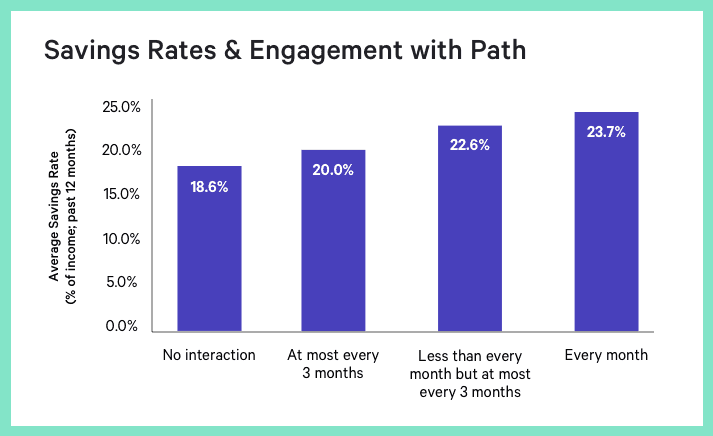

Wealthfront believes automating financial advice will lead to better outcomes. Our 2018 Financial Planning & Savings report shows how regular engagement with Path, our financial advice engine, correlates to an increase in a client's savings rate from 18.6% to 23.7% -- nearly a 28% increase in savings.

We started Wealthfront because we believed technology could have a powerful impact on people’s financial lives. And the more experience we gain with clients, the clearer it becomes that automating financial advice will lead to better outcomes.

To back this assertion we have been collecting savings data since we launched our financial advice engine, Path, in February 2017. Today we are thrilled to share the results for the first time.

These results motivate us to empower many more people with automated advice to increase their savings. Only through automation can we make a major dent in the savings gap that threatens a huge portion of the American population from retiring comfortably.

*According to June 2018 data from the U.S. Bureau of Economic Analysis, individuals were saving as little as 6.8% of their income.

Disclosure

The 2018 Wealthfront Savings Report has been prepared solely for informational purposes only. Nothing in this material should be construed as tax advice, a solicitation or offer, or recommendation, to buy or sell any financial product. Wealthfront Software LLC (“Wealthfront”) offers the software-based financial advice engine, Path, which delivers automated financial planning tools to help users achieve better outcomes. The information set forth herein has been obtained or derived from sources believed by Wealthfront to be reliable but it is not necessarily all-inclusive and is not guaranteed as to its accuracy and is not to be regarded as a representation or warranty, express or implied, as to the information’s accuracy or completeness. Wealthfront is a wholly owned subsidiary of Wealthfront Corporation, and an affiliate of Wealthfront Advisers LLC.

About the author(s)

Dan Carroll is Wealthfront's founder and Chief Strategy Officer. Dan founded Wealthfront to bring client-centric, transparent and low cost financial advice to the retail investor. View all posts by Dan Carroll

Andy Rachleff is Wealthfront's co-founder and Executive Chairman. He serves as a member of the board of trustees and chairman of the endowment investment committee for University of Pennsylvania and as a member of the faculty at Stanford Graduate School of Business, where he teaches courses on technology entrepreneurship. Prior to Wealthfront, Andy co-founded and was general partner of Benchmark Capital, where he was responsible for investing in a number of successful companies including Equinix, Juniper Networks, and Opsware. He also spent ten years as a general partner with Merrill, Pickard, Anderson & Eyre (MPAE). Andy earned his BS from University of Pennsylvania and his MBA from Stanford Graduate School of Business. View all posts by Andy Rachleff