Have you heard? Bonds are back! In the past year, bonds have gone from an investing afterthought to making headlines in The Economist, The NYT, The WSJ, and beyond. We’ve been into bonds since before they were cool, and today we’re delighted to announce our Automated Bond Portfolio: a first-of-its-kind, diversified selection of bond ETFs, optimized to earn a higher yield than a savings account with a lot less risk than equities. At a current 4.83% 30-day blended SEC yield (after fees, with total returns from March 30, 2023 – April 21, 2025 of 11.53%1), the Automated Bond Portfolio makes it easy to get the benefits of low-risk, tax-advantaged bonds — without the pesky maturity dates and manual management.

🙋Quick Q: What’s a 30-day blended SEC yield?

We created this term to represent a weighted average of the 30-day SEC yields for each ETF in your portfolio after deducting our 0.25% annual advisory fee. ETFs publish this standard annualized calculation based on interest and dividends earned over the last 30 days — after fund expenses are deducted. Please note that the 30-day SEC yield is not an indicator of the portfolio’s overall performance or future returns. The yield simply provides a snapshot of the income generated by the ETFs in the past 30 days, and it is subject to change. Like any investment, the price of the ETFs in the portfolio may fluctuate daily. Our published yield of 4.83% was last updated on April 21, 2025.

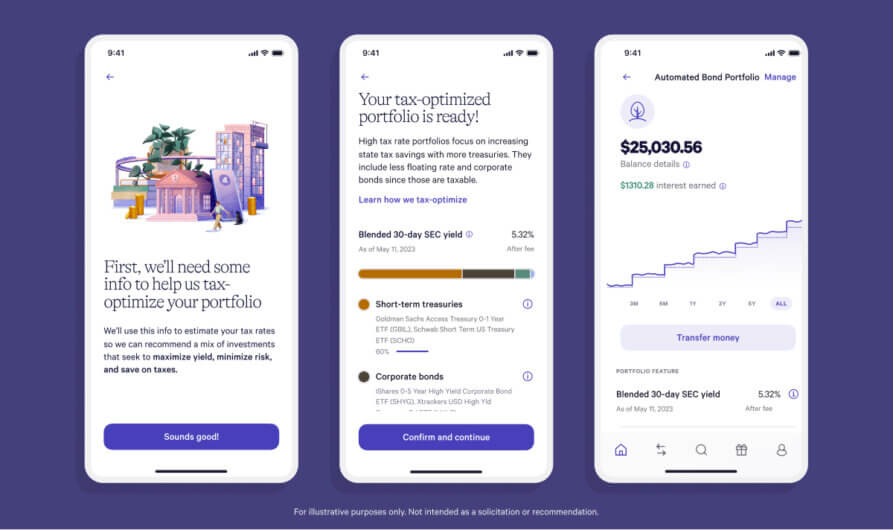

We’ll build you a personalized portfolio based on your tax situation with a diversified mix of Treasury bond and corporate bond ETFs to help you earn more, keep more after taxes, and have access to your money when you need it. Compared to other low-risk choices like I bonds and CDs, the Automated Bond Portfolio aims to provide a higher yield, more liquidity, and better diversification. In our (totally unbiased) opinion, it’s an ideal place to save for near-term financial goals like down payments, big trips, or home renovations.

