Managing your windfall

Pay down your debt, buy a home, plan ahead for your kids' college expenses, and maybe even retire earlier than expected. While everyone has different financial goals, here are some guidelines that will help you develop the best plan for allocating the money from your windfall after you've sold your stock.

Financial health

must-dos

Before you start building a plan for your windfall, you should pay down any high-interest debt and establish an emergency fund. While these aren't the sexiest ways to spend your money, they are critical to establishing a sound financial foundation.

Pay down high-interest debt

Any high-interest debts (like credit cards) should be paid down first. Paying down a credit card with an 18% interest rate is like earning a guaranteed 18% return. There aren't many financial opportunities in life that are comparable. After you have your credit cards in order, prioritize paying down other loans with an after-tax interest rate of 5% or more.

Build your emergency fund

Once you've paid off your expensive debt, you should think about building up an emergency fund. This is money you specifically set aside to cover unexpected expenses, not whatever is left over in your checking account after paying the bills.

Most people should hold enough money to cover your living expenses for three to six months. The best place to park this cash? An FDIC-insured high-yield savings account, because it allows you to earn some return without taking on market risk. (Might we recommend Wealthfront's Cash Account, which has a 3.30% APY?)

Did you know?

The average interest rates of debts and investments

Prioritize goals, evaluate trade-offs

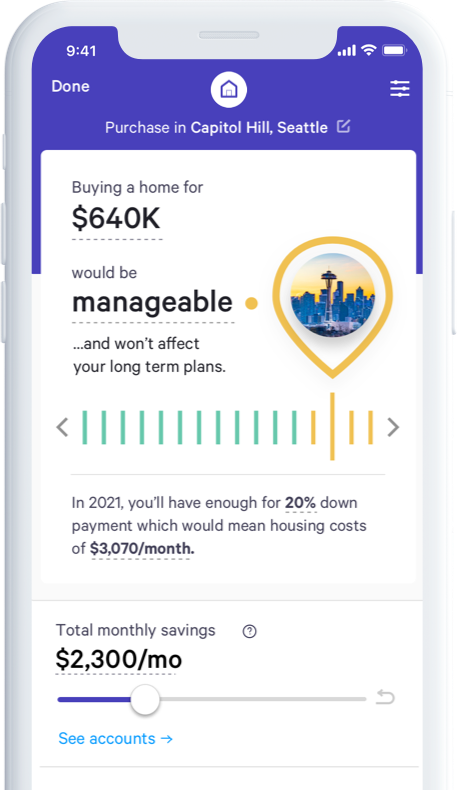

Once you've taken care of the essentials, it's time to strategize. Do you want to buy a home sooner than later? Can you take some time off for that long-imagined sabbatical? Can you set aside money to cover your children's college education costs in full? Do you have enough to consider early retirement?

You may have competing financial priorities, from near-term major purchases to planning for retirement. Guess what — you're not alone! For example, many people try to reconcile buying a home now and having enough to retire in the future.

Depending on your situation, there are a number of levers you can adjust to try and achieve a particular goal. For a home purchase it might be:

- Cut back on your spending today (save more)

- Plan to buy a home a year later (change goal timeline)

- Aim for a smaller home or cheaper location (change goal cost)

- Or perhaps adjust one of your other goals, like not taking the 6-month world trip you had in mind.

Exploring these different scenarios will help you land on the appropriate trade-offs you should make. It's important to be realistic about what's possible. One of the benefits of identifying goals and proactively building a plan is you'll understand what you actually can do, which hopefully makes you feel more confident and in control of your future. And as circumstances change or new goals pop up — as they inevitably do — you can revisit your plan and make adjustments.

