and the average savings account passed along to depositors in the 14 days following the FOMC meeting, rounded to the nearest basis point. Keep in mind that Ally tends to offer an APY that far exceeds the national average for a savings account, but they still don’t share as much of each increase with their clients as we do. In our analysis, we found that they haven’t even shared half of any given increase with clients in 2022 in the 14 days following a FOMC meeting, although it’s worth noting that they do raise rates outside that 14-day window in between meetings.

Source: DepositAccounts.com, Federal Reserve

The takeaway: Not only does the Wealthfront Cash Account currently have one of the highest APYs for cash on the market, provided by our partner banks—it also has a proven track record of passing along a large portion of every federal funds rate increase since the account’s inception in 2019.

You might wonder why Wealthfront doesn’t always pass along 100% of every fed funds rate increase. The answer relates to how we make money on the Cash Account, which is on the modest spread between what our partner banks (where we deposit your cash) pay us and what you are paid. As you likely know, Wealthfront partners with multiple banks to offer you a high APY on your cash––and that APY is highly dependent on the rate those banks pay us for deposits. The rate we get from our partner banks varies based on the federal funds rate and how much of a premium they are willing to pay for additional deposits. Lately, that premium has been decreasing, so we have needed to raise our rates a little more slowly than the fed funds rate has gone up in order to keep our spread roughly the same. However, as the chart above makes clear, we still manage to pass along more than our competitors—often a lot more.

Wealthfront helps you reliably earn more on your cash

At the end of the day, we know you have a lot of options when it comes to deciding where to keep your cash. We believe the Wealthfront Cash Account is an ideal place for your short-term savings whether you’re building an emergency fund, saving up for a home down payment, or just want to help your short-term cash grow until you’re ready to invest. That’s because the Cash Account provides access to:

- A high APY from our partner banks so your money reliably earns more for you with no effort

- FDIC insurance of up to $8 million through our partner banks (this is 32x what you get from a traditional bank)

- Fast and easy access to your cash with unlimited fee-free transfers to external accounts and a network of 19,000+ free ATMs

- Near-instant transfers to Wealthfront’s award-winning1 Automated Investing Account to invest your money in minutes during market hours

- Absolutely no account fees

We want to help you build long-term wealth on your own terms, and we’re proud to offer the Cash Account so you can get there faster. At Wealthfront, our mission is to build a financial system that favors people, not institutions. Because of this, we pass along (and will continue to pass along) a high percentage of each rate increase to you because we believe it’s the right thing to do. If we’re making money, we think you should be too.

Disclosure

1Nerdwallet (Best Robo-advisor, Portfolio Options, 2022; Best Robo-advisor, IRA, 2022) and Investopedia (Best Robo-advisor, 2020; Best Robo-advisor, 2022). Nerdwallet and Investopedia (the “Endorsers”) receives $55 – $70 for every Wealthfront Advisers LLC (“Wealthfront Advisers”) client who signs up and funds an Investment Account via advertisements placed on their respective websites. The Endorsers and Wealthfront Advisers are not associated with one another and have no formal relationship outside of this arrangement. Nerdwallet’s opinions are their own. Their ratings are determined by their editorial team. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities. Nerdwallet ranking as of January 2022. Wealthfront provides cash compensation in connection with obtaining this ranking. Investopedia designed a system that rates robo-advisors based on nine key categories and 49 variables. Each category covers the critical elements users need to thoroughly evaluate a robo-advisor. Learn more about their methodology and review process. Investopedia ranking as of January 2022. Wealthfront provided cash compensation in connection with obtaining this ranking. © 2017-2022 and TM, NerdWallet, Inc. All Rights Reserved.

We’ve partnered with Green Dot Bank, Member FDIC, to bring checking features to the Cash Account.

Checking features for the Cash Account are subject to identity verification by Green Dot Bank. Debit Card is optional and must be requested. Wealthfront Cash Account Visa (Registered TM) Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. Visa is a registered trademark of Visa International Service Association. Green Dot Bank operates under the following registered trade names: GO2bank, GoBank, Green Dot Bank and Bonneville Bank. All of these registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage. Wealthfront products and services are not provided by Green Dot Bank. Green Dot is a registered trademark of Green Dot Corporation. Copyright 2022 Green Dot Corporation. All rights reserved.

Other fees apply to the checking features. Fee-free ATM access applies to in-network ATMs only. Each calendar month, current eligible clients with ATM Transactions will receive a reimbursement of certain fees associated with their first two out-of-network ATM Transactions. Wealthfront Brokerage will utilize its best efforts to reimburse Green Dot’s $2.50 “out-of-network fee” and up to $5.00 of any operator or owner’s fee for your ATM Transactions, up to a maximum reimbursement of $7.50 per ATM Transaction (the “Reimbursement”). Your maximum total monthly Reimbursement shall be $15.00 ($7.50 + $7.50). If an ATM operator charges fees other than out-of-network fees and/or owner’s fees, Wealthfront Brokerage will not reimburse any portion of those fees. Once the maximum total monthly Reimbursement has been reached, no subsequent out-of-network ATM fees or charges that occur that calendar month will be reimbursed. For full details please review the Out-of-Network ATM Fee Reimbursement Terms and Conditions. Other eligibility requirements for mobile check deposit and to send a check may apply. Please see the Deposit Account Agreement for details.

Cash Account is offered by Wealthfront Brokerage LLC (“Wealthfront Brokerage”), a Member of FINRA/SIPC. Neither Wealthfront Brokerage nor any of its affiliates are a bank, and the Cash Account is not a checking or savings account. We convey funds to program (or “partner”) banks who accept and maintain deposits, provide the interest rate, and provide FDIC insurance. Investment management and advisory services–which are not FDIC insured–are provided by Wealthfront Advisers LLC (“Wealthfront Advisers”), an SEC-registered investment adviser, and financial planning tools are provided by Wealthfront Software LLC (“Wealthfront Software”).

The Annual Percentage Yield (“APY”) for the Cash Account may change at any time, before or after the Cash Account is opened. The APY for the Wealthfront Cash Account represents the weighted average of the APY on the aggregate deposit balances of all clients at the program banks. Deposit balances are not allocated equally among the participating program banks.

The cash balance in the Cash Account is swept to one or more program banks where it earns a variable rate of interest and is eligible for FDIC insurance. FDIC insurance is not provided until the funds arrive at the program banks. FDIC insurance coverage is limited to $250,000 per qualified customer account per banking institution. Wealthfront uses more than one program bank to ensure FDIC coverage of up to $8 million for your cash deposits. For more information on FDIC insurance coverage, please visit www.FDIC.gov. Customers are responsible for monitoring their total assets at each of the program banks to determine the extent of available FDIC insurance coverage in accordance with FDIC rules. The deposits at program banks are not covered by SIPC.

The information contained in this communication is provided for general informational purposes only, and should not be construed as investment or tax advice. Nothing in this communication should be construed as tax advice, a solicitation or offer, or recommendation, to buy or sell any security. Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Wealthfront Corporation or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Wealthfront Advisers, Wealthfront Brokerage, and Wealthfront Software are wholly owned subsidiaries of Wealthfront Corporation.

Copyright 2022 Wealthfront Corporation. All rights reserved.

About the author(s)

Amber is a Senior Manager of Product Support at Wealthfront and a licensed financial advisor holding Series 24, Series 65, Series 63, and Series 7 licenses from FINRA. Prior to joining Wealthfront, she worked at Scottrade. View all posts by Amber Guerrero