Not long term, not short term, but “just right” term

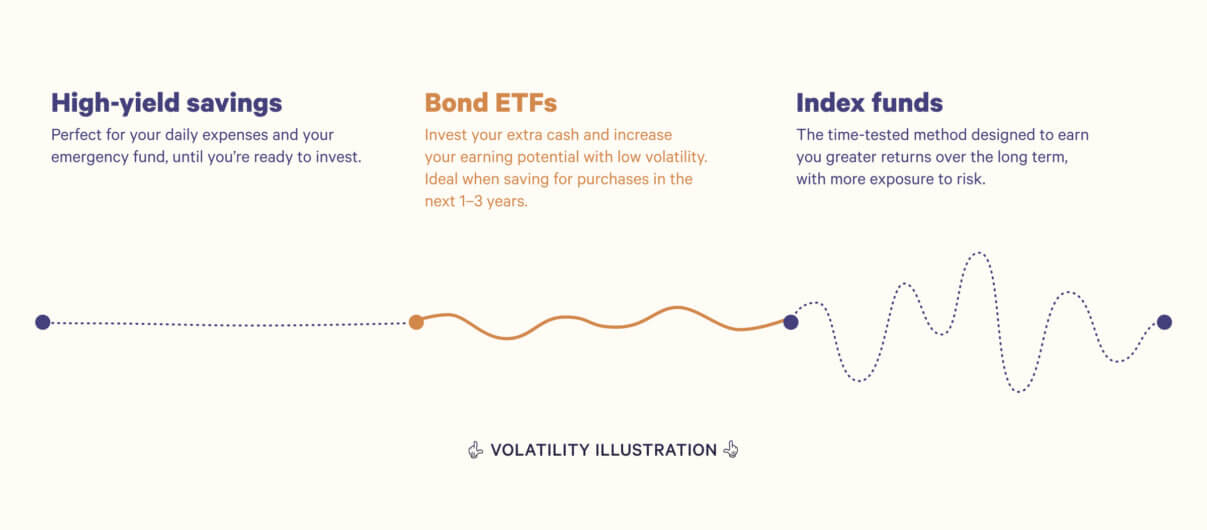

You’ve got your short-term savings and “right now” money in cash and your long-term wealth in diversified investments and stocks, but where do you put the funds you might plan to use in one to three years?

The Automated Bond Portfolio is designed to fill that gap. It’s a great option to consider if you are saving for an expense in a couple of years (like a car purchase or tuition) or if you want to balance out a riskier portion of your portfolio. Our research team constructed the Bond Portfolio using bond ETFs to offer a higher expected yield than our Cash Account with roughly half the market risk you’d take in the lowest-risk versions of our Classic and Socially Responsible portfolios.

Bond ETFs: bonds, but better

Buying bonds directly can be a headache — with clunky interfaces to navigate, maturity dates that lock up your cash, and manual management of your holdings. That’s why we built our Automated Bond Portfolio with bond ETFs instead. Here are three key advantages:

- They’re more liquid

ETFs trade like stocks, getting you the yields and tax advantages of bonds without the maturity dates and over-the-counter trades that make buying, selling, and reinvesting cumbersome and complex. You can withdraw your money with no penalties, and when you do, Wealthfront provides a clear estimate of your potential tax impact. - They’re more diversified

ETFs roll many different bonds into a single, tradeable asset — the resulting diversification can reduce both interest rate risk and credit risk, without sacrificing your expected yield. Our portfolio offers a combination of low-risk, tax-advantaged Treasury bonds with higher-yield corporate bonds to strike the right balance of yield and risk. - They’re easier to manage

Buying and selling individual bonds often involves dealing with arcane websites, planning your investments around arbitrary maturity dates and intermittent sales periods, and running up against maximum investment limits. Bond ETFs eliminate these hassles, and it gets even more hassle-free when we add our automatic reinvestment and rebalancing.

Unlike individual bonds, ETFs are subject to management fees and other administrative expenses, which are captured in expense ratios — ranging from 0.03% to 0.39%, in the case of the ETFs in the Automated Bond Portfolio. You should also know certain risk factors that are unique to ETFs: like price discrepancies between the ETF and its underlying assets, and the risk of the ETF not accurately tracking the performance of the bond market it’s meant to represent. But when you factor in the high yield, diversification, access to your money, and ease-of-use, we think our Automated Bond Portfolio compares favorably not only to individual bonds, but to just about every other low-risk choice out there (CDs, Money Market Funds, etc.).

Keep more of what you earn

Bonds can come with tax benefits — and the same is true of our Automated Bond Portfolio. Unlike interest received in a savings account, for instance, the interest received from Treasury bonds is exempt from state taxes (even when it comes through a bond ETF). We’ll use your estimated tax rates based on your state of residence, income, and filing status to build you a personalized portfolio that maximizes your after-tax yield while minimizing unnecessary risk. For example, if you’re in a higher tax bracket, we’ll allocate more of your portfolio to Treasuries, since the interest earned from Treasury bonds is typically exempt from state taxes.

We’ve long said that what sets Wealthfront apart is our focus on after-tax returns. Our Automated Bond Portfolio takes this one step further by combining our existing suite of powerful tax-minimization features — including Tax-Loss Harvesting, and automatic dividend reinvestment with tax-sensitive rebalancing — with an allocation that’s specific to your estimated tax rates.