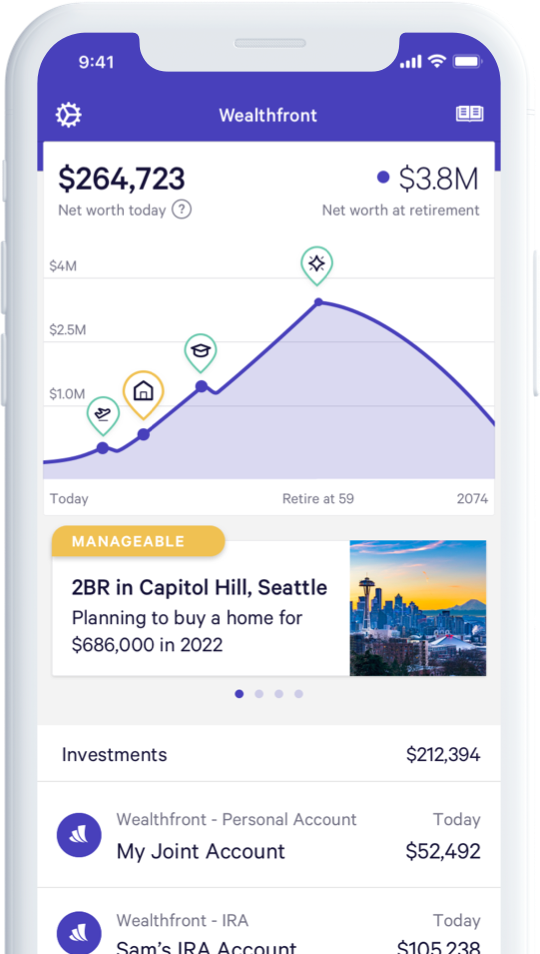

Explore these scenarios on Wealthfront's free financial planning app

Let technology do the heavy lifting. Link your financial accounts and we'll calculate your net worth, project its future value, and automatically update your plan as things change.

Explore your financial goals, see the all-in costs, and understand how much a windfall will impact your future.

Download for free

Where should you put

your savings?

Once you've prioritized your goals, you can allocate your savings accordingly.

Save for the near-term

If you have a specific near-term (~5 years) purchase in mind, like a down payment on your home, or are setting funds aside for an emergency fund, then holding onto cash makes sense because you don’t want to take any market risk. Your short-term cash should be held in a secure, high-interest account, such as our cash account, which has a 3.30% APY.

Get 3.30% APY with the Wealthfront Cash Account

- FDIC insurance for up to $8 million

- No fees

- Unlimited transfers

Hold the "right" amount of cash

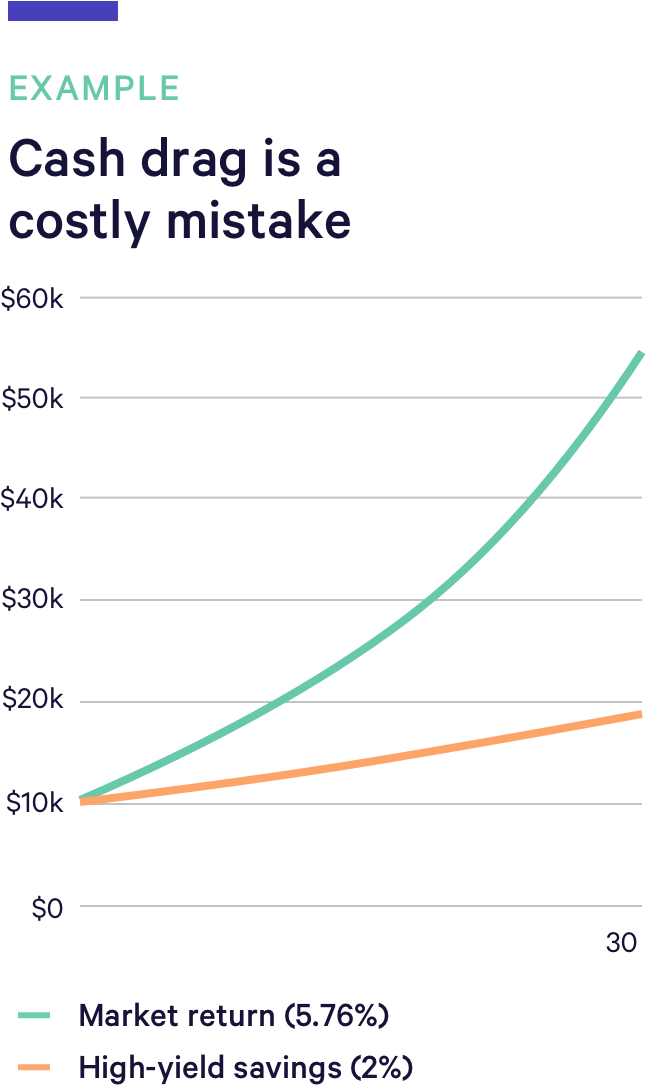

Holding any extra cash on top of what you need in the near term is known as "cash drag."