Build long-term wealth on your own terms

We’re proud to offer our clients a brand new way to get exposure to bonds that eliminates the hassle of direct bond purchases and makes it easy to save for your near-term goals. Our new Automated Bond Portfolio fills the gap between our high-earning, short-term Cash Account and our award-winning, long-term Automated Investing Account. And remember, our published 4.83% 30-day blended SEC yield is after both ETF expenses and the same, low 0.25% annual advisory fee we’ve always charged. In our continuing quest to help you build long-term wealth on your own terms, this portfolio gives you a new way to make the most of your money right now. Get started today with just $500.

Disclosure

1 The Wealthfront Automated Bond Portfolio (ABP) average annual net-of-fees, pre-tax return is a value-weighted composite of actual client returns in the High-Tax rate portfolio managed in accordance with our investment methodology. The composite includes all accounts that have existed at any point since the given inception date and have at least $5,000 in assets. Returns are net of all fees and expenses and incorporate reinvested dividends and earnings, adjusted for any applicable waivers.

Economic and market conditions can influence performance outcomes. Future performance may also deviate from past results due to changes in recommended asset allocations, as well as differences in future market returns. Past performance does not guarantee future results.

The information contained in this communication is provided for general informational purposes only, and should not be construed as investment or tax advice. Nothing in this communication should be construed as a solicitation or offer, or recommendation, to buy or sell any security. Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Wealthfront Advisers or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Investors should carefully assess the risks associated with bond ETF investments. Bond ETF performance may not precisely mirror the underlying index due to tracking errors from factors like bond weighting differences, transaction costs, and timing. Management fees can affect overall returns. Bond ETFs expose investors to risks, including interest rate risk, potentially leading to capital losses as rising rates decrease underlying bond values. Most bond ETFs lack a fixed maturity date or guaranteed principal repayment at maturity. Bond ETFs may generate capital gains from portfolio rebalancing, potentially resulting in unexpected tax liabilities.

Credit risk is a concern, as bond issuers’ financial health can impact ETF value. Some bond ETFs may use derivatives, introducing counterparty risk where losses can occur if a counterparty fails to fulfill its contractual obligations. Call risk should also be considered, as falling interest rates might prompt callable bond issuers to repay securities before maturity, forcing reinvestment in lower-yield or riskier securities.

Savings accounts are typically FDIC-insured. The Automated Bond Portfolio is covered by SIPC, which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash). Explanatory brochure available upon request or at www.sipc.org. It does not provide protection against losses resulting from market fluctuations.

Bond ETFs are less liquid than cash, potentially affecting buying and selling shares at desired prices. Some may prefer the stability and accessibility of savings or deposit accounts despite lower yields.

Equities may offer higher long-term gains than bonds or cash investments, providing capital appreciation and reinvestable dividend income. However, equities present increased risk due to market fluctuations and short-term price volatility. Investors with longer time horizons and higher risk tolerance may allocate a portion of their portfolios to equities, acknowledging the possibility of gains and losses. Investors should weigh these risks before investing. Past performance does not guarantee future results.

By using this website, you understand the information being presented is provided for informational purposes only and agree to our Terms of Use and Privacy Policy. Wealthfront Advisers relies on information from various sources believed to be reliable, including clients and third parties, but cannot guarantee the accuracy and completeness of that information.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Please see our Full Disclosure for important details.

Cash Account is offered by Wealthfront Brokerage LLC (“Wealthfront Brokerage”), a Member of FINRA/SIPC. Neither Wealthfront Brokerage nor any of its affiliates are a bank, and Cash Account is not a checking or savings account. We convey funds to partner banks who accept and maintain deposits, provide the interest rate, and provide FDIC insurance. Investment management and advisory services–which are not FDIC insured–are provided by Wealthfront Advisers LLC (“Wealthfront Advisers”), an SEC-registered investment adviser, and financial planning tools are provided by Wealthfront Software LLC (“Wealthfront”).

Wealthfront, Wealthfront Advisers and Wealthfront Brokerage are wholly owned subsidiaries of Wealthfront Corporation.

© 2023 Wealthfront Corporation. All rights reserved.

About the author(s)

The Wealthfront Team believes everyone deserves access to sophisticated financial advice. The team includes Certified Financial Planners (CFPs), Chartered Financial Analysts (CFAs), a Certified Public Accountant (CPA), and individuals with Series 7 and Series 66 registrations from FINRA. Collectively, the Wealthfront Team has decades of experience helping people build secure and rewarding financial lives. View all posts by The Wealthfront Team