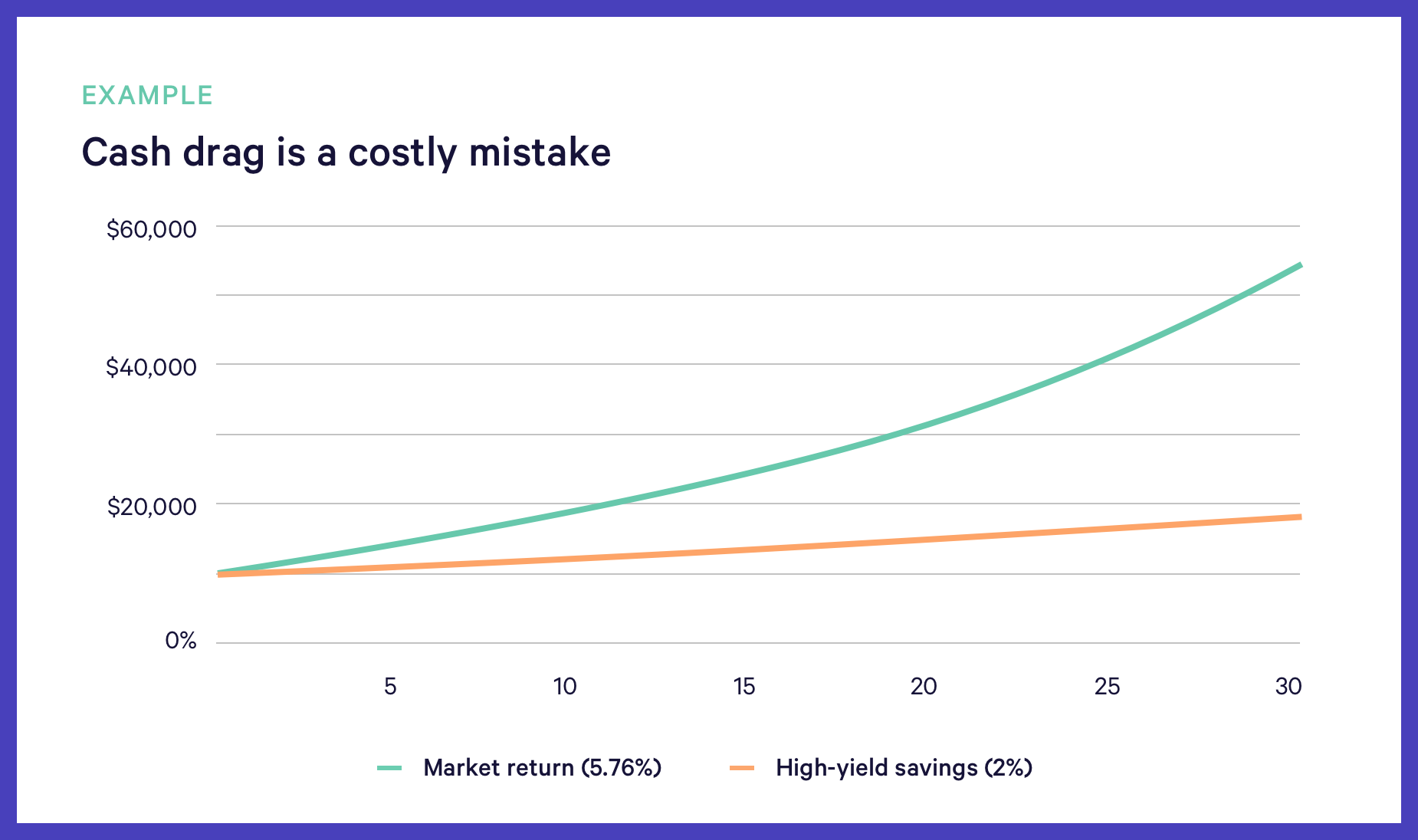

History shows that stock markets rise over the long term, so holding on to too much cash means you could be losing out on some valuable returns. To illustrate the downside of cash drag, let's compare how $10,000 in extra cash would grow in an FDIC-insured high-yield savings account compared to if it were invested: over 30 years, investing would lead to $35,515 more value— a 195.7% increase!

Leaving your cash that isn't earmarked for short-term goals in a savings account is, in reality, making a choice to take a lower return. Be intentional with how you allocate that savings because it can have a real impact over the long term.

Choose a passive investing strategy

We recommend investing what remains after you've paid down your debt and set aside cash for short-term goals. If you're looking to grow your money in the long run, you're probably best served investing "passively." In other words, invest your money in a broadly diversified portfolio of index funds that represent multiple asset classes.

Decades of academic and practitioner research convincingly show that active money managers are unable to consistently beat their benchmarks net of their fees, so you are better off investing in a portfolio of indexes funds that track broad market indexes (source: S&P Indices vs. Active) than trying to pick individual stocks.

Note that even with passive investing, you're bound to experience ups and downs. Weathering the storms is just part of the reality: to earn an attractive long-run rate of return, you'll have to be prepared to bear the associated risks.

How to get started

If you're still sitting on a large amount of excess cash after selling your company stock, paying off debt and building an emergency fund, then our advice would be to invest it in the diversified portfolio immediately. Research from Vanguard confirms that it usually pays to invest all at once (a lump-sum investment) rather than investing it over time.

But if the thought of putting all your money into the market at once gives you anxiety, then invest as much immediately as you feel comfortable, and then set up a recurring deposit to invest the rest over time.

Dollar-cost averaging, or investing a fixed amount on a regular schedule, keeps you committed to investing despite market conditions. An advantage of this strategy is it keeps you investing in poor markets where you can buy you more shares for the same amount of money. Counterintuitively, you will likely end up better off steadily investing in a volatile market than in a market where prices steadily rise assuming you get to the same ultimate value.

The value of diversification and rebalancing

Performance of diversified, rebalanced portfolio is nearly double that of a non-diversified

Automate your passive investing with Wealthfront

Our software-only solution is rooted in passive investing, plus we aim to maximize your returns by lowering taxes and minimizing fees.

And it's all effortless for you.

Invest with WealthfrontThe 10% rule

Feeling adventurous? Go ahead, take some risks — but do so without compromising your financial security.

It can be tempting to think about trying new things, such as picking stocks, making angel investments, buying real estate investment properties, or maybe giving cryptocurrency a spin.

While you should allow yourself some "play" money, it's probably best to limit it to no more than 10% of your total liquid net worth (your assets excluding your home minus any debt you have outstanding). The bedrock of your financial future should be in investments that will deliver over the long term, not on things that are speculative.

By following the 10% rule, you can keep your financial foundation secure in case your big bets go belly up.

REVIEW

How to manage your windfall

- Pay down your credit cards and other debt that charge after-tax interest rates in excess of 5%

- Build an emergency fund with 3-6 months worth of living expenses

- Consider competing financial priorities and do some scenario exploration so that you understand the trade-offs you'll need to make (pro tip: Wealthfront can help with this!)

- For near-term purchases, save your money in an FDIC insured high-yield savings account

- If you want to buy a home, consider the all-in costs (pro-tip: check out our Home Guide)

- Invest the rest of your money (we recommend a passive investment strategy)

- Limit "risky" investments to no more than 10% of your total liquid net worth